What the Options Market Tells Us About Philip Morris Intl

What the Options Market Tells Us About Philip Morris Intl

Whales with a lot of money to spend have taken a noticeably bullish stance on Philip Morris Intl.

資金雄厚的大鱷對菲利普莫里斯國際採取了明顯看好的態度。

Looking at options history for Philip Morris Intl (NYSE:PM) we detected 16 trades.

觀察菲利普莫里斯國際(紐交所:PM)的期權歷史記錄,我們發現了16筆交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 31% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,50%的投資者持看好觀望態度,31%的投資者持看淡觀望態度。

From the overall spotted trades, 2 are puts, for a total amount of $66,002 and 14, calls, for a total amount of $682,665.

從總體看,我們發現了2筆看跌期權交易,總金額爲66,002美元,以及14筆看漲期權交易,總金額爲682,665美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $140.0 for Philip Morris Intl during the past quarter.

分析這些合約中的成交量和未平倉合約,我們發現大型投資者在過去季度中一直關注菲利普莫里斯國際的股價窗口在50.0至140.0美元之間。

Insights into Volume & Open Interest

成交量和持倉量分析

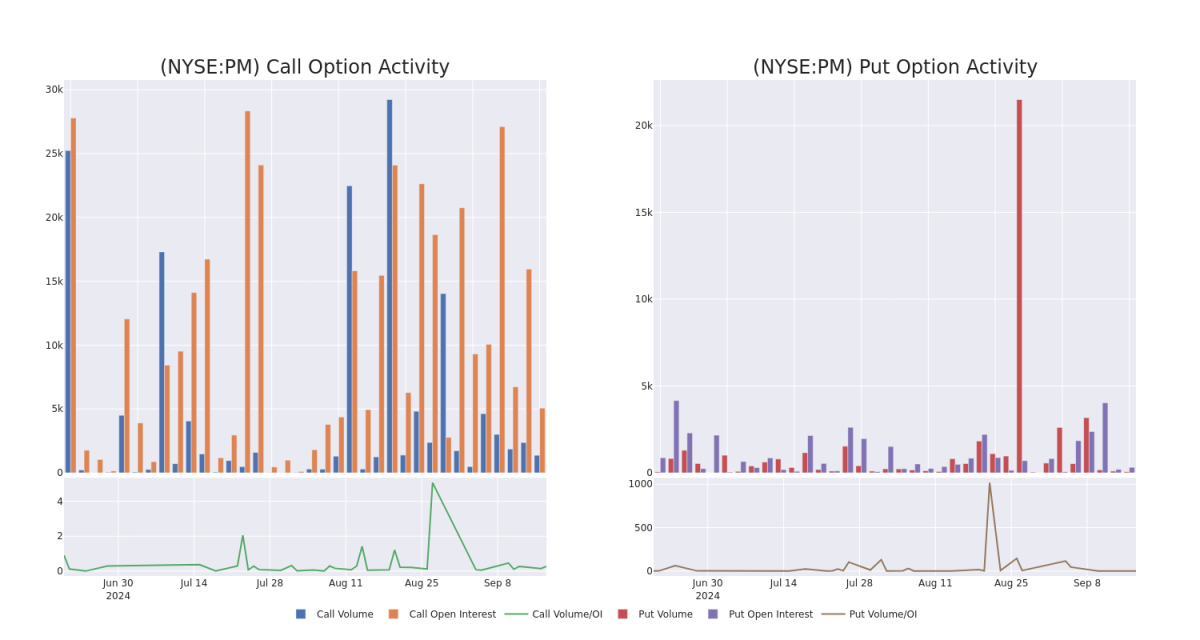

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Philip Morris Intl's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Philip Morris Intl's significant trades, within a strike price range of $50.0 to $140.0, over the past month.

檢查成交量和未平倉合約對股票研究至關重要。這些信息是評估菲利普莫里斯國際在某個行權價的期權的流動性和興趣水平的關鍵。以下是過去一個月菲利普莫里斯國際在50.0至140.0美元行權價範圍內的大宗交易中看漲和看跌合約成交量和未平倉合約趨勢的快照。

Philip Morris Intl Call and Put Volume: 30-Day Overview

菲利普莫里斯國際的看漲和看跌期權成交量: 30天概覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PM | CALL | TRADE | BULLISH | 01/16/26 | $18.1 | $15.6 | $17.38 | $110.00 | $173.8K | 688 | 130 |

| PM | CALL | SWEEP | BULLISH | 09/27/24 | $1.3 | $1.2 | $1.3 | $123.00 | $99.9K | 222 | 892 |

| PM | CALL | TRADE | NEUTRAL | 01/16/26 | $20.1 | $19.4 | $19.69 | $110.00 | $49.2K | 688 | 25 |

| PM | CALL | SWEEP | BULLISH | 09/19/25 | $9.8 | $9.5 | $9.8 | $125.00 | $49.0K | 4 | 47 |

| PM | PUT | SWEEP | BEARISH | 06/20/25 | $19.4 | $18.8 | $19.4 | $140.00 | $38.8K | 25 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 菲利普莫里斯 | 看漲 | 交易 | 看好 | 01/16/26 | $18.1 | $15.6 | $17.38 | $110.00 | 173,800美元 | 688 | Dated: September 3, 2024 |

| 菲利普莫里斯 | 看漲 | SWEEP | 看好 | 09/27/24 | $1.3 | $1.2 | $1.3 | $123.00 | $99.9K | 222 | 892 |

| 菲利普莫里斯 | 看漲 | 交易 | 中立 | 01/16/26 | $20.1 | $19.4 | 19.69美元 | $110.00 | $49.2千 | 688 | 25 |

| 菲利普莫里斯 | 看漲 | SWEEP | 看好 | 09/19/25 | $9.8 | $9.5 | $9.8 | $125.00 | $49.0千 | 4 | 47 |

| 菲利普莫里斯 | 看跌 | SWEEP | 看淡 | 06/20/25 | $19.4 | $18.8 | $19.4 | $140.00 | $38.8K | 25 | 20 |

About Philip Morris Intl

關於菲利普莫里斯國際

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US. With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokeable products but also gained a toehold into the US to sell its iQOS heatsticks.

菲利普莫里斯國際是奧馳亞在2008年創立的國際運營部門,銷售捲菸和降危風險產品,包括加熱棒、電子煙和口服尼古丁產品,主要在美國以外地區銷售。憑藉對瑞典瑞士Match的收購,後者是美國和斯堪的納維亞地區傳統口腔菸草產品和尼古丁袋的主要生產商,PMI不僅擺脫了可吸菸的產品,而且進入了美國市場以銷售其iQOS加熱棒。

Present Market Standing of Philip Morris Intl

菲利普莫里斯國際的現狀

- With a trading volume of 4,202,134, the price of PM is down by -2.3%, reaching $123.07.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 30 days from now.

- 交易量達到4,202,134股,PM的價格下跌了-2.3%,達到123.07美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個業績發佈日期爲30天后。

Professional Analyst Ratings for Philip Morris Intl

菲利普莫里斯國際的專業分析師評級

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $131.75.

過去一個月,有4位行業分析師分享了他們對這支股票的見解,提議平均目標價爲131.75美元。

- Maintaining their stance, an analyst from UBS continues to hold a Sell rating for Philip Morris Intl, targeting a price of $105.

- An analyst from B of A Securities has decided to maintain their Buy rating on Philip Morris Intl, which currently sits at a price target of $139.

- An analyst from Barclays has decided to maintain their Overweight rating on Philip Morris Intl, which currently sits at a price target of $145.

- An analyst from Stifel persists with their Buy rating on Philip Morris Intl, maintaining a target price of $138.

- UBS的分析師繼續保持立場,繼續對菲利普莫里斯國際公司持有賣出評級,目標價爲105美元。

- B of A證券的一位分析師決定維持對菲利普莫里斯國際公司的買入評級,目前的價格目標爲$139。

- 巴克萊銀行的一位分析師決定維持對菲利普莫里斯國際的超配評級,目前的目標價爲145美元。

- 斯蒂夫爾的一位分析師堅持對菲利普莫里斯國際公司的買入評級,維持目標價爲$138。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

From the overall spotted trades, 2 are puts, for a total amount of $66,002 and 14, calls, for a total amount of $682,665.

From the overall spotted trades, 2 are puts, for a total amount of $66,002 and 14, calls, for a total amount of $682,665.