Shanghai Kindly Enterprise Development GroupLTD (SHSE:603987) Earnings and Shareholder Returns Have Been Trending Downwards for the Last Three Years, but the Stock Hikes 26% This Past Week

Shanghai Kindly Enterprise Development GroupLTD (SHSE:603987) Earnings and Shareholder Returns Have Been Trending Downwards for the Last Three Years, but the Stock Hikes 26% This Past Week

Shanghai Kindly Enterprise Development Group Co.,LTD. (SHSE:603987) shareholders should be happy to see the share price up 26% in the last week. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 67% in that time. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

上海康德萊企業發展集團股東應該很高興看到上週股價上漲了26%。與此同時,在過去的三年裏,股價大幅下跌。悲劇的是,在那段時間內,股價下跌了67%。所以看到它重新攀升是好事。雖然許多人可能仍然感到緊張,但如果企業能盡最大努力,可能會有進一步的收益。

On a more encouraging note the company has added CN¥655m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

更令人鼓舞的是,公司在過去的7天內市值增加了65500萬元人民幣,讓我們看看究竟是什麼導致了股東們三年來的虧損。

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

雖然市場是一個強大的定價機制,但股價反映的不僅僅是企業的基本業績,還有投資者的情緒。一個不完美但簡單的方式來考慮公司市場意識的變化是比較每股收益(EPS)的變化和股價的變化。

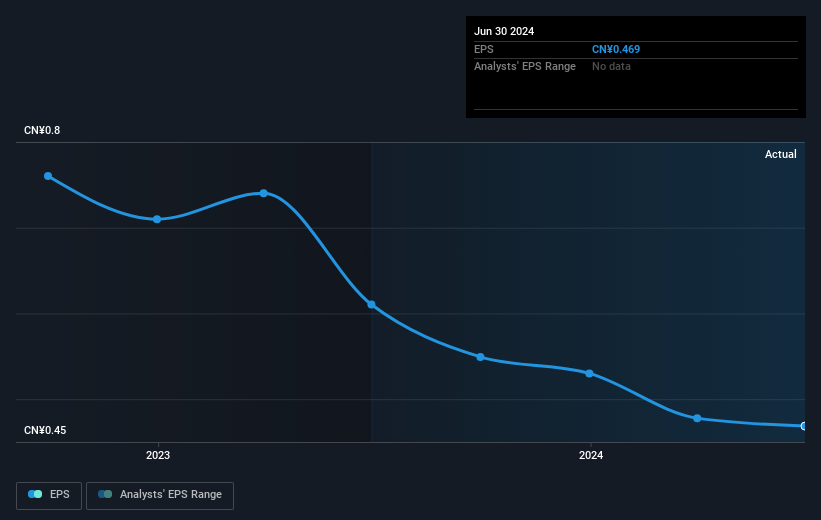

During the three years that the share price fell, Shanghai Kindly Enterprise Development GroupLTD's earnings per share (EPS) dropped by 4.5% each year. The share price decline of 31% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

在股價下跌的三年中,上海康德萊企業發展集團股份有限公司的每股收益每年下降了4.5%。股價下跌31%實際上比每股收益的滑坡更加陡峭。因此,市場似乎過去對這家企業過於自信。

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

您可以在下面的圖片中查看每股收益如何隨時間變化(單擊圖表以查看確切的價值)。

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

在購買或出售股票之前,我們始終建議對歷史增長趨勢進行仔細研究,可以在這裏找到相關信息。

A Different Perspective

不同的觀點

While the broader market lost about 6.0% in the twelve months, Shanghai Kindly Enterprise Development GroupLTD shareholders did even worse, losing 29% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Shanghai Kindly Enterprise Development GroupLTD better, we need to consider many other factors. For example, we've discovered 1 warning sign for Shanghai Kindly Enterprise Development GroupLTD that you should be aware of before investing here.

儘管整體市場在過去的十二個月中損失約6.0%,上海康德萊企業發展集團股東的損失更嚴重,損失了29%(甚至包括分紅)。然而,可能僅僅是因爲股價受到整體市場的緊張影響。值得留意基本面,以防有好的機會。不幸的是,去年的表現可能表明存在未解決的挑戰,因爲它比過去半個世紀的年化損失0.8%還要糟糕。一般來說,長期股價的疲軟可能是一個不好的跡象,儘管逆向投資者可能希望研究這隻股票,以期扭轉局面。跟蹤股價長期表現總是很有趣。但要更好地了解上海康德萊企業發展集團,我們需要考慮許多其他因素。例如,我們發現了上海康德萊企業發展集團的1個警示信號,您在投資之前應該注意。

But note: Shanghai Kindly Enterprise Development GroupLTD may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

但請注意:上海康德萊企業發展集團可能不是最適合購買的股票。因此,請查看這份免費名單,其中列出了過去盈利增長的有趣公司(以及未來增長預測)。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

During the three years that the share price fell, Shanghai Kindly Enterprise Development GroupLTD's earnings per share (EPS) dropped by 4.5% each year. The share price decline of 31% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

During the three years that the share price fell, Shanghai Kindly Enterprise Development GroupLTD's earnings per share (EPS) dropped by 4.5% each year. The share price decline of 31% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.