Gold Holds Near Record Highs Amid Anticipation Of Fed Rate Cut

Gold Holds Near Record Highs Amid Anticipation Of Fed Rate Cut

By RoboForex Analytical Department

由RoboForex分析部門提供

Gold prices remained stable at around $2580 per troy ounce on Tuesday, hovering close to their record highs. This resilience in the gold market is largely driven by the weakening US dollar and heightened expectations for a substantial interest rate cut by the Federal Reserve.

週二,黃金價格在每盎司2580美元左右保持穩定,接近其創紀錄的高位。黃金市場的這種韌性主要是由美元走弱和市場對聯儲局大幅減息預期的推動。

Current projections from the CME FedWatch tool indicate a 67% likelihood of a 50 basis point cut in today's Fed meeting, a significant increase from the 40% chance noted yesterday. Additionally, there's a 33% probability of a more modest 25 basis point reduction. These expectations have significantly influenced market sentiment, prompting investors to flock to gold as a protective asset.

CME FedWatch工具的當前預測顯示,在今天的聯邦儲備會議上,50個點子減息的可能性爲67%,較昨天的40%有顯著增加。此外,還有33%的可能性進行較爲溫和的25個點子的減息。這些預期對市場情緒產生了顯著影響,促使投資者紛紛湧向黃金作爲保護性資產。

Recent geopolitical events, such as the attempted assassination of US presidential candidate Donald Trump, have also underscored the metal's appeal as a safe haven, leading to a spike in demand during times of perceived instability.

最近的地緣政治事件,如美國總統候選人唐納德·特朗普的襲擊事件,也凸顯了黃金作爲避險資產的吸引力,在被認爲不穩定的時期引發了需求激增。

The potential easing of US monetary policy, expected to be confirmed in Wednesday's Fed announcement, further bolsters gold's attractiveness. With its lack of coupon income, gold becomes more appealing during periods when yields on US government bonds are falling, and the Dollar Index (DXY) is weakening.

美國貨幣政策的潛在寬鬆,預計將在週三的聯邦儲備公告中得到確認,進一步增強了黃金的吸引力。在美國政府債券收益率下降、美元指數(DXY)走弱的時期,黃金因其缺乏票息收入而變得更有吸引力。

Technical Analysis Of Gold

黃金技術面分析

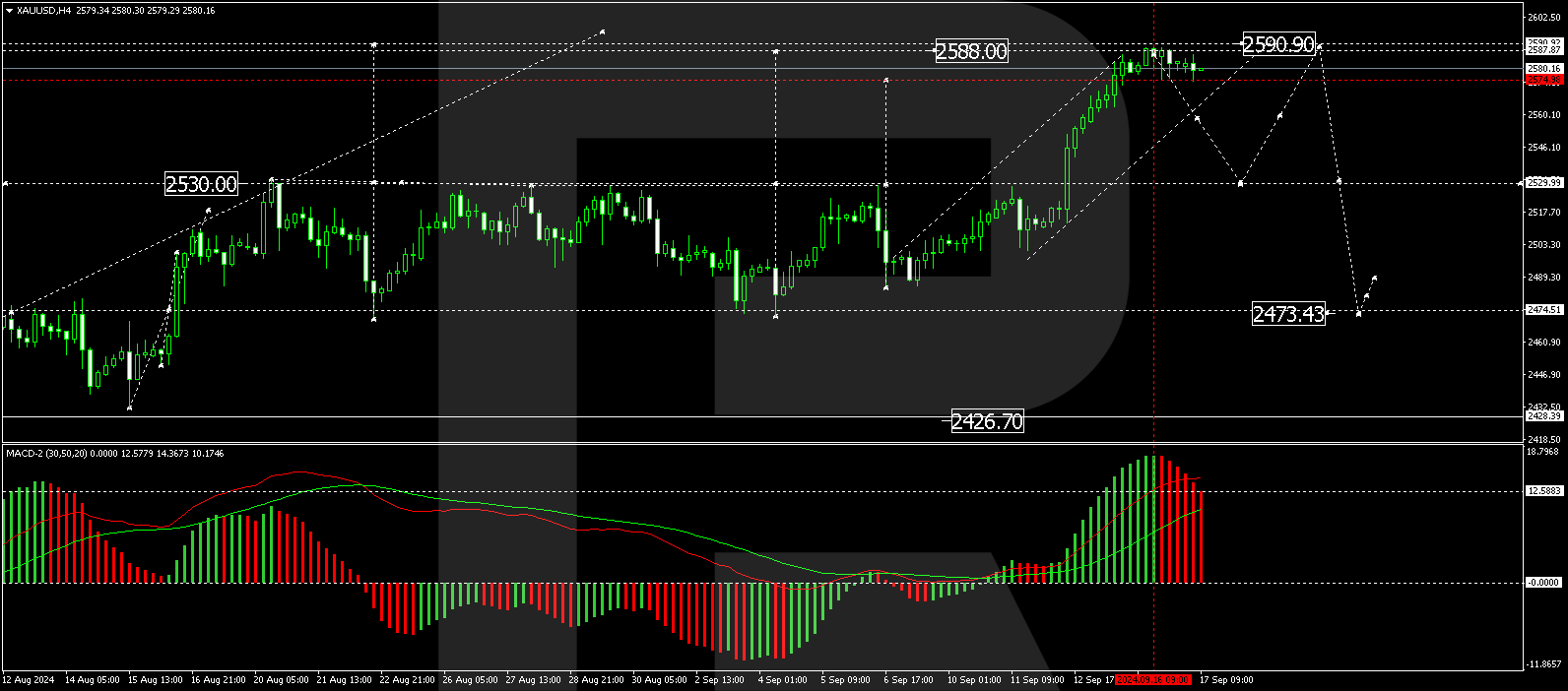

Gold (XAUUSD) broke through the consolidation range at 2530.00 and executed a growth wave up to 2586.00. The market has now reached the expansion potential of this range and is forming a new consolidation zone at these highs. The primary expectation is for a downward move to 2555.50, potentially extending into a corrective phase towards 2530.00. The MACD indicator supports this scenario, showing signal lines above zero but starting a downward trajectory, indicating the potential for a forthcoming decline.

黃金(XAUUSD)突破了2530.00的整理區間,上漲至2586.00。市場現已達到該區間的擴張潛力,並形成了一個新的高位整理區間。主要預期是向下走到2555.50,可能進一步進入一個向2530.00的修正階段。MACD指標支持這一情景,顯示信號線在零線之上,但開始向下運動,顯示即將出現的下跌可能。

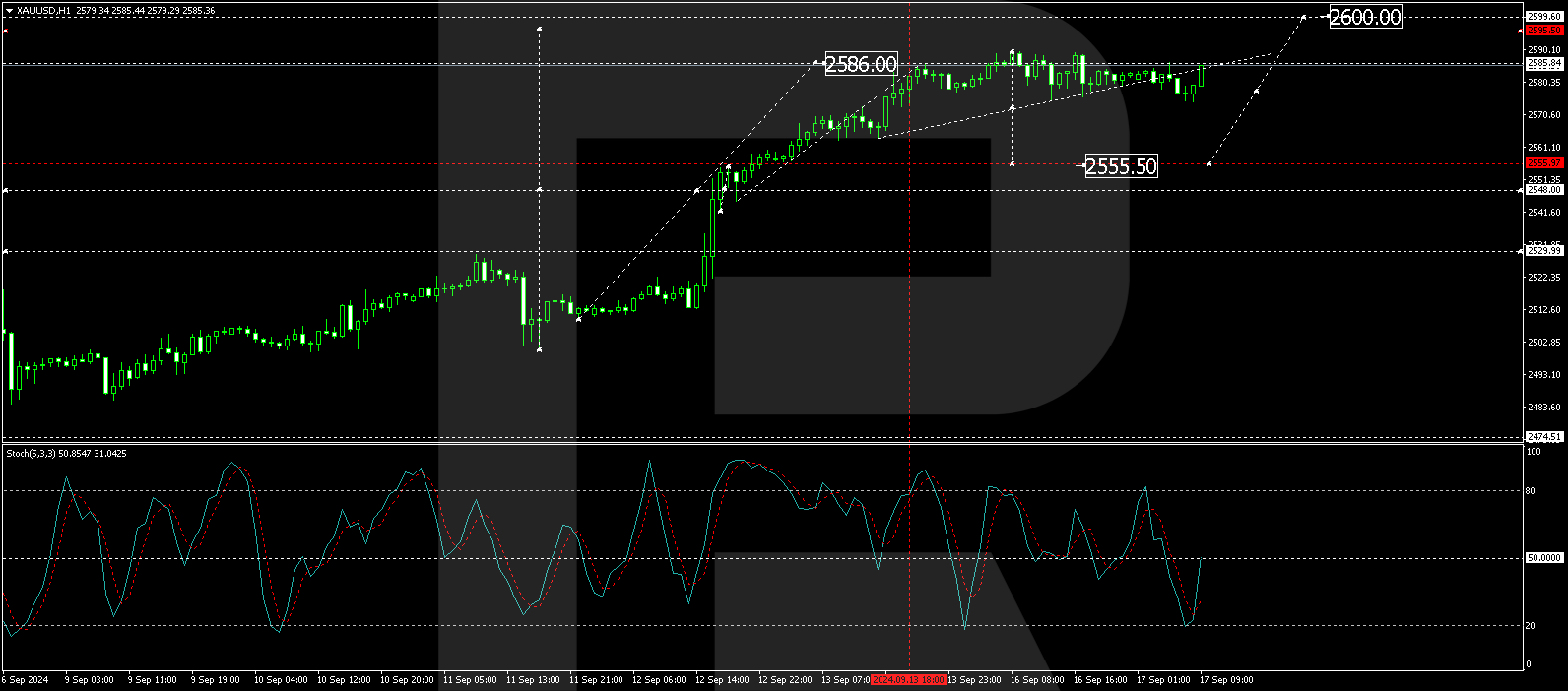

On the H1 chart, gold (XAUUSD) reached up to 2588.88 and is currently consolidating just below this peak. A break below this consolidation could lead to a move down to 2555.50. Conversely, a break above could briefly push prices towards 2600.00 before a potential reversal to 2530.00. The Stochastic oscillator, with its signal line below 50 and pointing sharply downward towards 20, corroborates this expected downward movement.

在H1圖表中,黃金(XAUUSD)達到了2588.88,並且目前在該高點之下處於整理中。突破該整理將可能導致下跌到2555.50。相反,突破可能會暫時推動價格上漲至2600.00,然後可能會出現向2530.00的逆轉。隨着其信號線低於50且急劇指向20的隨機震盪指標,這一預期的下跌趨勢得到了證實。

Disclaimer

免責聲明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析僅代表作者個人觀點,不得視爲交易建議。RoboForex不承擔基於本文所含交易建議和評論所產生的任何交易結果的責任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文來自非報酬的外部投稿人。它不代表Benzinga的報道,並且沒有因爲內容或準確性而被編輯。