JD.com's Options Frenzy: What You Need to Know

JD.com's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on JD.com.

富裕的鯨魚們在京東上採取了明顯看好的態度。

Looking at options history for JD.com (NASDAQ:JD) we detected 38 trades.

查看京東(納斯達克:JD)期權歷史記錄,我們發現了38筆交易。

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 31% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,39%的投資者以看好期望開倉,而31%則爲看淡。

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.

從所有發現的交易中,有2個看跌期權,總金額爲$109,680,有36個看漲期權,總金額爲$4,764,935。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $60.0 for JD.com over the last 3 months.

考慮到這些合同的成交量和未平倉合約量,鯨魚們似乎已經將京東的價格區間鎖定在$22.5到$60.0之間,持續了過去3個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

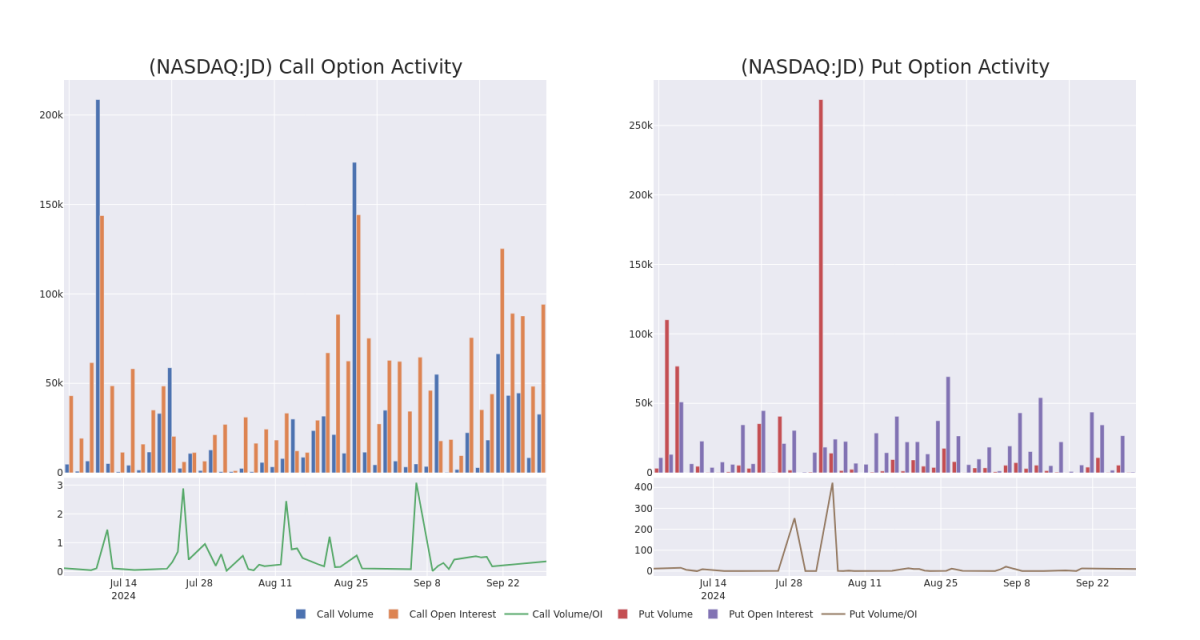

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for JD.com's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across JD.com's significant trades, within a strike price range of $22.5 to $60.0, over the past month.

審查成交量和未平倉合約量可以爲股票研究提供關鍵洞察。這些信息對於衡量京東在特定執行價格的期權的流動性和興趣水平至關重要。以下是過去一個月內在$22.5至$60.0執行價格區間內京東重要交易中看跌和看漲期權的成交量和未平倉合約量趨勢快照。

JD.com 30-Day Option Volume & Interest Snapshot

京東30天期權交易量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | TRADE | BULLISH | 11/15/24 | $1.99 | $1.89 | $1.98 | $48.00 | $792.0K | 3.0K | 4.0K |

| JD | CALL | TRADE | NEUTRAL | 10/18/24 | $2.77 | $2.71 | $2.74 | $42.00 | $548.0K | 1.5K | 375 |

| JD | CALL | SWEEP | NEUTRAL | 10/04/24 | $3.2 | $3.1 | $3.15 | $40.00 | $523.0K | 8.3K | 3.9K |

| JD | CALL | SWEEP | NEUTRAL | 10/04/24 | $1.7 | $1.65 | $1.67 | $42.50 | $326.1K | 153 | 3.2K |

| JD | CALL | TRADE | BULLISH | 12/19/25 | $4.15 | $3.95 | $4.1 | $60.00 | $246.0K | 4.9K | 611 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 京東 | 看漲 | 交易 | 看好 | 11/15/24 | $1.99 | $1.89 | $1.98 | $48.00 | $792.0K | 3.0K | 4.0K |

| 京東 | 看漲 | 交易 | 中立 | 10/18/24 | $2.77 | $2.71 | $2.74 | 根據TipRanks.com數據,Gruber是一位5星分析師,平均回報率爲14.5%,成功率爲60.5%。Gruber主要研究北美板塊的股票,重點關注Solaris Oilfield Infrastructure、Oceaneering International和Atlas Energy Solutions等股票。 | 548.0千美元 | 1.5K | 375 |

| 京東 | 看漲 | SWEEP | 中立 | 10/04/24 | $3.2 | $3.1 | $3.15 | $40.00 | $523.0K | 8.3K | 3.9K |

| 京東 | 看漲 | SWEEP | 中立 | 10/04/24 | $1.7 | $1.65 | $1.67 | $42.50 | $326.1K | 153 | 3.2K |

| 京東 | 看漲 | 交易 | 看好 | 2025年12月19日 | $4.15 | $3.95 | $4.1 | $60.00 | 246.0千美元 | 4.9K | 611 |

About JD.com

關於京東

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

京東是一家領先的電子商務平台,其2022年中國的成交量與拼多多相似(成交量沒有報告),根據我們的估計,但仍低於阿里巴巴。該平台提供廣泛的正品產品選擇,配送迅速可靠。該公司已經建立了自己的全國履約基礎設施和末端交付網絡,由自己的員工管理,支持其在線直營業務、在線市場以及全渠道業務。

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在檢查了京東的期權交易模式後,我們的注意力現在直接轉向該公司。這種轉變使我們能夠深入了解其當前的市場地位和表現。

Where Is JD.com Standing Right Now?

京東現狀如何?

- Currently trading with a volume of 17,103,941, the JD's price is up by 4.72%, now at $41.78.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 44 days.

- 目前交易成交量爲17,103,941,京東的股價上漲了4.72%,目前爲41.78美元。

- RSI讀數表明股票目前可能超買。

- 預期四十四天後公佈收益。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易員通過持續的教育、戰略交易調整、利用各種因子並保持對市場動態的敏銳感來減輕這些風險。通過Benzinga Pro隨時獲取京東的最新期權交易,以獲得實時警報。

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.