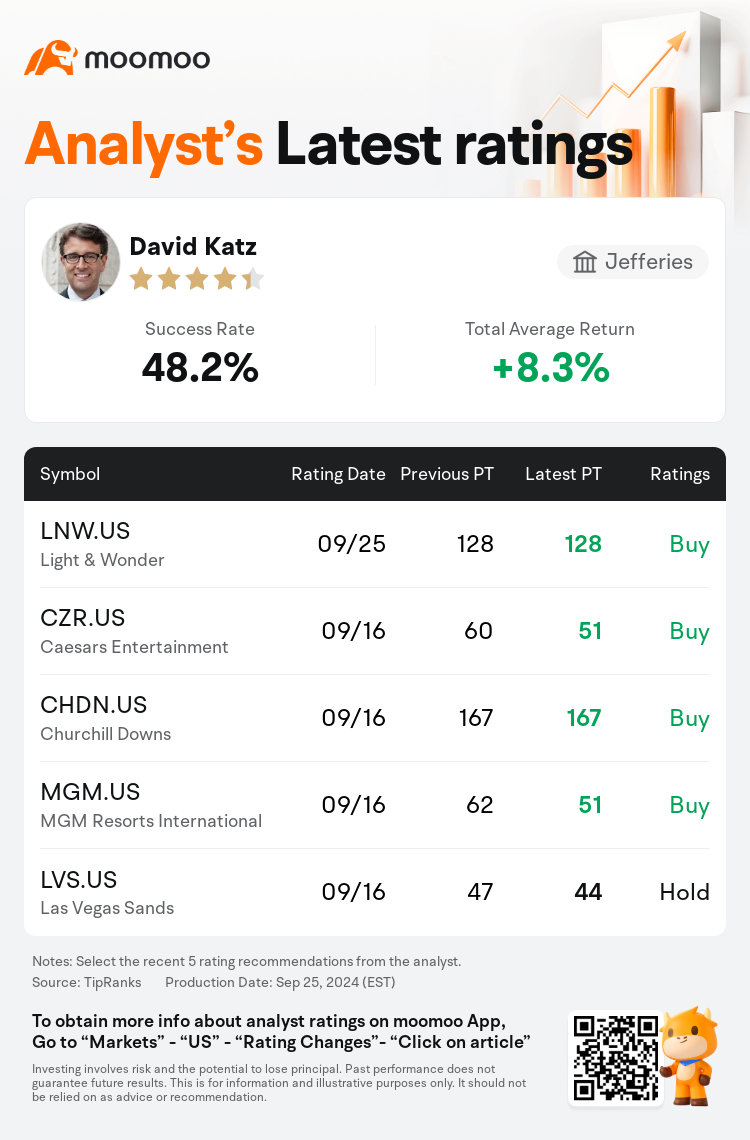

Jefferies analyst David Katz maintains $Light & Wonder (LNW.US)$ with a buy rating, and maintains the target price at $128.

According to TipRanks data, the analyst has a success rate of 48.2% and a total average return of 8.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Light & Wonder (LNW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Light & Wonder (LNW.US)$'s main analysts recently are as follows:

The injunction by the U.S. District Court of Nevada to halt the use of trade secrets concerning 'Dragon Link' and 'Lightning Link' indicates that there is a 'fair chance of success' for the ongoing suit, with the injunction expected to last until the conclusion of the litigation. Despite an 18% share price reaction to the 'Dragon Train' injunction, the perceived valuation upside is thought to 'more than compensate' for the associated risks.

A district court's decision to grant a preliminary injunction against Light & Wonder, restricting further sales and leasing of the 'highly successful' Dragon Train franchise until a definitive ruling, was unexpected. Prior to this legal development, it was believed the consensus anticipated an outcome in favor of Light & Wonder. However, recent court findings have surfaced, tilting the likelihood slightly towards Aristocrat, as reported by an analyst.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

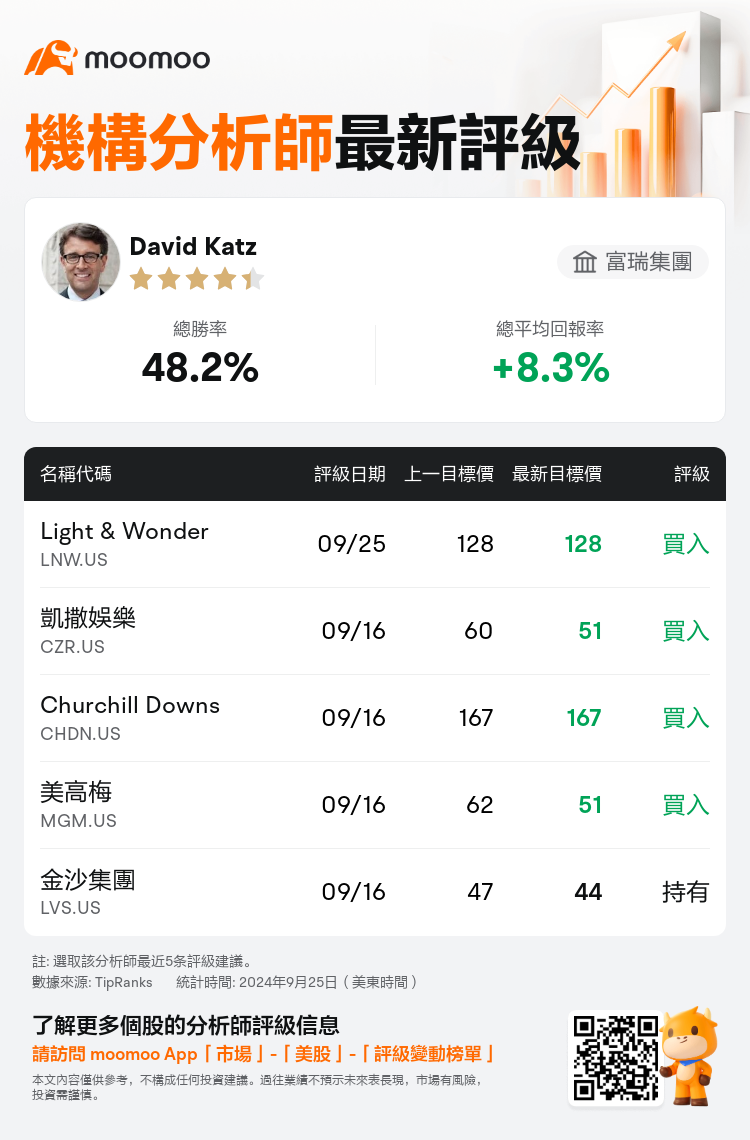

富瑞集團分析師David Katz維持$Light & Wonder (LNW.US)$買入評級,維持目標價128美元。

根據TipRanks數據顯示,該分析師近一年總勝率為48.2%,總平均回報率為8.3%。

此外,綜合報道,$Light & Wonder (LNW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Light & Wonder (LNW.US)$近期主要分析師觀點如下:

美國內華達州地方法院發佈的停止使用有關 「Dragon Link」 和 「Lightning Link」 的商業祕密的禁令表明,正在進行的訴訟有 「相當大的成功機會」,該禁令預計將持續到訴訟結束。儘管股價對 「Dragon Train」 禁令的反應爲18%,但人們認爲,預期的估值上行空間 「足以補償」 相關風險。

地方法院決定對Light & Wonder下達初步禁令,在做出最終裁決之前限制進一步銷售和租賃 「非常成功」 的Dragon Train特許經營權,這出乎意料。在此法律發展之前,據信該共識預見了有利於《光與奇蹟》的結果。但是,據一位分析師報道,最近的法庭調查結果已經浮出水面,使可能性略微偏向Aristocrat。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Light & Wonder (LNW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Light & Wonder (LNW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of