PDD Holdings's Options Frenzy: What You Need to Know

PDD Holdings's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on PDD Holdings. Our analysis of options history for PDD Holdings (NASDAQ:PDD) revealed 22 unusual trades.

金融巨頭在pdd holdings上做了明顯的看好舉動。我們對pdd holdings(NASDAQ:PDD)的期權歷史進行分析後發現22筆飛凡交易。

Delving into the details, we found 45% of traders were bullish, while 31% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $404,941, and 13 were calls, valued at $1,446,455.

深入細節後,我們發現45%的交易員持看好態度,而31%表現出看淡傾向。在所有發現的交易中,有9筆看跌交易,價值404,941美元,以及13筆看漲交易,價值1,446,455美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $85.0 to $140.0 for PDD Holdings over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,三個月來,大戶們一直把目標價區間定在pdd holdings的85.0至140.0美元之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

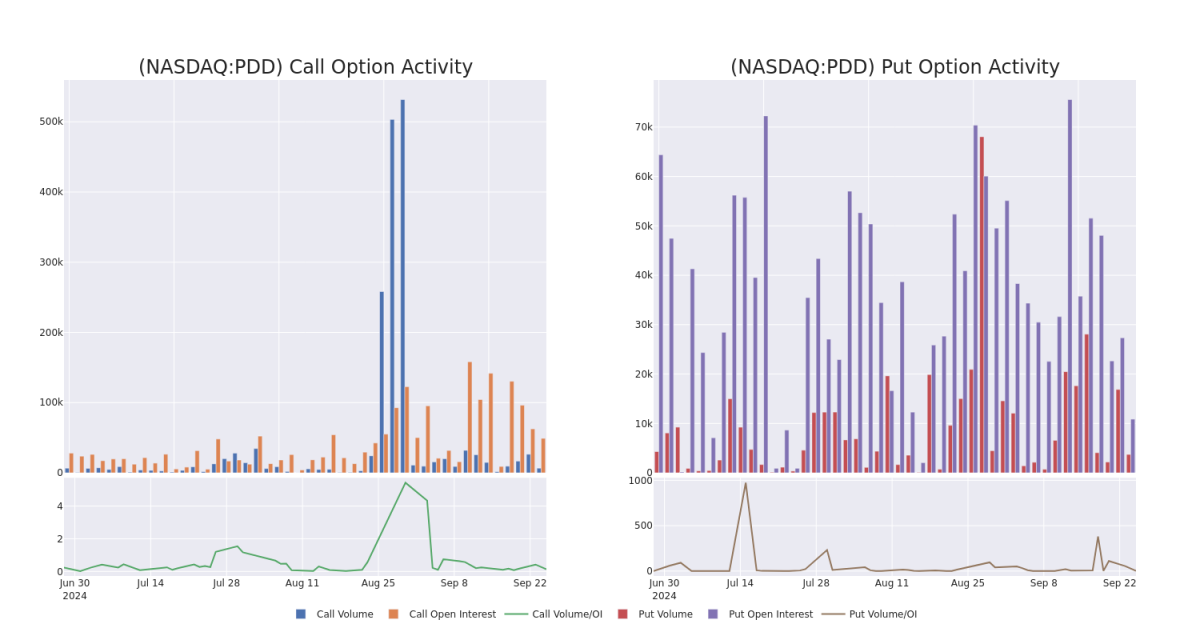

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PDD Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PDD Holdings's significant trades, within a strike price range of $85.0 to $140.0, over the past month.

審視成交量和未平倉合約量可以爲股票研究提供重要見解。這些信息對於評估在某些行權價上pdd holdings期權的流動性和興趣水平至關重要。以下是對pdd holdings重要交易的成交量和未平倉合約量趨勢的快照,涵蓋了過去一個月85.0至140.0美元行權價範圍內的看漲和看跌交易。

PDD Holdings 30-Day Option Volume & Interest Snapshot

PDD Holdings 30天期權成交量和持倉量一覽表

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 11/15/24 | $5.75 | $5.6 | $5.7 | $115.00 | $570.0K | 14.6K | 792 |

| PDD | CALL | TRADE | NEUTRAL | 12/20/24 | $25.55 | $24.1 | $24.74 | $90.00 | $247.4K | 916 | 0 |

| PDD | CALL | SWEEP | BEARISH | 04/17/25 | $19.55 | $18.9 | $19.55 | $105.00 | $144.6K | 905 | 88 |

| PDD | CALL | SWEEP | BULLISH | 10/18/24 | $4.35 | $4.15 | $4.3 | $112.00 | $140.1K | 941 | 361 |

| PDD | PUT | TRADE | BULLISH | 12/20/24 | $29.25 | $29.15 | $29.15 | $140.00 | $139.9K | 319 | 50 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 看漲 | 交易 | 看好 | 11/15/24 | $5.75 | $5.6 | $5.7 | $115.00 | $570.0K | 14.6K | 792 |

| PDD | 看漲 | 交易 | 中立 | 12/20/24 | $25.55 | $24.1 | $24.74 | $90.00 | $247.4K | 916 | 0 |

| PDD | 看漲 | SWEEP | 看淡 | 04/17/25 | $19.55 | $18.9 | $19.55 | $105.00 | $144.6K | 905 | 88 |

| PDD | 看漲 | SWEEP | 看好 | 10/18/24 | $4.35 | $4.15 | $4.3 | $112.00 | $140.1K | 941 | 361 |

| PDD | 看跌 | 交易 | 看好 | 12/20/24 | 29.25美元 | $29.15 | $29.15 | $140.00 | 139.9K美元 | 319 | 50 |

About PDD Holdings

關於pdd holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨國商業集團,擁有和經營一系列業務。PDD的目標是將更多的企業和人們引入數字經濟,從而使當地社區和小企業能從增加的生產率和新的機會中受益。PDD建立了一個支持其基礎業務的採購、物流和履行能力網絡。

Current Position of PDD Holdings

納斯達克現狀持倉

- With a volume of 4,364,295, the price of PDD is down -1.62% at $111.96.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 62 days.

- pdd holdings成交量爲4,364,295,股價下跌-1.62%,報111.96美元。

- RSI因子暗示底層股票可能被超買。

- 下一次盈利預計將在62天內發佈。

Expert Opinions on PDD Holdings

關於pdd holdings的專家意見

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $160.6.

過去一個月,5位行業分析師分享了他們對這支股票的見解,並提出了平均目標價爲160.6美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Bernstein persists with their Outperform rating on PDD Holdings, maintaining a target price of $170. * Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for PDD Holdings, targeting a price of $170. * Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for PDD Holdings, targeting a price of $158. * Reflecting concerns, an analyst from Citigroup lowers its rating to Neutral with a new price target of $120.* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for PDD Holdings, targeting a price of $185.

20年期期權交易員揭示了他的一行圖表技術,顯示了何時買入和賣出。複製他的交易,這些交易平均每20天獲利27%。點擊這裏獲取.* 柏瑞安的分析師堅持對PDD Holdings維持跑贏市場的評級,目標價爲170美元。 * 一位來自B of A Securities的分析師繼續持有PDD Holdings的買入評級,目標價爲170美元。 * 一位來自巴克萊銀行的分析師繼續持有PDD Holdings的增持評級,目標價爲158美元。 * 反映擔憂,花旗集團的分析師將評級降爲中立,新的目標價爲120美元。* 一位來自Benchmark的分析師繼續持有PDD Holdings的買入評級,目標價爲185美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.

交易期權存在更大的風險,但也可以獲得更高的利潤潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因子和保持注意市場動態來減輕這些風險。通過Benzinga Pro獲取PDD Holdings的最新期權交易,獲取實時提醒。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PDD Holdings's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PDD Holdings's options at certain strike prices. Below, we present a snapshot of the