SoFi Techs's Options Frenzy: What You Need to Know

SoFi Techs's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on SoFi Techs (NASDAQ:SOFI).

有大量資金可以花的投資者對SoFi Techs(納斯達克股票代碼:SOFI)採取了看漲立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,當交易出現在我們在本辛加追蹤的公開期權歷史記錄上時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SOFI, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 SOFI 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

So how do we know what these investors just did?

那麼我們怎麼知道這些投資者剛才做了什麼?

Today, Benzinga's options scanner spotted 10 uncommon options trades for SoFi Techs.

今天,Benzinga的期權掃描器發現了SoFi Techs的10種不常見的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 70% bullish and 30%, bearish.

這些大手交易者的整體情緒分爲70%看漲和30%(看跌)。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $130,388, and 6 are calls, for a total amount of $239,583.

在我們發現的所有特殊期權中,有4個是看跌期權,總額爲130,388美元,6個是看漲期權,總額爲239,583美元。

What's The Price Target?

目標價格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.0 to $12.0 for SoFi Techs during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注SoFi Techs在過去一個季度的價格範圍從7.0美元到12.0美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

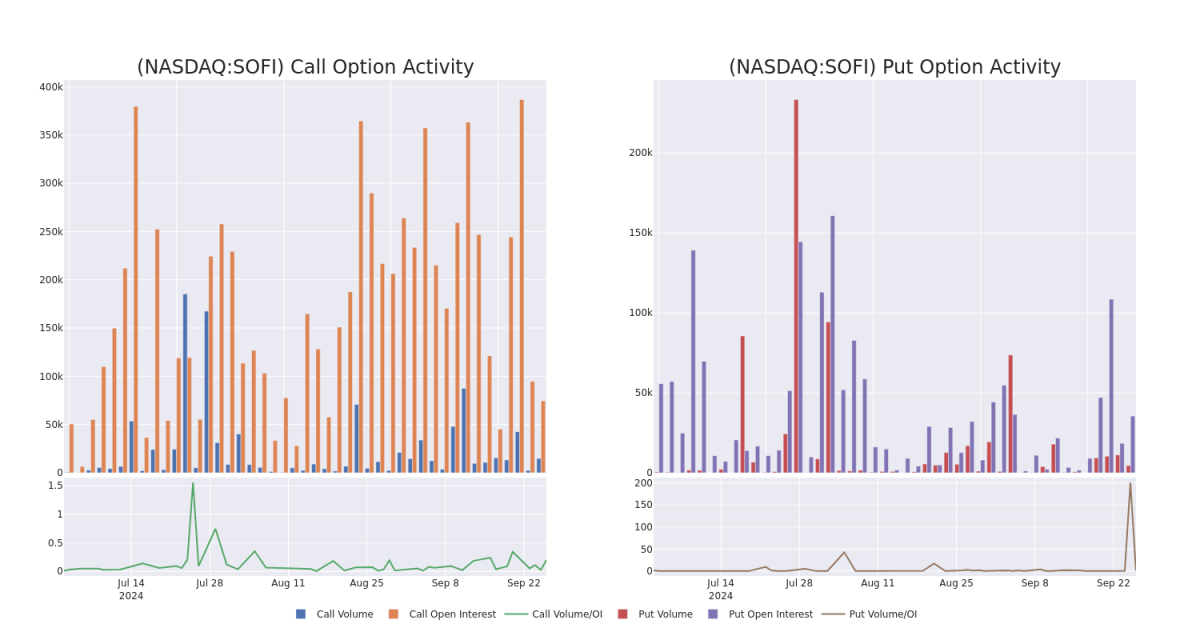

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in SoFi Techs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to SoFi Techs's substantial trades, within a strike price spectrum from $7.0 to $12.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了指定行使價下SoFi Techs期權的流動性和投資者對SoFi Techs期權的興趣。即將發佈的數據顯示了與SoFi Techs的大量交易相關的看漲期權和看跌期權交易量和未平倉合約的波動,在過去30天內,行使價範圍從7.0美元到12.0美元不等。

SoFi Techs Call and Put Volume: 30-Day Overview

SoFi Techs 看漲和看跌交易量:30 天概述

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SOFI | CALL | SWEEP | BULLISH | 03/21/25 | $0.6 | $0.58 | $0.6 | $10.00 | $60.1K | 23.3K | 1.0K |

| SOFI | CALL | SWEEP | BULLISH | 09/27/24 | $0.05 | $0.04 | $0.05 | $8.00 | $50.6K | 34.2K | 12.1K |

| SOFI | PUT | TRADE | BULLISH | 01/17/25 | $0.97 | $0.93 | $0.93 | $8.00 | $36.8K | 22.3K | 447 |

| SOFI | PUT | TRADE | BEARISH | 01/17/25 | $1.01 | $0.99 | $1.01 | $8.00 | $35.3K | 22.3K | 836 |

| SOFI | CALL | SWEEP | BULLISH | 01/15/27 | $3.4 | $3.35 | $3.4 | $7.00 | $34.0K | 3.4K | 106 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 索菲 | 打電話 | 掃 | 看漲 | 03/21/25 | 0.6 美元 | 0.58 美元 | 0.6 美元 | 10.00 美元 | 60.1 萬美元 | 23.3K | 1.0K |

| 索菲 | 打電話 | 掃 | 看漲 | 09/27/24 | 0.05 美元 | 0.04 美元 | 0.05 美元 | 8.00 美元 | 50.6 萬美元 | 34.2K | 12.1K |

| 索菲 | 放 | 貿易 | 看漲 | 01/17/25 | 0.97 美元 | 0.93 美元 | 0.93 美元 | 8.00 美元 | 36.8 萬美元 | 22.3K | 447 |

| 索菲 | 放 | 貿易 | 粗魯的 | 01/17/25 | 1.01 | 0.99 美元 | 1.01 | 8.00 美元 | 35.3 萬美元 | 22.3K | 836 |

| 索菲 | 打電話 | 掃 | 看漲 | 01/15/27 | 3.4 美元 | 3.35 美元 | 3.4 美元 | 7.00 美元 | 34.0 萬美元 | 3.4K | 106 |

About SoFi Techs

關於 SoFi Techs

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

SoFi是一家金融服務公司,成立於2011年,總部位於舊金山。該公司最初以學生貸款再融資業務而聞名,現已將其產品範圍擴大到包括個人貸款、信用卡、抵押貸款、投資帳戶、銀行服務和財務規劃。該公司打算成爲客戶財務的一站式服務,僅通過其移動應用程序和網站運營。通過在2020年收購伽利略,該公司還爲借記卡和數字銀行提供支付和帳戶服務。

Present Market Standing of SoFi Techs

SoFi Techs 目前的市場地位

- With a trading volume of 11,328,660, the price of SOFI is down by -0.11%, reaching $7.72.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 32 days from now.

- SOFI的交易量爲11,328,660美元,下跌了-0.11%,至7.72美元。

- 當前的RSI值表明,該股目前在超買和超賣之間處於中立狀態。

- 下一份收益報告定於32天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處訪問。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SOFI, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SOFI, it often means somebody knows something is about to happen.