A Closer Look at ServiceNow's Options Market Dynamics

A Closer Look at ServiceNow's Options Market Dynamics

Deep-pocketed investors have adopted a bullish approach towards ServiceNow (NYSE:NOW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NOW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for ServiceNow. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 23% bearish. Among these notable options, 2 are puts, totaling $75,360, and 15 are calls, amounting to $1,343,249.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $900.0 for ServiceNow over the last 3 months.

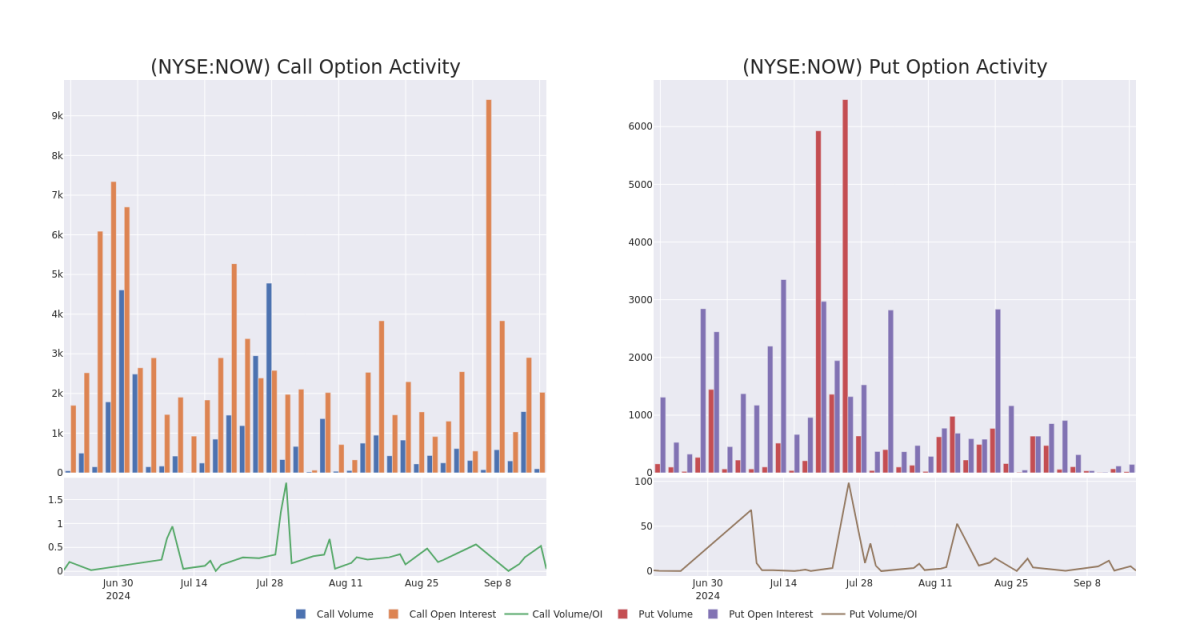

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for ServiceNow options trades today is 135.81 with a total volume of 116.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for ServiceNow's big money trades within a strike price range of $400.0 to $900.0 over the last 30 days.

ServiceNow Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | TRADE | BULLISH | 10/25/24 | $53.9 | $48.4 | $52.1 | $880.00 | $208.4K | 1 | 40 |

| NOW | CALL | TRADE | BEARISH | 10/04/24 | $53.4 | $51.0 | $51.0 | $850.00 | $204.0K | 45 | 40 |

| NOW | CALL | TRADE | NEUTRAL | 09/20/24 | $65.5 | $59.7 | $62.66 | $835.00 | $150.3K | 140 | 25 |

| NOW | CALL | TRADE | NEUTRAL | 09/20/24 | $60.3 | $55.5 | $57.85 | $840.00 | $138.8K | 672 | 0 |

| NOW | CALL | SWEEP | BEARISH | 09/20/24 | $47.9 | $46.0 | $46.0 | $850.00 | $115.0K | 281 | 25 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

Where Is ServiceNow Standing Right Now?

- Currently trading with a volume of 405,541, the NOW's price is down by -0.42%, now at $888.68.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 36 days.

What Analysts Are Saying About ServiceNow

In the last month, 1 experts released ratings on this stock with an average target price of $900.0.

- An analyst from Needham downgraded its action to Buy with a price target of $900.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ServiceNow options trades with real-time alerts from Benzinga Pro.