Here's Why We're Not Too Worried About Neonode's (NASDAQ:NEON) Cash Burn Situation

Here's Why We're Not Too Worried About Neonode's (NASDAQ:NEON) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. Indeed, Neonode (NASDAQ:NEON) stock is up 411% in the last year, providing strong gains for shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

即使業務虧損,股東在合適價格買入優質企業時仍有可能獲利。事實上,納斯達克(neonode)的股票在過去一年中上漲了411%,爲股東帶來了豐厚的收益。儘管如此,虧損企業存在風險,因爲它們有可能燃盡所有現金並陷入困境。

In light of its strong share price run, we think now is a good time to investigate how risky Neonode's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

鑑於其強勁的股價表現,我們認爲現在是研究納斯達克公司(Neonode)現金燃燒風險的好時機。在本報告中,我們將考慮公司的年度負自由現金流,以後將稱其爲'現金燃燒'。讓我們從審查公司的現金相對於其現金燃燒情況開始。

When Might Neonode Run Out Of Money?

納斯達克公司(Neonode)什麼時候會用盡現金?

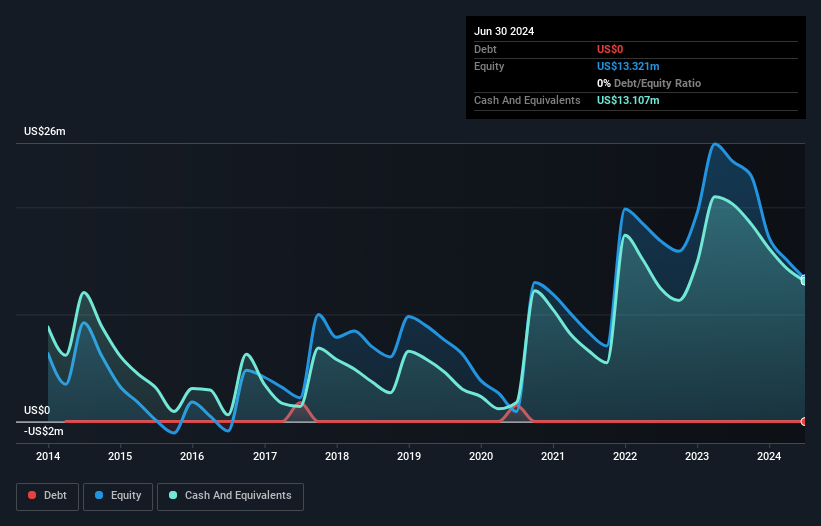

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Neonode last reported its June 2024 balance sheet in August 2024, it had zero debt and cash worth US$13m. Importantly, its cash burn was US$7.3m over the trailing twelve months. Therefore, from June 2024 it had roughly 22 months of cash runway. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

您可以通過將公司的現金金額除以其正在消耗現金的速度來計算一個公司的現金儲備時長。當Neonode在2024年6月報告其2024年8月財務狀況時,其沒有負債,現金價值爲1300萬美元。重要的是,其過去十二個月的現金燃燒額爲730萬美元。因此,從2024年6月開始,其大約有22個月的現金儲備時長。雖然這個現金儲備時長並不令人過分擔憂,明智的持有人會展望未來,並考慮公司如果現金用盡會發生什麼。下圖顯示了其現金餘額在過去幾年中的變化情況。

How Well Is Neonode Growing?

Neonode的增長如何?

Neonode boosted investment sharply in the last year, with cash burn ramping by 84%. As if that's not bad enough, the operating revenue also dropped by 20%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

納斯達克(neonode)去年大幅增加了投資,現金燃燒增長了84%。更糟糕的是,營業收入也下降了20%,這讓我們非常擔憂。考慮到這兩項指標,我們對公司的發展有些擔憂。過去的經驗總是值得研究的,但最重要的是未來。因此,審視我們分析師對該公司的預測顯然是極具意義的。

Can Neonode Raise More Cash Easily?

neonode可以很容易地籌集更多現金嗎?

Neonode seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Neonode 看起來在現金消耗方面處於相當好的位置,但我們仍然認爲值得考慮的是,如果有需要,它可以很容易地籌集更多資金。發行新股或負債是上市公司籌集更多資金的最常見方式。許多公司最終會發行新股來支持未來的增長。我們可以將公司的現金消耗與其市值相比較,以了解公司需要發行多少新股來支持一年的運營。

Since it has a market capitalisation of US$141m, Neonode's US$7.3m in cash burn equates to about 5.2% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

由於Neonode的市值爲1.41億美元,其730萬美元的現金消耗相當於其市值的約5.2%。這是一個很低的比例,所以我們認爲公司應該能夠籌集更多資金來支持增長,可能會有一點稀釋,甚至僅僅借些錢。

So, Should We Worry About Neonode's Cash Burn?

那麼,我們應該擔心Neonode的現金消耗嗎?

On this analysis of Neonode's cash burn, we think its cash burn relative to its market cap was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Neonode's situation. On another note, Neonode has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

通過對Neonode現金消耗情況的分析,我們認爲相對於市值而言,其現金消耗令人放心,但其現金消耗增加引起了我們的一些擔憂。雖然我們是那種總是對現金消耗公司涉及的風險有一些擔憂的投資者,但我們在本文討論的指標方面對Neonode的情況相對舒適。另外,Neonode有2個警示信號(其中1個有點令人擔憂),我們認爲您應該知道。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

當然,您可能會在其他地方尋找到一個出色的投資機會。因此,瞥一眼這個有趣公司的免費名單,和這個股票成長股的(根據分析師預測)。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Neonode boosted investment sharply in the last year, with cash burn ramping by 84%. As if that's not bad enough, the operating revenue also dropped by 20%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Neonode boosted investment sharply in the last year, with cash burn ramping by 84%. As if that's not bad enough, the operating revenue also dropped by 20%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.