Market Story | S&P 500 Hits All-Time High Tuesday Before Falling Back

Market Story | S&P 500 Hits All-Time High Tuesday Before Falling Back

The market cooled in the afternoon after climbing in morning trading. The S&P 500 hit a record high Tuesday morning before falling back, one day before the most exciting FOMC monetary policy meetings for years, with investor hype expecting at least the first 25 bp rate cut -0.25%.

上午交易中市場上漲後,下午有所降溫。週二上午標普500指數創下紀錄高點,然後回落,正好在最令人興奮的一天的前一天。 FOMC 投資者熱情高漲,期待至少首次25個點子的利率期貨削減-0.25%。

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ was up 3 bps, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.04%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.20%.

美東時間下午4點後 $標普500指數 (.SPX.US)$ 上漲了3個點子,$道瓊斯指數 (.DJI.US)$ 下跌了0.04%,而 $納斯達克綜合指數 (.IXIC.US)$ 上漲了0.20%。

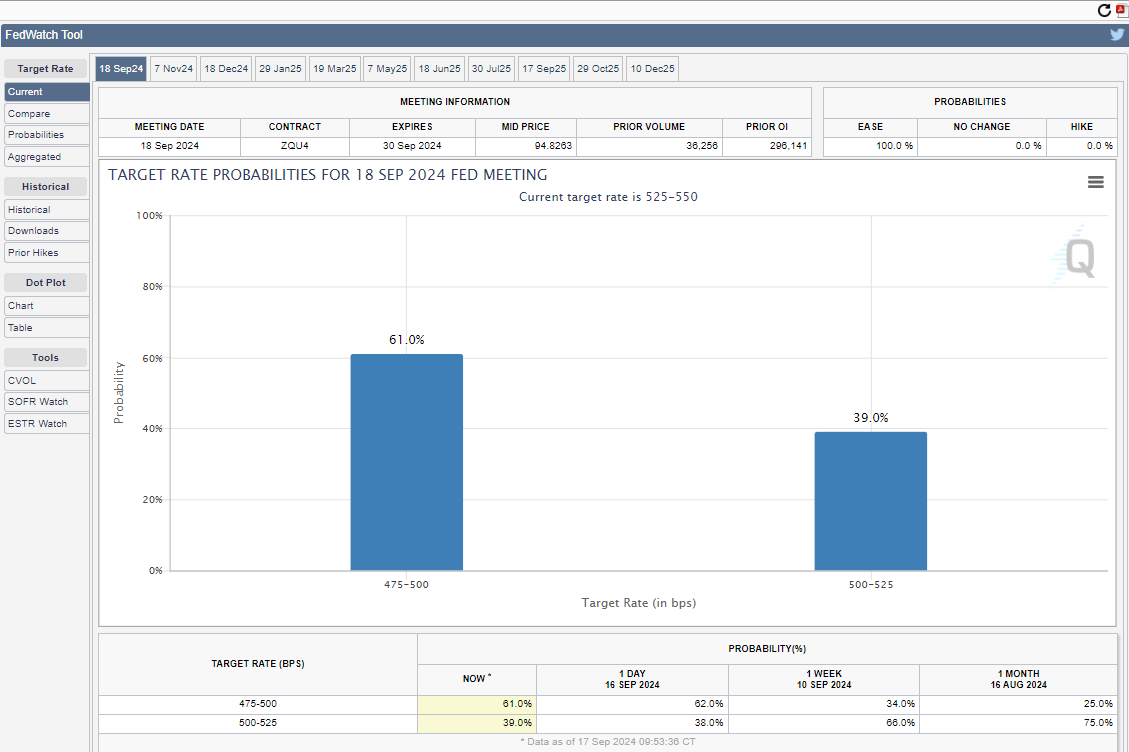

In macro, investors are looking toward the Wednesday FOMC Monetary Policy meeting, where the Treasury Futures market expects rate cuts, according to the CME FedWatch tool.

宏觀方面,投資者正期待週三的FOMC貨幣政策會議,在這次會議上,根據CME FedWatch工具顯示,國債期貨市場預計會出現減息。

On Monday, Former President of the New York Federal Reserve Bill Dudley wrote in Bloomberg Opinion that the FED should go for larger cuts on Wednesday.

週一,前紐約聯儲銀行行長比爾·達德利在彭博蘭觀點中寫道,聯儲局應在週三進行更大規模的減息。

"As I noted last Friday at a Bretton Woods Committee conference in Singapore, the logic supporting a 50-basis-point cut is compelling," he wrote. He said inflation is lower, and jobs are still secure, "Yet short-term interest rates remain far above neutral. This disparity needs to be corrected as quickly as possible."

「正如我上週在新加坡的佈雷頓森林委員會會議上所說,支持50個點子減息的邏輯是令人信服的,」他寫道。他說通脹率較低,就業狀況仍然穩定,「然而短期利率仍遠高於中性水平,這種差距需要儘快糾正。」 更廣泛的加密貨幣市場也經歷了回撤,其中CoinMarketCap上的加密貨幣指數在過去24小時下跌了1%。 週二,美國八月份零售銷售數據由美國人口調查局公佈,數據顯示零售銷售總值環比增長0.1%,排除食品服務、汽車、建築材料和汽油的核心銷售。FHN金融公司的馬克·斯特里伯說,一些類別出現了價格下跌,但數據表明家庭需求仍然強勁。

Tuesday, U.S. August retail numbers came out from the Census Beuro and showed the total value of retail sales increased 0.1% month over month, and 'core' sales excluding food services, auto, building materials, and gasoline. Mark Strieber from FHN Financial said some categories fell from price declines- but the figures indicate household demand is still resilient.

星期二,美國八月零售銷售數據從美國人口普查局發佈,數據顯示零售銷售總值環比增長0.1%,核心銷售(排除食品服務、汽車、建築材料和汽油)也有增長。FHN金融公司的馬克·斯特里伯說,一些類別出現了價格下跌,但數據表明家庭需求仍然強勁。

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

對期權感興趣嗎?要在期權頁面上查看這些股票和更多信息,請點擊 這裏想了解更多關於期權的信息嗎? 點擊此鏈接查看moomoo教育點擊此處註冊會議。在這裏加入我們獨家期權聊天室,獲得我們專家Sarge的個人召喚。 在這裏加入我們的獨家期權聊天,得到我們的投資專家Sarge的個人實況解說。

Yesterday, users talked about rate cuts and how they might affect or not affect their investments.

昨天,用戶們討論了利率減息對他們的投資可能產生的影響或不影響的問題。

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

交易員們,你們覺得,在2024年的市場中是否會跟隨群衆?今天你看到了什麼?群衆在關注什麼?請在下面的評論中告訴我!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

免責聲明:此內容僅供信息使用,不是任何特定投資或策略的推薦或認可。指數未經管理,不能直接投資。“投資涉及風險,可能導致本金損失。此內容中提供的投資信息爲一般性質,僅供舉例說明,並可能不適合所有投資者。它是在不考慮個體投資者的財務狀況、投資目標、投資時間表或風險容忍度的情況下提供的。在考慮個人相關情況之前,請先考慮此信息的適用性,然後再做出任何投資決策。過去的表現並不預示或保證未來的成功。Moomoo不對上述內容的足夠性或適時性作出任何聲明或保證。提供的數據和信息是從被認爲是可靠的來源獲得的,但是Moomoo並不保證前述材料準確無誤。有關更多信息,請參見Moovers社區發帖。link有關更多信息,請參見Moovers社區發帖中的鏈接。