Unpacking the Latest Options Trading Trends in Cisco Systems

Unpacking the Latest Options Trading Trends in Cisco Systems

Financial giants have made a conspicuous bullish move on Cisco Systems. Our analysis of options history for Cisco Systems (NASDAQ:CSCO) revealed 12 unusual trades.

金融巨頭對思科系統(NASDAQ:CSCO)進行了引人注目的看好交易。我們對思科系統的期權歷史數據進行分析後發現12次飛凡交易。

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $262,915, and 7 were calls, valued at $262,318.

在深入研究細節時,我們發現66%的交易員看好,而33%顯示出看淡的傾向。在我們發現的所有交易中,有5筆爲看跌期權,價值262,915美元,有7筆是看漲期權,價值262,318美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $57.5 for Cisco Systems during the past quarter.

分析這些合約的成交量和未平倉合約數量後,似乎大戶在過去一個季度一直關注思科系統在40.0美元到57.5美元之間的價格區間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

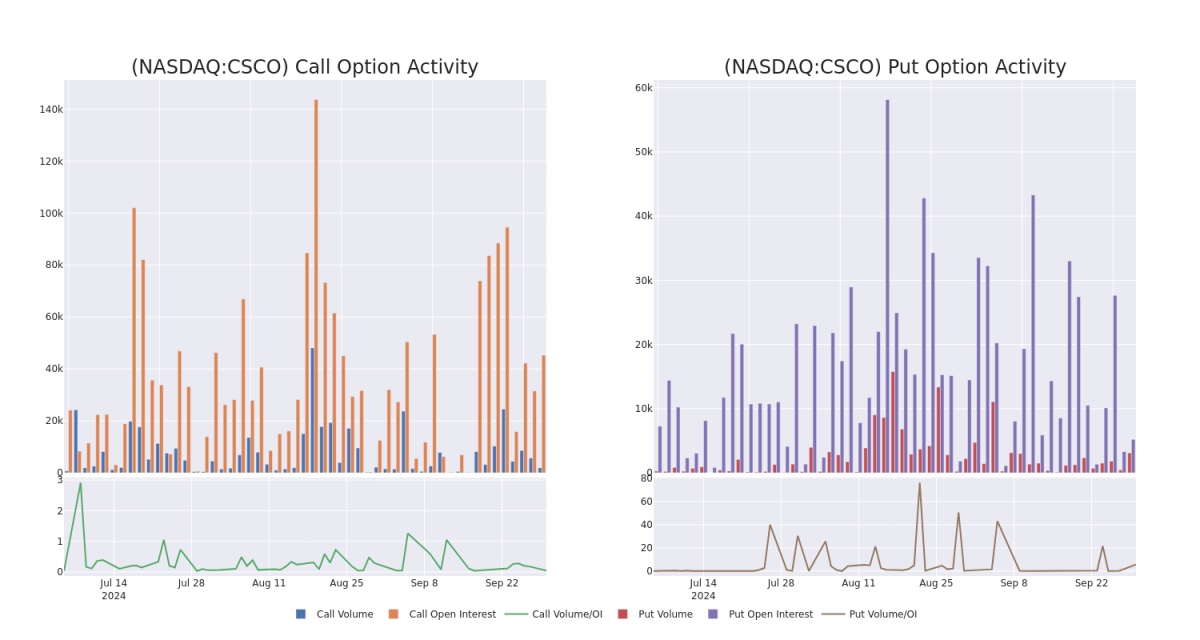

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Cisco Systems's options for a given strike price.

這些數據可以幫助您跟蹤思科系統特定行權價的期權流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cisco Systems's whale activity within a strike price range from $40.0 to $57.5 in the last 30 days.

在下面,我們可以觀察到過去30天內思科系統所有鯨魚活動的看漲和看跌期權的成交量和未平倉合約變化,行權價區間爲40.0到57.5美元。

Cisco Systems Option Activity Analysis: Last 30 Days

思科系統期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CSCO | PUT | TRADE | BULLISH | 01/16/26 | $3.05 | $2.91 | $2.91 | $47.50 | $91.6K | 2.8K | 315 |

| CSCO | CALL | SWEEP | BULLISH | 03/21/25 | $1.45 | $1.4 | $1.45 | $57.50 | $66.1K | 7.7K | 444 |

| CSCO | PUT | TRADE | BULLISH | 10/18/24 | $0.64 | $0.61 | $0.62 | $52.50 | $62.0K | 1.8K | 1.7K |

| CSCO | PUT | TRADE | BEARISH | 03/21/25 | $4.1 | $4.0 | $4.1 | $55.00 | $47.1K | 466 | 116 |

| CSCO | CALL | TRADE | BEARISH | 11/01/24 | $1.0 | $0.91 | $0.93 | $53.00 | $46.5K | 1.2K | 513 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 思科系統 | 看跌 | 交易 | 看好 | 01/16/26 | $3.05 | $2.91 | $2.91 | $47.50 | $91.6K | 2.8K | 315 |

| 思科系統 | 看漲 | SWEEP | 看好 | 03/21/25 | $1.45 | $1.4 | $1.45 | $57.50 | $66.1K | 7.7K | 444 |

| 思科系統 | 看跌 | 交易 | 看好 | 10/18/24 | $0.64 | $0.61 | $0.62 | $52.50 | $62.0K | 1.8K | 1.7K |

| 思科系統 | 看跌 | 交易 | 看淡 | 03/21/25 | $4.1 | $4.0 | $4.1 | $55.00 | $47.1K | 466 | 279 |

| 思科系統 | 看漲 | 交易 | 看淡 | 11/01/24 | $1.0 | 0.91美元 | $0.93 | 53.00美元 | $46.5K | 1.2K | 513 |

About Cisco Systems

關於思科系統的相關情況

Cisco Systems is the largest provider of networking equipment in the world and one of the largest software companies in the world. Its largest businesses are selling networking hardware and software (where it has leading market shares) and cybersecurity software such as firewalls. It also has collaboration products, like its Webex suite, and observability tools. It primarily outsources its manufacturing to third parties and has a large sales and marketing staff—25,000 strong across 90 countries. Overall, Cisco employs 80,000 people and sells its products globally.

思科系統是世界上最大的網絡設備供應商之一,也是全球最大的軟件公司之一。它的主要業務是銷售網絡硬件和軟件(在這些領域擁有領先的市場份額),以及諸如防火牆之類的網絡安全軟件。它還有協作產品,如其Webex套件,以及可觀測性工具。它主要將製造外包給第三方,並擁有一個25,000人的龐大的銷售和營銷人員,在90個國家和地區都有業務。總的來說,思科系統僱用了80,000人,並在全球銷售其產品。

After a thorough review of the options trading surrounding Cisco Systems, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面審查思科系統周圍的期權交易後,我們轉而更詳細地審查該公司。這包括對其當前市場地位和表現的評估。

Where Is Cisco Systems Standing Right Now?

思科系統目前處於什麼位置?

- With a volume of 13,639,008, the price of CSCO is up 0.38% at $53.22.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 44 days.

- 成交量爲13,639,008,CSCO的價格上漲0.38%,報53.22美元。

- RSI因子暗示底層股票可能被超買。

- 下一次業績預計將在44天內發佈。

What Analysts Are Saying About Cisco Systems

關於思科系統,分析師們的看法是什麼

In the last month, 1 experts released ratings on this stock with an average target price of $60.0.

上個月,有1位專家發佈了對這支股票的評級,平均目標價爲60.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Cisco Systems with a target price of $60.

20年期權交易專家揭示了他的一線圖表技術,顯示何時買入和賣出。跟隨他的交易,每20天平均獲利率達27%。點擊這裏獲取訪問權限。* 從evercore ISI Group的一位分析師的評估一貫如一,對思科系統給予跑贏大盤的評級,並設定60美元的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cisco Systems with Benzinga Pro for real-time alerts.

交易期權涉及更大風險,但也提供更高利潤的潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因子和保持對市場動態的敏感來減輕這些風險。使用Benzinga Pro隨時獲取最新的思科系統期權交易警報。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.