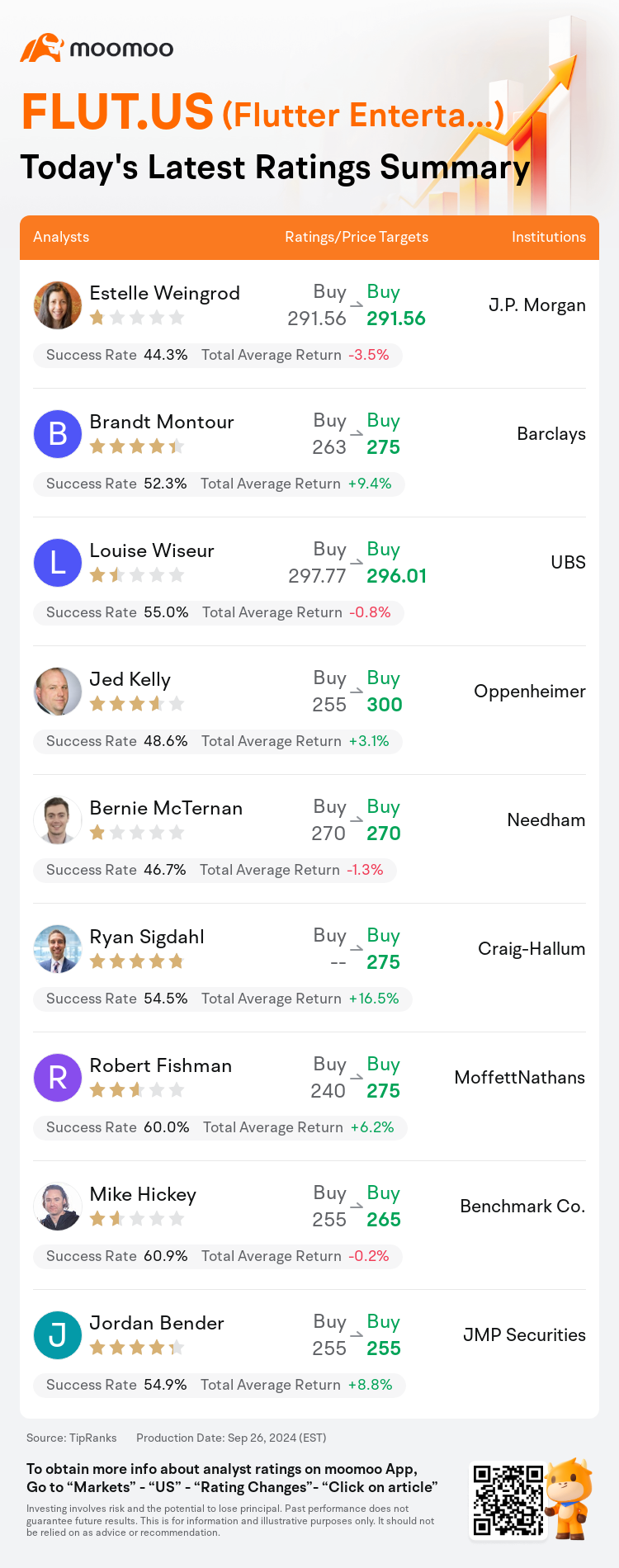

On Sep 26, major Wall Street analysts update their ratings for $Flutter Entertainment (FLUT.US)$, with price targets ranging from $255 to $300.

J.P. Morgan analyst Estelle Weingrod maintains with a buy rating, and maintains the target price at $291.56.

Barclays analyst Brandt Montour maintains with a buy rating, and adjusts the target price from $263 to $275.

UBS analyst Louise Wiseur maintains with a buy rating, and adjusts the target price from $297.77 to $296.01.

UBS analyst Louise Wiseur maintains with a buy rating, and adjusts the target price from $297.77 to $296.01.

Oppenheimer analyst Jed Kelly maintains with a buy rating, and adjusts the target price from $255 to $300.

Needham analyst Bernie McTernan maintains with a buy rating, and maintains the target price at $270.

Furthermore, according to the comprehensive report, the opinions of $Flutter Entertainment (FLUT.US)$'s main analysts recently are as follows:

Following the capital markets day, there's an anticipation of increased hold assumptions and the inclusion of 2027 estimates. The key insight from the event is that Flutter Entertainment's competitive advantage, known as 'Flutter Edge', remains robust and is likely to expand further.

Following a positive Investor Day, expectations for Flutter Entertainment have been enhanced with the introduction of a 2027 U.S. segment EBITDA target of $2.4B, a product roadmap aimed at achieving a 16% U.S. structural hold, and a strategy for a $5B financial repurchase plan. These developments reinforce the view of the company as a 'Core Holding.' Projections for the 2025 U.S. segment suggest 40%-45% incremental margins, indicative of a stable U.S. market, though there is an openness to increase expenditure should the customer acquisition costs relative to the lifetime value of customers improve.

Here are the latest investment ratings and price targets for $Flutter Entertainment (FLUT.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

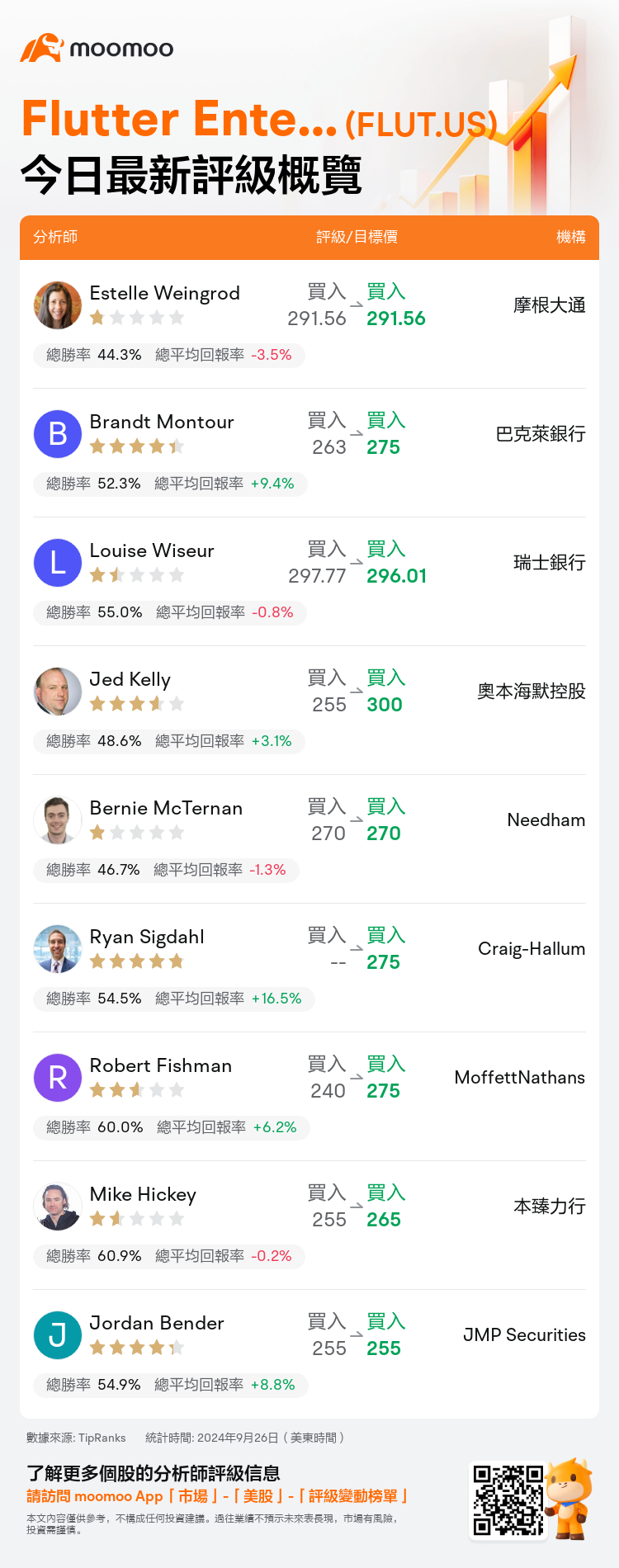

美東時間9月26日,多家華爾街大行更新了$Flutter Entertainment (FLUT.US)$的評級,目標價介於255美元至300美元。

摩根大通分析師Estelle Weingrod維持買入評級,維持目標價291.56美元。

巴克萊銀行分析師Brandt Montour維持買入評級,並將目標價從263美元上調至275美元。

瑞士銀行分析師Louise Wiseur維持買入評級,並將目標價從297.77美元下調至296.01美元。

瑞士銀行分析師Louise Wiseur維持買入評級,並將目標價從297.77美元下調至296.01美元。

奧本海默控股分析師Jed Kelly維持買入評級,並將目標價從255美元上調至300美元。

Needham分析師Bernie McTernan維持買入評級,維持目標價270美元。

此外,綜合報道,$Flutter Entertainment (FLUT.US)$近期主要分析師觀點如下:

在資本市場日之後,預計持有假設增加,幷包括2027年的估計。該事件的關鍵洞察是,Flutter Entertainment的競爭優勢,即『Flutter Edge』,依然強勁,並有可能進一步擴大。

在一次積極的投資者日之後,對Flutter Entertainment的預期隨着引入2027年美國業務EBITDA目標爲24億美元、旨在實現16%美國結構性持有的產品路線圖以及500億美元財務回購計劃策略而得到加強。這些發展進一步強化了公司作爲『核心持有』的觀點。針對2025年美國業務部門的預測顯示40%-45%的增量利潤率,表明美國市場穩定,儘管有可能進一步增加支出,如果顧客獲取成本相對於顧客生命週期價值有所改善的話。

以下爲今日9位分析師對$Flutter Entertainment (FLUT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Louise Wiseur維持買入評級,並將目標價從297.77美元下調至296.01美元。

瑞士銀行分析師Louise Wiseur維持買入評級,並將目標價從297.77美元下調至296.01美元。

UBS analyst Louise Wiseur maintains with a buy rating, and adjusts the target price from $297.77 to $296.01.

UBS analyst Louise Wiseur maintains with a buy rating, and adjusts the target price from $297.77 to $296.01.