- 要聞

- 摩根大通維持對富途控股的增持評級,將目標股價上調至160.00美元

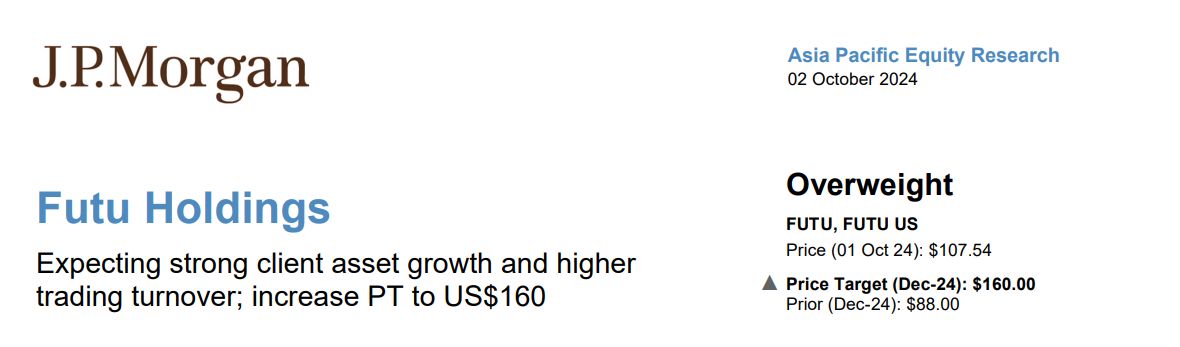

JP Morgan Maintains an Overweight Rating on Futu Holdings, Raising the Price Target to $160.00

JP Morgan Maintains an Overweight Rating on Futu Holdings, Raising the Price Target to $160.00

On October 2, JPMorgan released a research report maintaining an "overweight" rating on Futu Holdings and significantly raising the target price from $88 to $160. JPMorgan pointed out the following highlights:

Key beneficiary of the Hong Kong market rally: Hong Kong's market reached a record intraday turnover volume of HK$500 billion on Monday, while retail investment sentiment markedly improved. The company is projected to see robust AUM growth in the second half of 2024, propelled by strong client asset inflows and significant mark-to-market gains, driven by the improving investment climate.

Valuation and blue-sky scenario: After incorporating recent positive developments, JP Morgan's 2025 earnings forecast for Futu is 36% above the consensus. Currently, Futu trades at ~15x P/E based on JP Morgan's 2025 estimates, which is below the consensus 25E P/E of 20.8X. JP Morgan's projections assume a trading velocity of 12.1 and client assets of HK$820 billion for 2025. In a blue-sky scenario where trading velocity returns to its 2021 level of 14.5X and margin financing exceeds JP Morgan's baseline estimate by 20%, Futu's 2025 earnings could go up by another 23%.

A high-quality leveraged play on KWEB: The company is viewed as a leveraged play on the KWEB (China Internet Index), with a notable correlation between Futu's share price and the KWEB. JP Morgan analysts maintain a bullish stance on China internet stocks, such as Alibaba, suggesting potential gains for Futu's share price. Additionally, Futu continues to exhibit strong fundamentals, including growth in client/AUM, as well as product launches.

A high-quality leveraged play on KWEB: The company is viewed as a leveraged play on the KWEB (China Internet Index), with a notable correlation between Futu's share price and the KWEB. JP Morgan analysts maintain a bullish stance on China internet stocks, such as Alibaba, suggesting potential gains for Futu's share price. Additionally, Futu continues to exhibit strong fundamentals, including growth in client/AUM, as well as product launches.

Downside risks include: 1) weakness in China tech stocks, leading to lackluster trading volume growth; 2) regulatory risk; 3) lower-than-expected growth in the number of paying clients.

Upside risks include: 1) higher-than-expected growth in paying client numbers; 2) stronger-than-expected trading volume growth; 3) better-than-expected operating efficiency improvement; 4) Futu launched crypto business in Aug-24, which could bring upside to clients and AUM growth.

10月2日,摩根大通發佈了一份研究報告,維持對富途控股的「增持」評級,並將目標價從88美元大幅上調至160美元。摩根大通指出以下亮點:

10月2日,摩根大通發佈了一份研究報告,維持對富途控股的「增持」評級,並將目標價從88美元大幅上調至160美元。摩根大通指出以下亮點:

富途爲香港和中國內地市場漲勢的主要受益者:週一,香港市場創下了5000億港元的單日交易量紀錄,同時港股投資者情緒顯著改善。預計2024年下半年,富途的資產管理規模將實現顯著增長,主要得益於大量客戶資產的流入以及投資環境的持續改善,從而推動資產價值的增長。

估值及極佳情景分析:在考慮到最近的積極因素後,摩根大通對富途2025年的盈利預測比市場共識高出36%。目前,基於摩根大通對2025年的預測,富途的市盈率約爲15倍,低於市場共識的20.8倍。摩根大通預測2025年交易換手率爲12.1倍,客戶資產爲8200億港元。在一個最理想的情景下,如果交易速度能恢復到2021年的14.5倍,且按金融資比摩根大通的基本預測高出20%,富途2025年的盈利可能額外增長23%。

估值及極佳情景分析:在考慮到最近的積極因素後,摩根大通對富途2025年的盈利預測比市場共識高出36%。目前,基於摩根大通對2025年的預測,富途的市盈率約爲15倍,低於市場共識的20.8倍。摩根大通預測2025年交易換手率爲12.1倍,客戶資產爲8200億港元。在一個最理想的情景下,如果交易速度能恢復到2021年的14.5倍,且按金融資比摩根大通的基本預測高出20%,富途2025年的盈利可能額外增長23%。富途爲投資中國互聯網指數的高槓杆策略:富途的股價與KWEB(中國互聯網指數)緊密相關,被視爲對該指數的高槓杆投資手段。摩根大通分析師對包括阿里巴巴在內的中國互聯網股持續保持樂觀,這預示着富途股價有進一步上升的潛力。同時,富途預計將保持其強勁的基本面表現,繼續實現客戶及資產管理規模的增長,並推出新產品。

目標價風險:

下行風險:中國科技股表現疲軟導致交易量增長乏力、監管風險、付費客戶數量增長低於預期。

上行風險:付費客戶數量增長超出預期、交易量增長超出預期、運營效率改善超出預期、2024年8月推出的加密貨幣業務可能會促進客戶數和資產管理規模(AUM)的增長。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧