Decoding Atlassian's Options Activity: What's the Big Picture?

Decoding Atlassian's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Atlassian. Our analysis of options history for Atlassian (NASDAQ:TEAM) revealed 15 unusual trades.

金融巨頭對Atlassian展開了明顯的看好行動。我們對Atlassian(納斯達克:TEAM)的期權歷史進行分析,發現了15筆飛凡交易。

Delving into the details, we found 40% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $645,143, and 5 were calls, valued at $218,012.

深入細節後,我們發現40%的交易者持有看漲意向,而20%呈現看淡傾向。我們發現的所有交易中,有10筆看跌,價值645,143美元,5筆看漲,價值218,012美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $165.0 for Atlassian during the past quarter.

分析這些合約的成交量和持倉量顯示,大型交易者在過去一個季度一直瞄準Atlassian的價格範圍從130.0到165.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

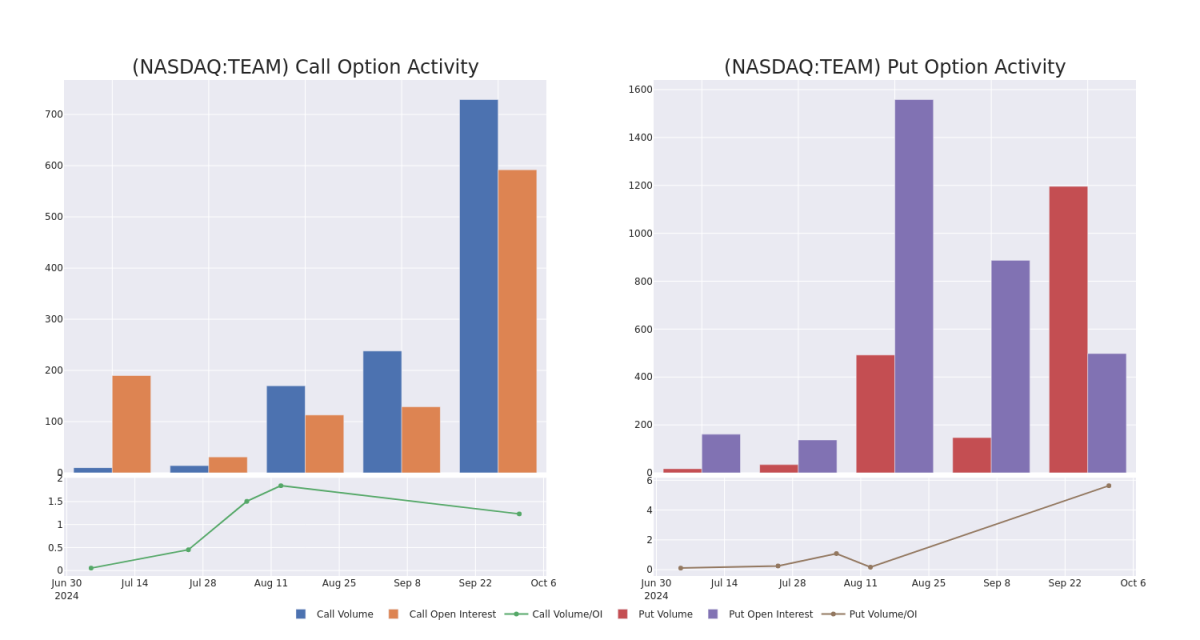

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Atlassian's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Atlassian's substantial trades, within a strike price spectrum from $130.0 to $165.0 over the preceding 30 days.

評估成交量和持倉量是期權交易中的一項戰略步驟。這些指標揭示了在指定執行價格下,大型交易者對Atlassian期權的流動性和投資者興趣。即將到來的數據將呈現在過去30天內,針對Atlassian實質性交易,從130.0到165.0美元的執行價格範圍內,與看漲和看跌相關的成交量和持倉量波動。

Atlassian Call and Put Volume: 30-Day Overview

Atlassian看漲期權和看跌期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEAM | PUT | SWEEP | BULLISH | 01/16/26 | $16.4 | $15.7 | $15.7 | $130.00 | $157.0K | 118 | 0 |

| TEAM | PUT | SWEEP | BEARISH | 01/16/26 | $27.3 | $26.3 | $27.16 | $155.00 | $136.3K | 159 | 100 |

| TEAM | PUT | TRADE | BULLISH | 01/15/27 | $23.7 | $22.0 | $22.64 | $130.00 | $113.2K | 2 | 0 |

| TEAM | CALL | TRADE | BULLISH | 11/15/24 | $10.3 | $8.9 | $9.9 | $165.00 | $85.1K | 72 | 65 |

| TEAM | PUT | SWEEP | BEARISH | 01/17/25 | $16.8 | $16.5 | $16.6 | $165.00 | $52.9K | 219 | 108 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEAM | 看跌 | SWEEP | 看好 | 01/16/26 | $16.4 | 15.7 | 15.7 | $130.00 | $157.0K | 118 | 0 |

| TEAM | 看跌 | SWEEP | 看淡 | 01/16/26 | $27.3 | $26.3美元 | 27.16美元 | $155.00 | $136.3K | 159 | 100 |

| TEAM | 看跌 | 交易 | 看好 | 01/15/27 | $23.7 | $22.0 | $22.64 | $130.00 | $113.2K | 2 | 0 |

| TEAM | 看漲 | 交易 | 看好 | 11/15/24 | $10.3 | $8.9 | $9.9 | 165.00美元 | $85.1K | 72 | 65 |

| TEAM | 看跌 | SWEEP | 看淡 | 01/17/25 | $16.8 | $16.5 | $16.6 | 165.00美元 | $52.9K | 219 | 108 |

About Atlassian

關於Atlassian

Atlassian produces software that helps teams work together more efficiently and effectively. The company provides project planning and management software, collaboration tools, and IT help desk solutions. The company operates in four segments: subscriptions (term licenses and cloud agreements), maintenance (annual maintenance contracts that provide support and periodic updates and are generally attached to perpetual license sales), perpetual license (upfront sale for indefinite usage of the software), and other (training, strategic consulting, and revenue from the Atlassian Marketplace app store). Atlassian was founded in 2002 and is headquartered in Sydney.

Atlassian生產的軟件幫助團隊更加高效、有效地協同工作。公司提供項目計劃和管理軟件、協作工具和IT幫助台解決方案。公司分爲四個部分:訂閱(期限許可證和雲協議)、維護(提供支持和週期性更新的年度維護合同,通常與永久許可證銷售捆綁)、永久許可證(一次性軟件使用的銷售收入)和其他(培訓、戰略諮詢以及來自Atlassian Marketplace應用商店的收入)。Atlassian成立於2002年,總部位於悉尼。

In light of the recent options history for Atlassian, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Atlassian最近的期權歷史,現在適合關注公司本身。我們旨在探索其當前的表現。

Where Is Atlassian Standing Right Now?

Atlassian現在處於什麼位置?

- With a volume of 1,416,279, the price of TEAM is up 1.88% at $161.8.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 30 days.

- TEAm的成交量爲1,416,279股,價格上漲1.88%,報161.8美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一輪收益預計將在30天內發佈。

What Analysts Are Saying About Atlassian

關於Atlassian,分析師們在說些什麼

2 market experts have recently issued ratings for this stock, with a consensus target price of $215.0.

2位市場專家最近對這支股票做出了評級,共識目標價爲$215.0。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Raymond James has elevated its stance to Outperform, setting a new price target at $200. * Reflecting concerns, an analyst from Oppenheimer lowers its rating to Outperform with a new price target of $230.

Benzinga Edge的期權異動板塊可以在事件發生之前發現潛在的市場變動者。查看大資金在您喜愛的股票上持倉情況。點擊這裏查看.*來自Raymond James的分析師已將其評級提升至Outperform,並制定了一個新的目標價爲200美元。*反映擔憂,來自Oppenheimer的分析師將其評級調低至Outperform,並設定了一個新的目標價爲230美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Atlassian with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易員通過持續教育、策略性交易調整、利用各種因子和保持對市場動態的敏感來降低這些風險。通過Benzinga Pro隨時獲取關於Atlassian最新期權交易的信息。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Atlassian's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Atlassian's substantial trades, within a strike price spectrum from $130.0 to $165.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Atlassian's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Atlassian's substantial trades, within a strike price spectrum from $130.0 to $165.0 over the preceding 30 days.