Comparing AbbVie With Industry Competitors In Biotechnology Industry

Comparing AbbVie With Industry Competitors In Biotechnology Industry

In the ever-changing and fiercely competitive business landscape, conducting thorough company analysis is crucial for investors and industry experts. In this article, we will undertake a comprehensive industry comparison, evaluating AbbVie (NYSE:ABBV) and its primary competitors in the Biotechnology industry. By closely examining key financial metrics, market position, and growth prospects, our aim is to provide valuable insights for investors and shed light on company's performance within the industry.

在不斷變化且競爭激烈的商業環境中,進行徹底的公司分析對於投資者和行業專家至關重要。在本文中,我們將進行全面的行業比較,評估艾伯維公司(紐交所: ABBV)及其生物技術行業的主要競爭對手。通過緊密審視關鍵財務指標、市場地位和增長前景,我們的目標是爲投資者提供有價值的見解,同時揭示公司在行業內的表現。

AbbVie Background

艾伯維公司背景

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie是一家藥品公司,其在免疫學(包括Humira、Skyrizi和Rinvoq)和腫瘤學(包括Imbruvica和Venclexta)方面擁有強大的業務。該公司於2013年初從Abbott分拆而來。2020年收購雅培使其在美容業務(包括Botox)中新增了一些產品和藥品。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| AbbVie Inc | 65.83 | 51.29 | 6.34 | 18.4% | $5.0 | $10.26 | 4.31% |

| Amgen Inc | 55.13 | 29 | 5.58 | 13.63% | $3.0 | $5.15 | 20.07% |

| Regeneron Pharmaceuticals Inc | 27.54 | 4.07 | 8.82 | 5.19% | $1.76 | $3.07 | 12.32% |

| Gilead Sciences Inc | 103.33 | 5.77 | 3.81 | 9.01% | $2.98 | $5.41 | 5.36% |

| Biogen Inc | 23.80 | 1.73 | 2.85 | 3.75% | $0.92 | $1.92 | 0.36% |

| United Therapeutics Corp | 16.20 | 2.75 | 6.63 | 5.04% | $0.39 | $0.64 | 19.85% |

| Genmab AS | 18.72 | 3.24 | 5.45 | 4.44% | $2.15 | $5.21 | 29.58% |

| Biomarin Pharmaceutical Inc | 52.77 | 2.51 | 5.23 | 2.07% | $0.16 | $0.58 | 19.61% |

| Incyte Corp | 164.95 | 4.35 | 3.92 | -10.6% | $-0.37 | $0.97 | 9.34% |

| Sarepta Therapeutics Inc | 163.36 | 10.85 | 7.96 | 0.63% | $0.03 | $0.32 | 38.93% |

| Neurocrine Biosciences Inc | 34.32 | 4.59 | 5.52 | 2.66% | $0.16 | $0.58 | 30.37% |

| Roivant Sciences Ltd | 1.97 | 1.53 | 59.62 | 1.67% | $0.09 | $0.05 | 154.96% |

| Exelixis Inc | 22.84 | 3.57 | 4.05 | 10.65% | $0.28 | $0.62 | 35.61% |

| Average | 57.08 | 6.16 | 9.95 | 4.01% | $0.96 | $2.04 | 31.36% |

| 公司 | 市銷率P/S | 淨資產收益率ROE | 息稅前收入EBITDA (以十億計) | 毛利潤 (以十億計) | 營收增長 | CrowdStrike Holdings Inc (847.84) | 營業收入增長 |

|---|---|---|---|---|---|---|---|

| 艾比維公司 | 65.83 | 51.29 | 6.34 | 18.4% | $5.0 | $10.26 | 4.31% |

| 安進公司 | 55.13 | 29 | 5.58 | 13.63% | $3.0 | $5.15 | 20.07% |

| 再生元製藥公司股票(冠狀病毒疫情期間上市股票表現) | 27.54 | 4.07 | 8.82 | 5.19% | $1.76 | $3.07 | 12.32% |

| Gilead Sciences Inc | 103.33% | 5.77 | 3.81 | 9.01% | $2.98 | $5.41 | 5.36% |

| Biogen Inc | 23.80 | 1.73 | 2.85 | 3.75% | 0.92美元 | $1.92 | 0.36% |

| United Therapeutics Corp | 16.20 | 2.75 | 6.63 | 5.04% | 0.39美元 | $0.64 | 19.85% |

| 根瑪布 | 18.72 | 3.24 | 5.45 | 4.44% | $2.15 | $5.21 | 29.58% |

| Biomarin Pharmaceutical Inc | 52.77 | 2.51 | 5.23 | 2.07% | $0.16 | $0.58 | 19.61% |

| Incyte Corp | 164.95 | 4.35 | 3.92 | -10.6% | -0.37美元 | $0.97 | 9.34% |

| Sarepta Therapeutics Inc | 163.36 | 10.85 | 7.96 | 0.63% | 0.03美元 | 0.32美元 | 38.93% |

| Neurocrine Biosciences Inc | 34.32 | 4.59 | 5.52 | 2.66% | $0.16 | $0.58 | 30.37% |

| Roivant Sciences Ltd | 1.97 | 1.53 | share應翻譯爲「分享」,options應翻譯爲「期權」,warrants應翻譯爲「認股證」,long應翻譯爲「開多」。 | 1.67% | $0.09 | $0.05 | 154.96% |

| Exelixis Inc | 22.84 | 3.57 | 4.05 | 10.65% | $0.28 | $0.62 | 35.61% |

| 平均值 | 57.08 | 6.16 | 9.95 | 4.01% | 0.96美元 | $2.04 | 31.36% |

After examining AbbVie, the following trends can be inferred:

經過對艾伯維公司的研究,可以得出以下趨勢:

Notably, the current Price to Earnings ratio for this stock, 65.83, is 1.15x above the industry norm, reflecting a higher valuation relative to the industry.

It could be trading at a premium in relation to its book value, as indicated by its Price to Book ratio of 51.29 which exceeds the industry average by 8.33x.

With a relatively low Price to Sales ratio of 6.34, which is 0.64x the industry average, the stock might be considered undervalued based on sales performance.

The Return on Equity (ROE) of 18.4% is 14.39% above the industry average, highlighting efficient use of equity to generate profits.

With higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $5.0 Billion, which is 5.21x above the industry average, the company demonstrates stronger profitability and robust cash flow generation.

With higher gross profit of $10.26 Billion, which indicates 5.03x above the industry average, the company demonstrates stronger profitability and higher earnings from its core operations.

The company's revenue growth of 4.31% is significantly below the industry average of 31.36%. This suggests a potential struggle in generating increased sales volume.

值得注意的是,該股票目前的市盈率爲65.83,比行業標準高出1.15倍,反映出相對行業更高的估值。

它可能在市淨率上溢價交易,其市淨率達到51.29,超過行業平均水平8.33倍。

股票的市銷率相對較低,爲6.34,比行業平均水平低0.64倍,基於銷售表現,該股可能被認爲是被低估的。

18.4%的淨資產收益率(ROE)高於行業平均水平14.39%,突顯出有效利用權益產生利潤。

憑藉高達500億美元的利息、稅收、折舊和攤銷前利潤(EBITDA),超出行業平均水平5.21倍,該公司展示了更強大的盈利能力和強勁的現金流生成能力。

憑藉高達102.6億美元的毛利潤,超出行業平均水平5.03倍,該公司展示了更強大的盈利能力和更高的核心業務收入。

公司的營收增長率爲4.31%,明顯低於行業平均水平31.36%。這表明公司在增加銷售量方面可能面臨挑戰。

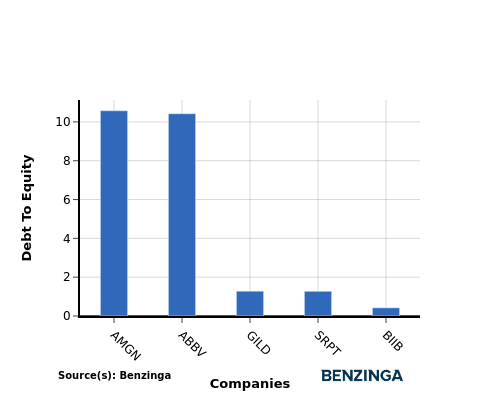

Debt To Equity Ratio

債務權益比率

The debt-to-equity (D/E) ratio indicates the proportion of debt and equity used by a company to finance its assets and operations.

債權與股權比率反映了公司爲融資其資產和運營活動而使用債務與股權的比例。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行業比較中考慮債務權益比率可以簡明地評估公司的財務狀況和風險特徵,有助於投資者做出明智的決策。

In terms of the Debt-to-Equity ratio, AbbVie can be assessed by comparing it to its top 4 peers, resulting in the following observations:

就負債與淨資產比率而言,艾伯維公司可以通過與其前4家同行進行比較來評估,得出以下觀察結果:

In terms of the debt-to-equity ratio, AbbVie is positioned in the middle among its top 4 peers.

This suggests a relatively balanced financial structure, where the company maintains a moderate level of debt while also utilizing equity financing with a debt-to-equity ratio of 10.42.

在負債與權益比方面,艾伯維公司位於其前4名同行公司中間位置。

這表明了一個相對平衡的財務結構,公司在保持適度負債的同時也利用權益融資,負債權益比爲10.42。

Key Takeaways

要點

For AbbVie in the Biotechnology industry, the PE, PB, and PS ratios indicate high valuation compared to peers, suggesting potential overvaluation. Conversely, the high ROE, EBITDA, and gross profit ratios reflect strong profitability and operational efficiency relative to industry competitors. The low revenue growth rate may pose a challenge for AbbVie in maintaining its high valuation multiples.

對於生物技術行業的艾伯維公司,市盈率、市淨率和市銷率顯示高估值,相比同行,暗示潛在高估。相反,高ROE、EBITDA和毛利潤比率顯示公司相對於行業競爭對手具有強勁的盈利能力和運營效率。低營業收入增長率可能對艾伯維公司維持其高估值倍數構成挑戰。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成並由編輯審查。

Notably, the current Price to Earnings ratio for this stock,

Notably, the current Price to Earnings ratio for this stock,