Unpacking the Latest Options Trading Trends in Lockheed Martin

Unpacking the Latest Options Trading Trends in Lockheed Martin

Investors with a lot of money to spend have taken a bearish stance on Lockheed Martin (NYSE:LMT).

有大量資金的投資者對洛克希德馬丁(NYSE:LMT)持看淡態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LMT, it often means somebody knows something is about to happen.

無論這些是機構還是有錢的個人,我們不清楚。但當這樣的事情發生在LMT時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 10 uncommon options trades for Lockheed Martin.

今天,Benzinga的期權掃描器發現了洛克希德馬丁的10筆不尋常的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 30% bullish and 40%, bearish.

這些大宗交易者的整體情緒分爲30%的看漲和40%的看淡。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $89,950, and 8 are calls, for a total amount of $409,385.

在我們發現的所有特殊期權中,有2個看跌期權,總金額爲$89,950,有8個看漲期權,總金額爲$409,385。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $655.0 for Lockheed Martin over the last 3 months.

綜合考慮這些合約的成交量和未平倉合約,過去3個月來大戶一直在以$400.0至$655.0的價格區間內目標鎖定洛克希德馬丁。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

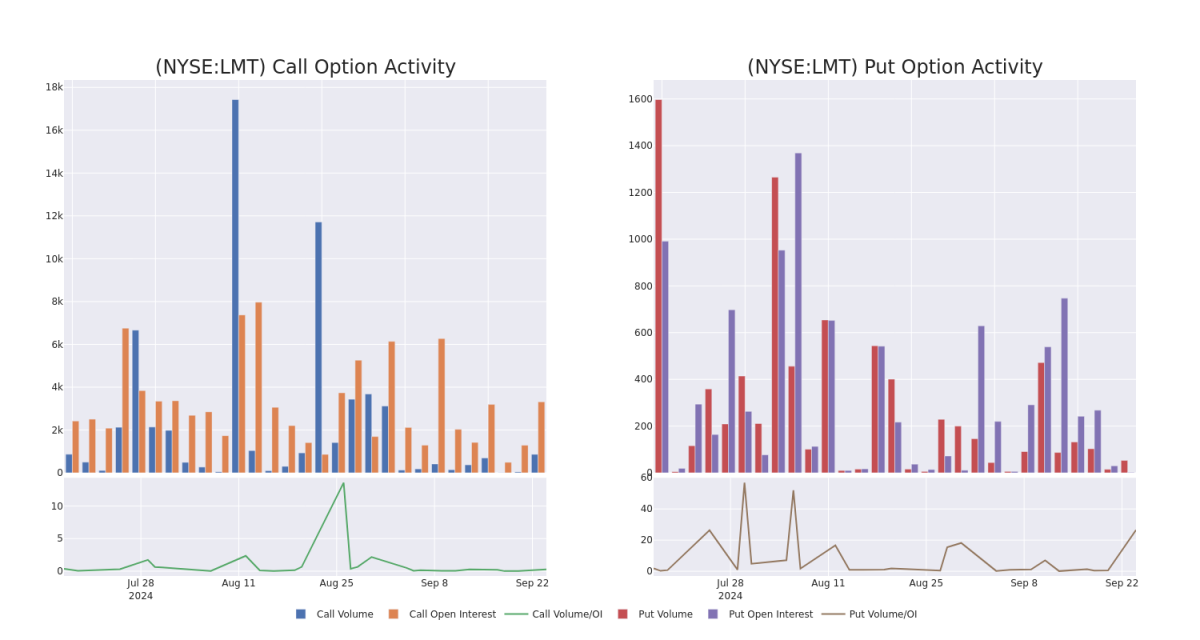

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lockheed Martin's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lockheed Martin's substantial trades, within a strike price spectrum from $400.0 to $655.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易的戰略步驟。這些指標揭示了在指定行使價格下的洛克希德馬丁期權中的流動性和投資者興趣。即將到來的數據將展示過去30天內的成交量和未平倉合約波動情況,涵蓋了從$400.0至$655.0的看漲和看跌期權,與洛克希德馬丁的大宗交易相關。

Lockheed Martin 30-Day Option Volume & Interest Snapshot

洛克希德馬丁30天期權成交量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | SWEEP | BEARISH | 10/04/24 | $2.95 | $2.75 | $2.75 | $620.00 | $91.0K | 614 | 458 |

| LMT | PUT | TRADE | NEUTRAL | 12/18/26 | $65.9 | $58.2 | $61.9 | $600.00 | $61.9K | 0 | 10 |

| LMT | CALL | TRADE | NEUTRAL | 06/20/25 | $52.0 | $50.2 | $51.15 | $600.00 | $61.3K | 124 | 13 |

| LMT | CALL | TRADE | BULLISH | 12/20/24 | $10.8 | $10.3 | $10.8 | $655.00 | $54.0K | 65 | 0 |

| LMT | CALL | SWEEP | BEARISH | 01/17/25 | $44.8 | $41.7 | $41.7 | $580.00 | $50.0K | 692 | 23 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | 看漲 | SWEEP | 看淡 | 10/04/24 | $2.95應翻譯爲$2.95 | $2.75 | $2.75 | 示例7 | 91000 美元 | 614 | 458 |

| LMT | 看跌 | 交易 | 中立 | 12/18/26 | $65.9 | $58.2 | $61.9 | $600.00 | $61.9K | 0 | 10 |

| LMT | 看漲 | 交易 | 中立 | 06/20/25 | $52.0 | $50.2 | $51.15 | $600.00 | $61.3K | 124 | 13 |

| LMT | 看漲 | 交易 | 看好 | 12/20/24 | $10.8 | $10.3 | $10.8 | 655.00美元 | $54.0K | 65 | 0 |

| LMT | 看漲 | SWEEP | 看淡 | 01/17/25 | $44.8 | 目標價41.7美元。 | 目標價41.7美元。 | $50.0K | 692 | 23 |

About Lockheed Martin

關於洛克希德馬丁

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

洛克希德馬丁是世界上最大的國防承包商,自2001年贏得F-35聯合打擊戰鬥機計劃以來一直主導着西方高端戰機市場。洛克希德的主要業務領域是航空航天,該領域的營業收入超過三分之二來自F-35。洛克希德的其他業務領域包括旋轉和任務系統,主要涵蓋西科斯基直升機業務;導彈和防火控制,其創建了導彈和導彈防禦系統;空間系統,其生產衛星並從聯合發射聯盟獲得股權收入。

Following our analysis of the options activities associated with Lockheed Martin, we pivot to a closer look at the company's own performance.

在對洛克希德馬丁相關期權活動進行分析後,我們將轉向更近距離地關注該公司自身的表現。

Where Is Lockheed Martin Standing Right Now?

洛克希德馬丁現在處於什麼地位?

- With a volume of 440,199, the price of LMT is down -0.03% at $605.67.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 20 days.

- LMt的成交量爲440,199,價格爲605.67美元,下跌-0.03%。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一輪盈利預計將在20天內發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LMT, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LMT, it often means somebody knows something is about to happen.