This Is What Whales Are Betting On United Parcel Service

This Is What Whales Are Betting On United Parcel Service

Financial giants have made a conspicuous bullish move on United Parcel Service. Our analysis of options history for United Parcel Service (NYSE:UPS) revealed 13 unusual trades.

金融巨頭在聯合包裹的股票上做出了明顯的看好舉動。我們對聯合包裹(紐交所:UPS)期權歷史的分析顯示出了13筆飛凡的交易。

Delving into the details, we found 38% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $405,725, and 2 were calls, valued at $138,120.

深入細節,我們發現38%的交易員持看好態度,而30%表現出看淡傾向。在所有我們發現的交易中,有11筆看跌,價值405,725美元,還有2筆看漲,價值138,120美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $210.0 for United Parcel Service over the recent three months.

根據交易活動,顯而易見的投資者正瞄準聯合包裹在最近三個月內的股價區間從90.0美元到210.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

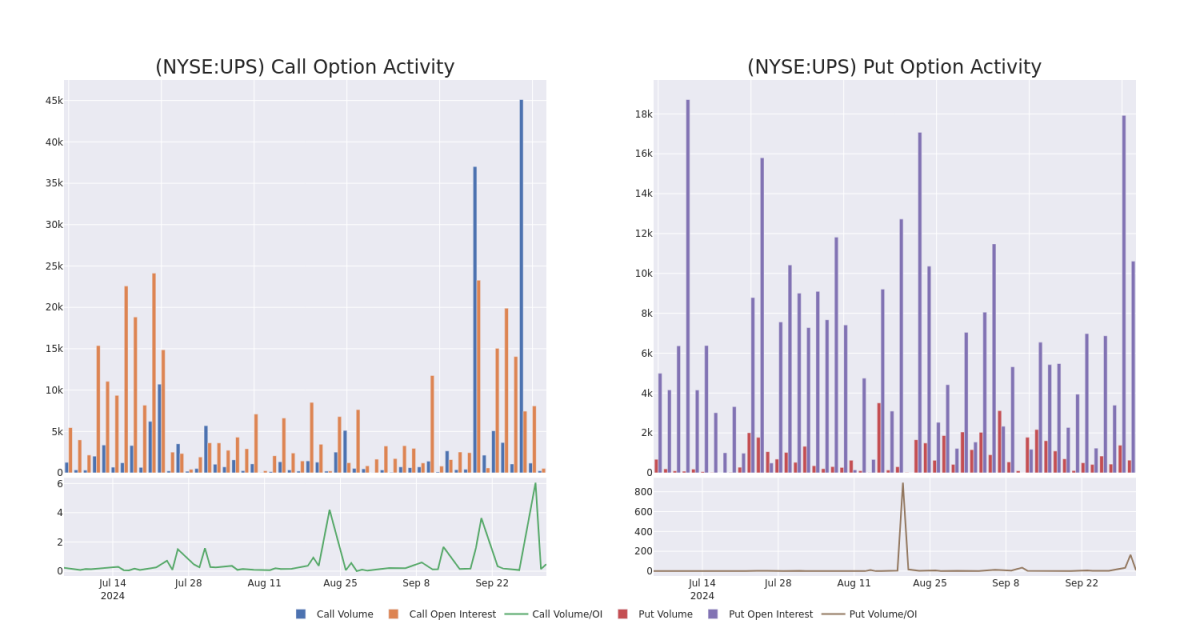

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Parcel Service's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Parcel Service's substantial trades, within a strike price spectrum from $90.0 to $210.0 over the preceding 30 days.

評估成交量和未平倉合約在期權交易中是一個戰略性步驟。這些指標揭示了投資者對於聯合包裹指定執行價格的期權的流動性和興趣。即將公佈的數據將呈現出最近30天內,涉及聯合包裹實質性交易的看漲和看跌的成交量和未平倉合約的波動,這兩者在執行價格區間從90.0美元到210.0美元之間。

United Parcel Service Option Volume And Open Interest Over Last 30 Days

聯合包裹期權成交量和未平倉合約在過去30天的情況

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | SWEEP | BEARISH | 10/25/24 | $4.9 | $4.75 | $4.75 | $134.00 | $95.0K | 371 | 225 |

| UPS | PUT | SWEEP | NEUTRAL | 01/17/25 | $23.5 | $23.5 | $23.5 | $155.00 | $61.1K | 9.0K | 28 |

| UPS | PUT | SWEEP | BEARISH | 01/17/25 | $77.2 | $76.65 | $77.19 | $210.00 | $54.0K | 2 | 7 |

| UPS | CALL | SWEEP | BULLISH | 06/20/25 | $19.6 | $19.35 | $19.6 | $120.00 | $43.1K | 148 | 24 |

| UPS | PUT | SWEEP | BEARISH | 01/17/25 | $47.75 | $47.6 | $47.75 | $180.00 | $42.9K | 7 | 9 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | 看漲 | SWEEP | 看淡 | 10/25/24 | $4.9 | $4.75 | $4.75 | $134.00 | 95.0千美元 | 371 | 225 |

| UPS | 看跌 | SWEEP | 中立 | 01/17/25 | $23.5 | $23.5 | $23.5 | $155.00 | $61.1K | 9.0K | 28 |

| UPS | 看跌 | SWEEP | 看淡 | 01/17/25 | $77.2 | $76.65 | $77.19 | 目標股價爲$210.00。 | $54.0K | 2 | 7 |

| UPS | 看漲 | SWEEP | 看好 | 06/20/25 | $19.6 | $19.35 | $19.6 | $120.00 | $43.1K | 148 | 24 |

| UPS | 看跌 | SWEEP | 看淡 | 01/17/25 | $47.75 | $47.6 | $47.75 | 180.00美元 | $42.9K | 7 | 9 |

About United Parcel Service

關於聯合包裹

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

作爲全球最大的包裹遞送公司,聯合包裹 (UPS) 管理着一個龐大的機隊,擁有超過500架飛機和10萬輛車輛,以及數百個分揀設施,每天向全球住宅和企業遞送約2200萬個包裹。UPS的美國國內包裹業務佔據總營業收入的約64%,而國際包裹業務佔據20%。航空和海運貨運,卡車運輸中介和合同物流業務佔據其餘部分。UPS目前正在爲其於2015年收購的卡車運輸中介部門Coyote尋求「戰略替代方案」。

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company's own performance.

在分析與聯合包裹相關的期權活動之後,我們轉向更仔細地觀察該公司自身的表現。

Current Position of United Parcel Service

聯合包裹的當前位置

- Currently trading with a volume of 1,281,411, the UPS's price is down by -0.45%, now at $132.67.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

- 聯合包裹目前的成交量爲1,281,411,價格下跌了-0.45%,目前爲132.67美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計將在22天內發佈業績。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Parcel Service's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Parcel Service's substantial trades, within a strike price spectrum from $90.0 to $210.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Parcel Service's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Parcel Service's substantial trades, within a strike price spectrum from $90.0 to $210.0 over the preceding 30 days.