Looking At Valero Energy's Recent Unusual Options Activity

Looking At Valero Energy's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Valero Energy. Our analysis of options history for Valero Energy (NYSE:VLO) revealed 8 unusual trades.

金融巨頭在瓦萊羅能源上做出了明顯的看淡舉動。我們對瓦萊羅能源(紐交所:VLO)期權歷史的分析顯示,出現了8筆異常交易。

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $75,500, and 6 were calls, valued at $204,499.

深入細節,我們發現37%的交易員持有看好態度,而62%顯示出看淡傾向。在我們發現的所有交易中,有2筆是看跌期權,價值爲$75,500,而有6筆是看漲期權,價值爲$204,499。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $150.0 for Valero Energy over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,過去3個月來,鯨魚一直把瓦萊羅能源的價格區間鎖定在$110.0至$150.0。

Insights into Volume & Open Interest

成交量和持倉量分析

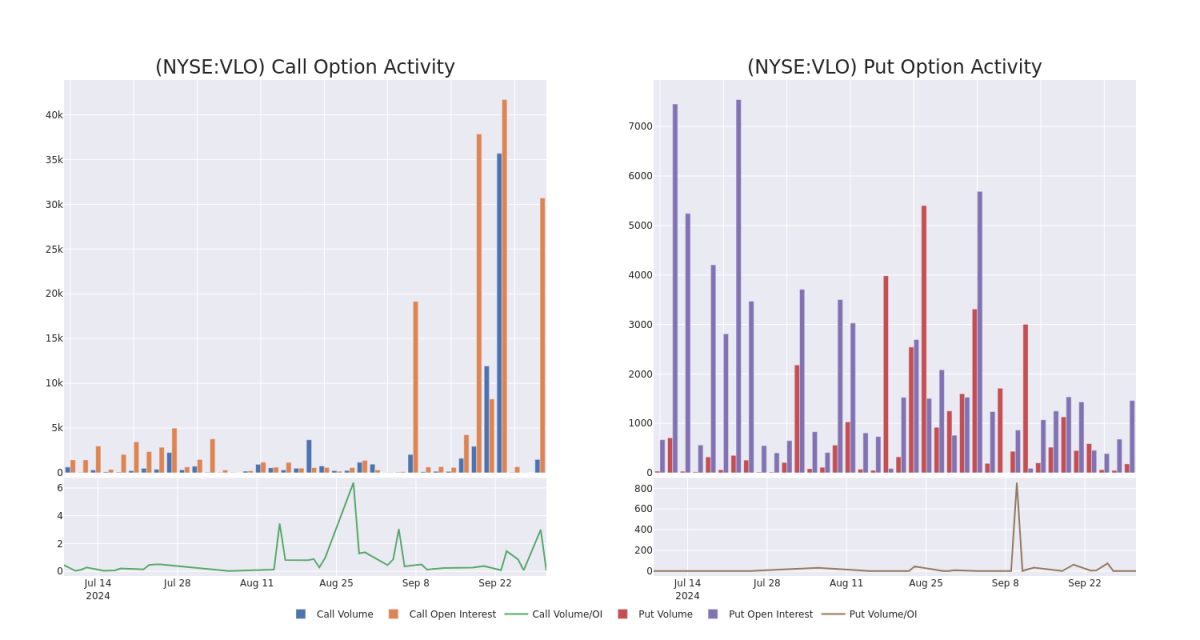

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Valero Energy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Valero Energy's whale trades within a strike price range from $110.0 to $150.0 in the last 30 days.

觀察成交量和未平倉合約量是期權交易中的重要舉措。這些數據可以幫助您追蹤瓦萊羅能源特定行權價的期權的流動性和興趣。在過去30天內,我們可以觀察到瓦萊羅能源所有鯨魚交易的成交量和未平倉合約量的演變,分別針對從$110.0到$150.0的行權價區間。

Valero Energy Option Activity Analysis: Last 30 Days

瓦萊羅能源期權活動分析:最近30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | CALL | SWEEP | BEARISH | 10/04/24 | $2.91 | $1.0 | $1.0 | $138.00 | $45.5K | 108 | 645 |

| VLO | PUT | TRADE | BULLISH | 10/18/24 | $4.35 | $4.3 | $4.3 | $137.00 | $43.0K | 159 | 73 |

| VLO | CALL | SWEEP | BEARISH | 10/18/24 | $3.8 | $3.7 | $3.7 | $137.00 | $37.0K | 171 | 243 |

| VLO | CALL | TRADE | BEARISH | 12/20/24 | $3.75 | $3.6 | $3.62 | $150.00 | $36.2K | 30.3K | 115 |

| VLO | PUT | TRADE | BULLISH | 10/18/24 | $3.3 | $3.25 | $3.25 | $135.00 | $32.5K | 1.3K | 107 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | 看漲 | SWEEP | 看淡 | 10/04/24 | $2.91 | $1.0 | $1.0 | 138.00美元 | $45.5K | 108 | 645 |

| VLO | 看跌 | 交易 | 看好 | 10/18/24 | $4.35 | $4.3 | $4.3 | $137.00 | $43.0K | 159 | 73 |

| VLO | 看漲 | SWEEP | 看淡 | 10/18/24 | $3.8 | $3.7 | $3.7 | $137.00 | $37.0K | 171 | 243 |

| VLO | 看漲 | 交易 | 看淡 | 12/20/24 | $3.75 | $3.6 | 3.62 美元 | $150.00 | 36200美元 | 30.3千 | 115 |

| VLO | 看跌 | 交易 | 看好 | 10/18/24 | $3.3 | $3.25 | $3.25 | $135.00 | $32.5K | 1.3K | 107 |

About Valero Energy

關於瓦萊羅能源

Valero Energy is one of the largest independent refiners in the United States. It operates 15 refineries, with a total throughput capacity of 3.2 million barrels a day in the US, Canada, and the United Kingdom. Valero also owns 12 ethanol plants with capacity of 1.6 billion gallons a year and holds a 50% stake in Diamond Green Diesel, which has the capacity to produce 1.2 billion gallons per year of renewable diesel.

瓦萊羅能源是美國最大的獨立精煉公司之一。在美國、加拿大和英國經營15個煉油廠,總通過能力達到320萬桶/日。瓦萊羅還擁有12個乙醇工廠,年產能達16億加侖,並持有Diamond Green Diesel的50%股權,Diamond Green Diesel的可再生柴油產能爲12億加侖/年。

In light of the recent options history for Valero Energy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於瓦萊羅能源最近的期權歷史,現在適當集中關注公司本身。我們旨在探索它的當前表現。

Present Market Standing of Valero Energy

瓦萊羅能源的當前市場地位

- With a volume of 2,116,758, the price of VLO is up 1.61% at $137.21.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 23 days.

- 瓦萊羅能源(VLO)的成交量爲2,116,758股,價格上漲1.61%,報137.21美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一次收益預計在23天內公佈。

What Analysts Are Saying About Valero Energy

分析師對於瓦萊羅能源的觀點

In the last month, 4 experts released ratings on this stock with an average target price of $149.25.

在過去一個月裏,有4位專家對這隻股票發佈了評級,平均目標價爲$149.25。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* In a cautious move, an analyst from Piper Sandler downgraded its rating to Neutral, setting a price target of $123. * An analyst from Wells Fargo persists with their Equal-Weight rating on Valero Energy, maintaining a target price of $172. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Valero Energy with a target price of $171. * Maintaining their stance, an analyst from Goldman Sachs continues to hold a Sell rating for Valero Energy, targeting a price of $131.

Benzinga Edge的期權異動板塊可以在市場動向發生之前發現潛在的市場推動者。了解大資金在您喜愛的股票上持有的倉位。點擊此處進行訪問。* 以謹慎的舉措,派傑投資的分析師將其評級下調爲中立,設定目標價爲123美元。* 富國銀行的分析師堅持其對瓦萊羅能源的等權重評級,維持目標價爲172美元。* 在其評估中持續保持一致,瑞穗銀行的分析師繼續維持對瓦萊羅能源的增持評級,目標價爲171美元。* 高盛的分析師繼續持有對瓦萊羅能源的賣出評級,以131美元的價格爲目標。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Valero Energy options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和更大的潛在回報。敏銳的交易員通過不斷學習、調整策略、監控多個因子以及密切關注市場動向來管理這些風險。通過Benzinga Pro實時提示了解最新的瓦萊羅能源期權交易情況。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Valero Energy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Valero Energy's whale trades within a strike price range from $110.0 to $150.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Valero Energy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Valero Energy's whale trades within a strike price range from $110.0 to $150.0 in the last 30 days.