Market Whales and Their Recent Bets on QCOM Options

Market Whales and Their Recent Bets on QCOM Options

Deep-pocketed investors have adopted a bullish approach towards Qualcomm (NASDAQ:QCOM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in QCOM usually suggests something big is about to happen.

有實力的投資者採取看好立場是對高通(納斯達克:QCOM)的態度,市場參與者不應忽視這一點。我們在Benzinga跟蹤了公開期權記錄,今天揭示了這一重要動向。這些投資者的身份仍不得而知,但在QCOM中所做出的這一大規模舉措通常意味着有重要的事情即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Qualcomm. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當Benzinga的期權掃描器突出了15個高度非同尋常的高通期權活動。這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 26% bearish. Among these notable options, 8 are puts, totaling $935,328, and 7 are calls, amounting to $249,290.

這些重量級投資者中的普遍情緒是分裂的,66%偏向看好,26%看淡。在這些顯著的期權中,有8個看跌,總額爲$935,328,有7個看漲,總額爲$249,290。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $220.0 for Qualcomm over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,最近3個月來鯨魚一直以目標價$160.0至$220.0在高通股票上做交易。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

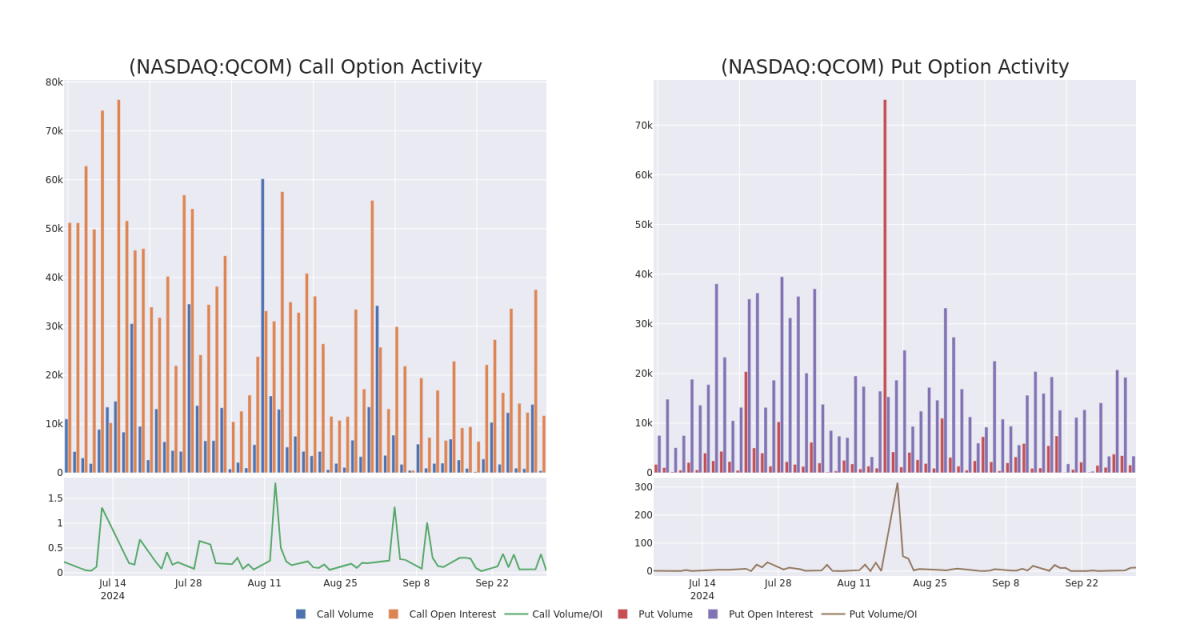

In today's trading context, the average open interest for options of Qualcomm stands at 1372.0, with a total volume reaching 2,001.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Qualcomm, situated within the strike price corridor from $160.0 to $220.0, throughout the last 30 days.

在今天的交易背景下,高通期權的平均未平倉合約量爲1372.0,總成交量達到2,001.00。隨附的圖表描繪了高通股票中看漲和看跌期權的成交量和未平倉合約隨着時間的推移而變化,在過去30天中處於$160.0至$220.0罷工價區間內的高價值交易。

Qualcomm 30-Day Option Volume & Interest Snapshot

高通30天期權成交量和利息縱覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | SWEEP | BULLISH | 09/19/25 | $27.1 | $26.55 | $26.55 | $175.00 | $286.5K | 45 | 108 |

| QCOM | PUT | SWEEP | BULLISH | 09/19/25 | $26.8 | $26.5 | $26.49 | $175.00 | $225.2K | 45 | 193 |

| QCOM | PUT | SWEEP | BEARISH | 10/04/24 | $2.42 | $2.2 | $2.41 | $167.50 | $120.9K | 1.9K | 400 |

| QCOM | PUT | SWEEP | BEARISH | 02/21/25 | $17.6 | $17.55 | $17.6 | $170.00 | $100.2K | 841 | 376 |

| QCOM | PUT | TRADE | BEARISH | 10/18/24 | $9.2 | $8.95 | $9.15 | $172.50 | $82.3K | 566 | 11 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | 看跌 | SWEEP | 看好 | 09/19/25 | $27.1 | $26.55 | $26.55 | $175.00 | $286.5K | 45 | 108 |

| QCOM | 看跌 | SWEEP | 看好 | 09/19/25 | $26.8 | $26.5 | $26.49 | $175.00 | $225.2K | 45 | 193 |

| QCOM | 看跌 | SWEEP | 看淡 | 10/04/24 | $2.42 | $2.2 | $2.41 | $167.50 | $120.9K | 1.9K | 400 |

| QCOM | 看跌 | SWEEP | 看淡 | 02/21/25 | $17.6 | $17.55 | $17.6 | $170.00 | $100.2K | 841 | 376 |

| QCOM | 看跌 | 交易 | 看淡 | 10/18/24 | $9.2 | $8.95 | 9.15美元 | $172.50 | $82.3K | 566 | 11 |

About Qualcomm

關於高通

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

高通開發和許可無線技術,並設計智能手機芯片。該公司的關鍵專利圍繞CDMA和OFDMA技術展開,這些技術是無線通信的標準,是所有3G、4G和5G網絡的支柱。高通的知識產權被幾乎所有無線設備製造商許可。該公司也是世界上最大的無線芯片供應商,向幾乎所有主要手機制造商提供尖端處理器。高通還將射頻前端模塊賣到智能手機市場,並將芯片賣到汽車和物聯網市場。

Qualcomm's Current Market Status

高通的當前市場狀況

- Currently trading with a volume of 1,901,049, the QCOM's price is up by 2.2%, now at $169.43.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 28 days.

- 高通股票目前交易量爲1,901,049股,價格上漲2.2%,目前爲169.43美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預期業績發佈在28天后。

What The Experts Say On Qualcomm

高通的專家意見

1 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

1名市場專家最近對這隻股票發表了評級,達成了目標價210.0美元的共識。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Qualcomm, targeting a price of $210.

Benzinga Edge的期權異動板塊可提前發現潛在的市場推動因素。查看大機構對您最喜歡的股票持倉情況。點擊這裏獲取訪問權限。* 傑富瑞銀行的分析師保持立場,繼續給予高通Overweight買入評級,並設定了$210的目標價格。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $220.0 for Qualcomm over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $220.0 for Qualcomm over the last 3 months.