US Listed-Chinese Stocks Surge Tuesday on Policy Boost, Who Is Leading the Way

US Listed-Chinese Stocks Surge Tuesday on Policy Boost, Who Is Leading the Way

On September 24, China announced its largest economic stimulus package since pandemic, triggering a frenzy in AH shares and US-listed Chinese stocks. Chinese stocks listed in the US soared on Tuesday, with the $NASDAQ Golden Dragon China (.HXC.US)$ closing up more than 9%, marking the biggest gain since 2022. Among the popular stocks, $Kanzhun (BZ.US)$ surged over 19%, $Bilibili (BILI.US)$ rose by 17%, $JD.com (JD.US)$ by nearly 14%, while $XPeng (XPEV.US)$, $NIO Inc (NIO.US)$, $Li Auto (LI.US)$, and $PDD Holdings (PDD.US)$ all rose by more than 11%.

9月24日,中國宣佈自疫情爆發以來最大規模的經濟刺激計劃,引發了AH股和在美上市的中國股票的瘋狂。週二,美國上市的中國股票飆升,$納斯達克中國金龍指數 (.HXC.US)$ 收盤漲幅超過9%,創下2022年以來的最大漲幅。在熱門股票中,$BOSS直聘 (BZ.US)$ 暴漲逾19%,$嗶哩嗶哩 (BILI.US)$ 漲幅達17%,$京東 (JD.US)$ 近14%,而$小鵬汽車 (XPEV.US)$,$蔚來 (NIO.US)$,$理想汽車 (LI.US)$和$拼多多 (PDD.US)$ 所有板塊的漲幅均超過11%。

In the options market, the trading volume of bullish options on China-related assets also saw a sharp increase, indicating a surge in optimism among global investors towards Chinese stocks.

在期權市場,中國相關資產看好期權的成交量也大幅增加,表明全球投資者對中國股票持樂觀態度的顯著增長。

Beijing's Extensive Policy Measures Fuel Market Confidence

Beijing's Extensive Policy Measures Fuel Market Confidence

北京的大規模政策措施助力市場信心

The People's Bank of China has recently unveiled a comprehensive package of policies to the market, including:

中國人民銀行最近向市場公佈了一系列全面的政策,包括:

1. The rare simultaneous reduction in the reserve requirement ratio and policy interest rates: On one hand, it announced a 50 bp cut in the bank reserve requirement ratio and provided unconventional guidance on the possibility of further cuts of 25-50 bp before the year-end; on the other hand, it declared a 20 basis point decrease in the key short-term interest rate - the 7-day reverse repo rate, driving down the market benchmark interest rate.

1. 銀行存款準備金率和政策利率的罕見同時下調:一方面宣佈將銀行存款準備金率下調50個點子,並就年底前可能進一步降低25-50個點子提供了非常規指導;另一方面,宣佈將關鍵短期利率-7天逆回購利率降低20個點子,拉低市場基準利率。

2. Lowering the interest rates on existing housing loans and standardizing the minimum down payment ratio for housing loans, which is expected to reduce residential interest pressure, unleash consumer consumption potential, and stimulate real estate demand.

2. 下調現有住房貸款利率並規範住房貸款最低首付比例,預計可減少住房利息壓力,釋放消費潛力,刺激房地產需求。

3. For the stock market, two new instruments have been introduced to support the stock market: including establishing a swap program for securities, funds and insurance companies to obtain liquidity from the central bank through asset collateralization, significantly enhancing funding and stock holding capabilities; at the same time, the introduction of special re-lending facilities to guide banks in providing loans to listed companies and major shareholders, supporting buybacks and stock holdings. In terms of the initial scale, these two instruments are expected to bring about an incremental funding of around 800 billion RMB, injecting liquidity into the Chinese stock market.

3. 對於股市,已推出兩項新工具支持股市發展:包括建立證券、基金和保險公司通過資產抵押獲得流動性的互換計劃,極大增強了融資和持股能力;同時,推出了專項再貸款便利,指導銀行向上市公司和主要股東提供貸款,支持回購和持股。就初始規模而言,這兩項工具預計將爲中國股市注入約8000億人民幣的增量資金,增加流動性。

Lynn Song, ING's Chief Economist for China said:

ING中國首席經濟學家宋凌表示:

"We view the measures announced today as a positive move, particularly due to the simultaneous release of multiple policies instead of gradual implementation. We believe that there is still room for further relaxation in the coming months, especially with the majority of global central banks currently following a rate-cutting path."

「我們認爲,今天宣佈的措施是一項積極舉措,尤其是由多項政策同時釋放,而非逐步實施。我們相信,在未來幾個月仍有進一步放鬆的空間,尤其是在全球大多數中央銀行目前都在走減息路線的情況下。」

The unexpectedly comprehensive policy measures demonstrate Beijing's determination to combat deflation, economic slowdown, and low investor confidence, with the potential to boost consumer spending, alleviate pressure on the real estate sector, stabilize domestic demand, and inject new vitality into the economy. Simultaneously, it aims to improve market risk appetite for Chinese assets, attracting a new wave of incremental capital inflows. Currently, foreign capital's allocation to Chinese assets remains relatively low. With the return of confidence and liquidity, undervalued Chinese concept stocks with strong fundamentals are expected to usher in a new chapter.

意外全面的政策措施顯示了北京打擊通縮、經濟放緩和投資者信心不足的決心,有望促進消費支出,減輕對房地產業的壓力,穩定國內需求,爲經濟注入新活力。同時,旨在提高對中國資產的市場風險偏好,吸引新一波增量資本流入。目前,外資對中國資產的配置仍相對較低。隨着信心和流動性的回歸,有着強大基本面的被低估中國概念股有望迎來新篇章。

According to Morgan Stanley's stock strategist Laura Wang,

根據摩根士丹利的股票策略師Laura Wang稱:

"We anticipate that both the domestic A-share market and the offshore market will respond positively to these measures, potentially leading to a tactical rebound rally and even outperforming the emerging markets in the short term."

「我們預計,國內A股市場和離岸市場將對這些措施做出積極回應,可能導致短期內的戰術性反彈行情,甚至在新興市場中表現出色。」

How to Allocate Assets and Capitalize on China Assets' Rebound?

How to Allocate Assets and Capitalize on China Assets' Rebound?

如何分配資產並利用中國資產的反彈?

For investors who are optimistic about the broad valuation recovery of Chinese assets driven by the current round of policies, investing in related ETFs may be a relatively straightforward choice.

對於那些對當前一輪政策推動的中國資產整體估值回升持樂觀態度的投資者,投資相關ETF可能是一個相對直接的選擇。

For investors who are still cautious about the effects of the policies and anticipate differentiation in the performance of Chinese concept stocks, selective sector and stock picking are necessary. Investors can focus on targets with strong profitability, ample cash flow, stable stock buybacks or dividends, and good expectations of future performance growth. In terms of industries, analysts are paying close attention to sectors such as banking and insurance, consumer goods, and internet technology.

For investors who are still cautious about the effects of the policies and anticipate differentiation in the performance of Chinese concept stocks, selective sector and stock picking are necessary. Investors can focus on targets with strong profitability, ample cash flow, stable stock buybacks or dividends, and good expectations of future performance growth. In terms of industries, analysts are paying close attention to sectors such as banking and insurance, consumer goods, and internet technology.

Additionally, as a significant global consumer of oil and the largest consumer of mineral resources, China's stimulus measures have also strongly boosted commodity prices and cyclical sectors such as metals and mining, which are highly sensitive to Chinese demand. On Tuesday, both WTI and Brent crude oil prices rose nearly 3% intraday, with major metal price increases driving mining stocks to lead the gains, with the S&P Metals & Mining Select Industry Index rising by 4.12%.

Additionally, as a significant global consumer of oil and the largest consumer of mineral resources, China's stimulus measures have also strongly boosted commodity prices and cyclical sectors such as metals and mining, which are highly sensitive to Chinese demand. On Tuesday, both WTI and Brent crude oil prices rose nearly 3% intraday, with major metal price increases driving mining stocks to lead the gains, with the S&P Metals & Mining Select Industry Index rising by 4.12%.

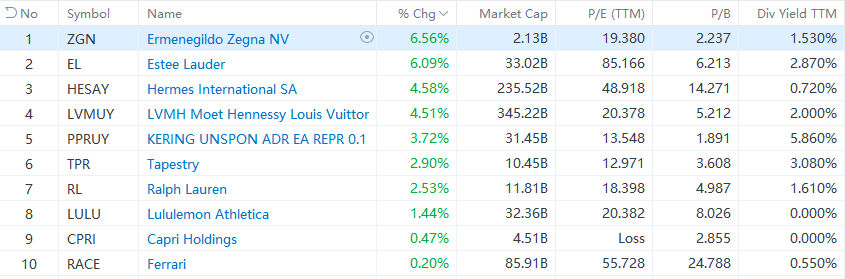

Luxury stocks also saw a collective rise, with the S&P Global Luxury Index up by 2.41%, outperforming the $S&P 500 Index (.SPX.US)$'s 0.25%.

Luxury stocks also saw a collective rise, with the S&P Global Luxury Index up by 2.41%, outperforming the $標普500指數 (.SPX.US)$'s 0.25%.

It is worth noting that despite the significant rebound in the short term driven by the positive signals from the policy measures, some analysts still harbor doubts about the effects of this round of policies. Major institutions such as Goldman Sachs and Morgan Stanley believe that loose monetary policy needs to be combined with more robust fiscal policies to effectively stimulate domestic demand. HSBC also views the current loose policy combination as the starting point for further measures, expecting more fiscal stimulus measures in the future, including the issuance of special national bonds, to ensure economic growth returns to a positive trajectory. It will be crucial to closely monitor data supporting macroeconomic stabilization in sectors such as manufacturing, consumption, and real estate, as well as more evidence of improved corporate profitability.

It is worth noting that despite the significant rebound in the short term driven by the positive signals from the policy measures, some analysts still harbor doubts about the effects of this round of policies. Major institutions such as Goldman Sachs and Morgan Stanley believe that loose monetary policy needs to be combined with more robust fiscal policies to effectively stimulate domestic demand. HSBC also views the current loose policy combination as the starting point for further measures, expecting more fiscal stimulus measures in the future, including the issuance of special national bonds, to ensure economic growth returns to a positive trajectory. It will be crucial to closely monitor data supporting macroeconomic stabilization in sectors such as manufacturing, consumption, and real estate, as well as more evidence of improved corporate profitability.

Source: Bloomberg, The People's Bank of China

來源:彭博社,中國人民銀行

The People's Bank of China has recently unveiled a comprehensive package of policies to the market, including:

The People's Bank of China has recently unveiled a comprehensive package of policies to the market, including: