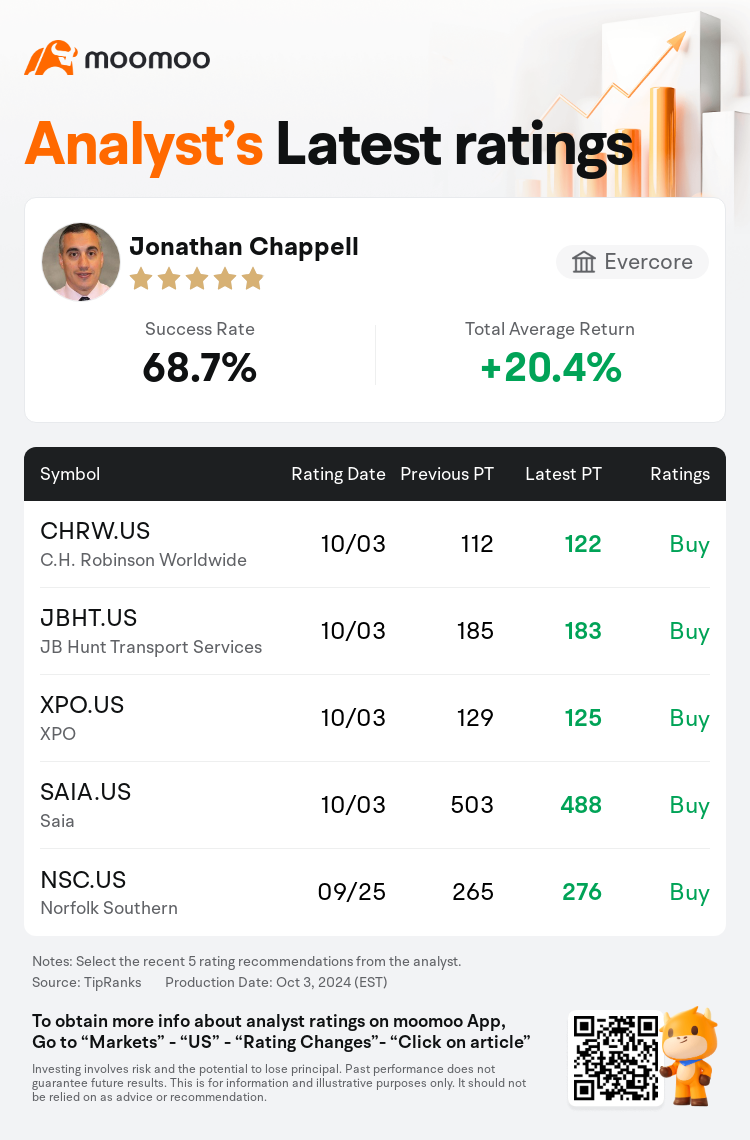

Evercore analyst Jonathan Chappell maintains $C.H. Robinson Worldwide (CHRW.US)$ with a buy rating, and adjusts the target price from $112 to $122.

According to TipRanks data, the analyst has a success rate of 68.7% and a total average return of 20.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $C.H. Robinson Worldwide (CHRW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $C.H. Robinson Worldwide (CHRW.US)$'s main analysts recently are as follows:

The operational enhancement efforts of C.H. Robinson are expected to contribute to earnings per share increases and share price appreciation. The company's commitment to utilizing technological solutions to augment gross margin, along with their efficiency initiatives, is anticipated to drive them closer to achieving a 40% operating margin within their NAST business segment. Margin improvements are projected into 2025, with expectations set for a 37.5% margin even under scenarios of modest cyclical improvement.

As we approach the third-quarter earnings season, the transportation sector may find some solace in the belief that the decline in crucial bottom-line drivers probably hasn't significantly affected the already conservative expectations, with minimal, albeit present, risk to the third-quarter EPS forecasts. On a less optimistic note, the fourth quarter, which usually shows stronger performance and where improvements are anticipated in estimates, is commencing on a weaker note, suggesting potential risks to the fourth-quarter projections according to the fundamental outlook.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

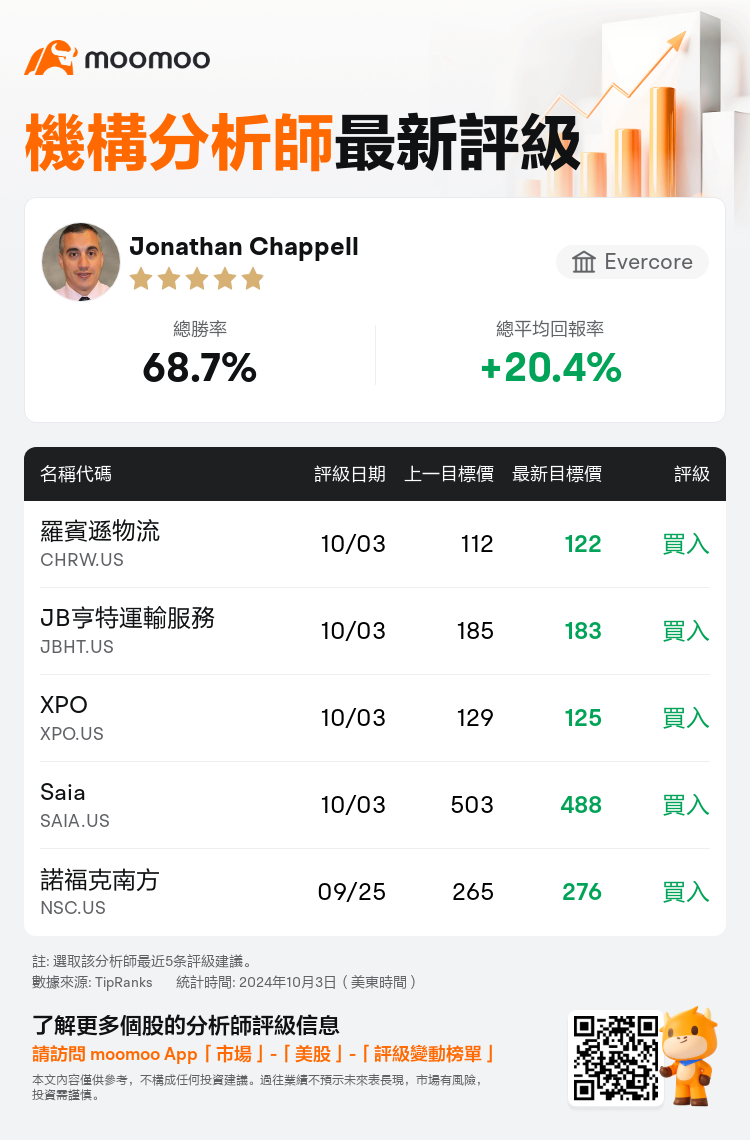

Evercore分析師Jonathan Chappell維持$羅賓遜物流 (CHRW.US)$買入評級,並將目標價從112美元上調至122美元。

根據TipRanks數據顯示,該分析師近一年總勝率為68.7%,總平均回報率為20.4%。

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

C.H. Robinson的運營改善工作預計將促進每股收益的增加和股價的上漲。該公司承諾利用技術解決方案來提高毛利率,並採取效率舉措,預計將推動他們在NaST業務領域中接近實現40%的營業利潤率。預計利潤率將提高到2025年,即使在週期性略有改善的情況下,預期利潤率也將達到37.5%。

隨着第三季度業績期的臨近,運輸行業可能會感到安慰,因爲他們認爲關鍵利潤驅動因素的下降可能沒有對本已保守的預期產生重大影響,第三季度每股收益預測的風險微乎其微,儘管仍然存在。不那麼樂觀的是,第四季度通常表現更強,預計會有所改善,但開局時表現疲軟,這表明根據基本面展望,第四季度的預測存在潛在風險。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of