Smart Money Is Betting Big In Micron Technology Options

Smart Money Is Betting Big In Micron Technology Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Micron Technology.

擁有大量資金的鯨魚明顯看淡美光科技。

Looking at options history for Micron Technology (NASDAQ:MU) we detected 17 trades.

查看美光科技(納斯達克:MU)期權歷史,我們發現了17筆交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 47% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,41%的投資者以牛市預期開倉,47%的投資者以熊市預期開倉。

From the overall spotted trades, 3 are puts, for a total amount of $226,275 and 14, calls, for a total amount of $582,345.

從所有發現的交易中,有3筆看跌交易,總金額爲$226,275,有14筆看漲交易,總金額爲$582,345。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $85.0 to $100.0 for Micron Technology over the recent three months.

根據交易活動,顯然重要的投資者們正瞄準着涵蓋從$85.0到$100.0的價格區間,時間跨度爲最近三個月的美光科技。

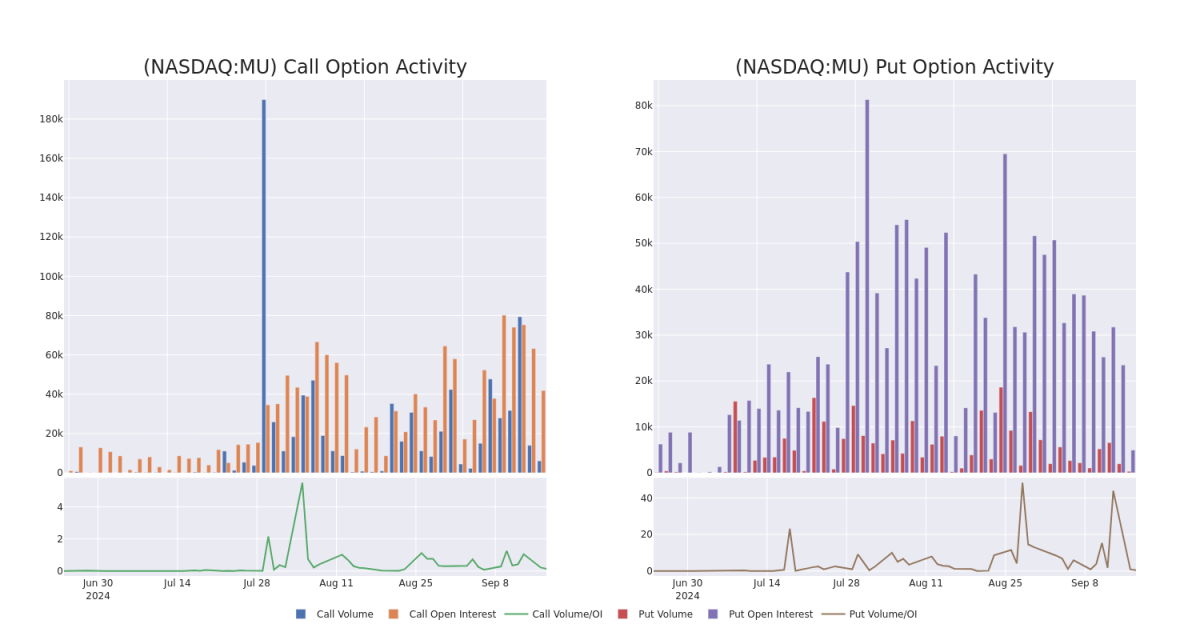

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In terms of liquidity and interest, the mean open interest for Micron Technology options trades today is 3601.92 with a total volume of 6,396.00.

就流動性和興趣而言,美光科技的期權交易今天的平均持倉量爲3601.92,總成交量爲6,396.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Micron Technology's big money trades within a strike price range of $85.0 to $100.0 over the last 30 days.

在下面的圖表中,我們可以追蹤過去30天內,在85.0至100.0美元的行權價區間內,美光科技看漲和看跌期權的大宗交易的成交量和持倉量的發展情況。

Micron Technology Option Volume And Open Interest Over Last 30 Days

Micron Technology過去30天的期權成交量和未平倉合約

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | PUT | TRADE | BULLISH | 06/20/25 | $13.35 | $13.15 | $13.2 | $87.50 | $99.0K | 1.4K | 225 |

| MU | PUT | SWEEP | BEARISH | 03/21/25 | $15.75 | $15.65 | $15.75 | $95.00 | $96.0K | 3.3K | 62 |

| MU | CALL | SWEEP | BEARISH | 03/21/25 | $15.3 | $15.1 | $15.16 | $85.00 | $84.9K | 1.1K | 58 |

| MU | CALL | TRADE | BEARISH | 01/16/26 | $23.2 | $23.05 | $23.05 | $85.00 | $59.9K | 294 | 28 |

| MU | CALL | SWEEP | BULLISH | 09/20/24 | $2.79 | $2.45 | $2.8 | $87.00 | $56.0K | 1.9K | 209 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美光 | 看跌 | 交易 | 看好 | 06/20/25 | $13.35 | $13.15 | $13.2 | $87.50 | $99.0千 | 1.4千 | 225 |

| 美光 | 看跌 | SWEEP | 看淡 | 03/21/25 | $15.75 | $15.65 | $15.75 | $ 95.00 | $96.0K | 3.3K | 62 |

| 美光 | 看漲 | SWEEP | 看淡 | 03/21/25 | $15.3 | $15.1 | $15.16 | $85.00 | $84.9K | 1.1千 | 119,308 |

| 美光 | 看漲 | 交易 | 看淡 | 01/16/26 | $23.2 | $23.05 | $23.05 | $85.00 | $59.9千美元 | 294 | 28 |

| 美光 | 看漲 | SWEEP | 看好 | 09/20/24 | $2.79 | $2.45 | $2.8 | $87.00 | $56.0K | 1.9K | 209 |

About Micron Technology

關於美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光科技是世界上最大的半導體公司之一,專門從事存儲芯片。其主要營業收入來自動態隨機存取存儲器(DRAM),它還少量接觸與或非(NAND)閃存芯片。美光科技服務於全球用戶,將芯片銷售到數據中心、移動電話、消費電子、工業和汽車應用中。該公司具有垂直一體化優勢。

Where Is Micron Technology Standing Right Now?

美光科技現在處於什麼位置?

- Currently trading with a volume of 2,940,198, the MU's price is up by 0.98%, now at $88.03.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 8 days.

- 美光科技當前交易量爲2,940,198股,價格上漲0.98%,目前爲88.03美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計將在8天內發佈收益報告。

Professional Analyst Ratings for Micron Technology

美光科技的專業分析師評級

5 market experts have recently issued ratings for this stock, with a consensus target price of $121.4.

5位市場專家最近對這支股票發表了評級意見,一致目標價爲121.4美元。

- An analyst from Needham persists with their Buy rating on Micron Technology, maintaining a target price of $140.

- An analyst from Raymond James persists with their Outperform rating on Micron Technology, maintaining a target price of $125.

- An analyst from Exane BNP Paribas has revised its rating downward to Underperform, adjusting the price target to $67.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Micron Technology, targeting a price of $175.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Micron Technology, which currently sits at a price target of $100.

- Needham的分析師堅持對美光科技的買入評級,目標價維持在140美元。

- Raymond James的分析師堅持對美光科技的表現評級,維持目標價爲125美元。

- Exane BNP Paribas的分析師已將評級下調至弱勢,調整價格目標至67美元。

- Susquehanna的分析師持續對美光科技持有積極評級,目標價爲175美元。

- 摩根士丹利的分析師決定維持對美光科技的等權評級,目標價目前爲100美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

交易期權涉及更高的風險,但也提供了更高的利潤潛力。 精明的交易者通過持續的教育,策略性的交易調整,利用各種指標以及關注市場動態來減輕這些風險。 使用Benzinga Pro的實時警報關注美光技術的最新期權交易。