If EPS Growth Is Important To You, Restaurant Brands International (NYSE:QSR) Presents An Opportunity

If EPS Growth Is Important To You, Restaurant Brands International (NYSE:QSR) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

對於很多投資者,尤其是那些缺乏經驗的人來說,購買一些有好故事的公司的股票是很常見的,即使這些公司是虧損的。有時這些故事可以讓投資者有所動搖,導致他們憑感情而非公司的好基本面進行投資。虧損的公司還未能證明自己具備盈利能力,外部資本流入可能最終會枯竭。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Restaurant Brands International (NYSE:QSR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

如果這種公司不是您的風格,您喜歡那些能夠創造營業收入甚至盈利的公司,那麼您很可能會對餐飲品牌國際(紐交所:QSR)感興趣。雖然這並不一定意味着它被低估,但業務的盈利能力足以引起一些讚賞 - 尤其是如果它在增長。

How Quickly Is Restaurant Brands International Increasing Earnings Per Share?

餐飲品牌國際的每股收益增長速度有多快?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Restaurant Brands International's EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

如果您認爲市場甚至稍微具有效率性,那麼從長期來看,您期望一家公司的股價會跟隨其每股收益(EPS)情況。這意味着大多數成功的長期投資者認爲EPS的增長是一個真正的積極信號。股東將高興地得知,餐飲品牌國際的EPS在過去三年中每年複合增長21%。如果這樣的增長持續下去,那麼股東將有許多原因可以微笑。

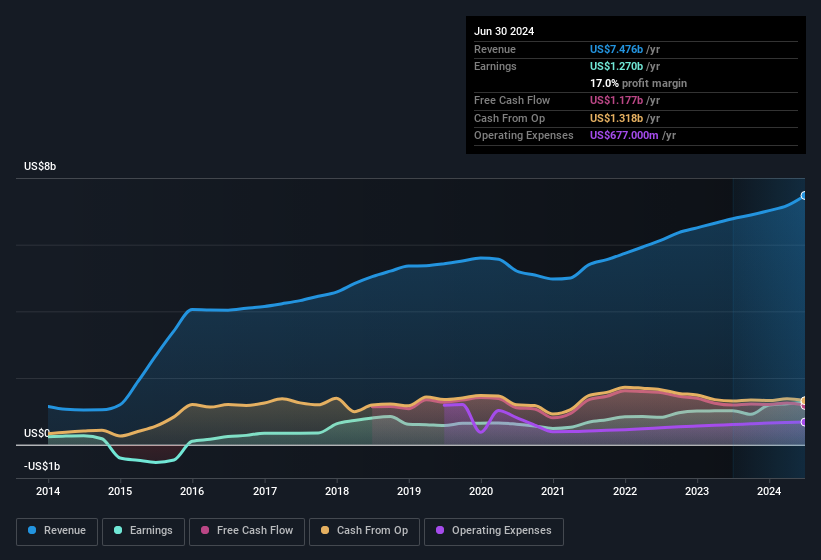

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Restaurant Brands International maintained stable EBIT margins over the last year, all while growing revenue 10% to US$7.5b. That's a real positive.

頂線增長是增長可持續性的重要指標,結合高利潤前利潤和稅前利潤(EBIT)利潤率,這是一家公司在市場上保持競爭優勢的絕佳途徑。餐飲品牌國際在過去一年中保持穩定的EBIT利潤率,同時營業收入增長了10%達到75億美元。這是一個真正的積極信號。

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

在下面的圖表中,您可以看到該公司隨着時間的推移如何增長收入和收益。單擊圖表以查看確切的數字。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Restaurant Brands International?

雖然我們生活在當下,但毫無疑問未來在投資決策過程中最爲重要。那麼爲什麼不查看這個互動圖表,展示餐飲品牌國際未來的每股收益預估呢?

Are Restaurant Brands International Insiders Aligned With All Shareholders?

餐飲品牌國際內部人員與所有股東的立場是否一致?

Owing to the size of Restaurant Brands International, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$327m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

由於餐飲品牌國際的規模龐大,我們不會指望內部人士持有公司的重大比例。但我們從他們是公司的投資者這一事實中感到安心。我們注意到,他們在公司的顯著持股價值爲3.27億美元。投資者將欣賞管理層擁有如此大比例的股權,因爲這顯示了他們對公司未來的承諾。

Should You Add Restaurant Brands International To Your Watchlist?

你是否應該將餐飲品牌國際添加到您的自選列表中?

If you believe that share price follows earnings per share you should definitely be delving further into Restaurant Brands International's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Restaurant Brands International's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. You still need to take note of risks, for example - Restaurant Brands International has 3 warning signs (and 1 which is significant) we think you should know about.

如果你相信股價遵循每股收益,那麼你絕對應該更深入地研究餐飲品牌國際強勁的每股收益增長。此外,高比例的內部持股令人印象深刻,表明管理層重視每股收益增長,並對餐飲品牌國際未來的實力充滿信心。從其優點來看,穩健的每股收益增長以及與股東利益一致的公司內部人士,將表明這是一家值得進一步研究的企業。你仍然需要注意風險,例如 - 餐飲品牌國際有3個警示信號(其中1個是重大的),我們認爲您應該了解。

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

儘管不增長收益且沒有內部人士購買的股票可能會有回報,但對於重視這些關鍵指標的投資者來說,以下是在美國具有潛在增長和內部人士信心的經過慎重篩選的公司列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)