UP Fintech +10%, Here are Options Market Dynamics From Benzinga Pro

UP Fintech +10%, Here are Options Market Dynamics From Benzinga Pro

Investors with a lot of money to spend have taken a bullish stance on $UP Fintech (TIGR.US)$.

資金雄厚的投資者對看好態度持久 $向上融科 (TIGR.US)$.

Today, Benzinga's options scanner spotted 33 uncommon options trades for UP Fintech Holding. The overall sentiment of these big-money traders is split between 45% bullish and 45%, bearish.

今天,Benzinga的期權掃描器發現了33筆UP Fintech Holding的不尋常期權交易。這些大手交易者的整體情緒在45%看漲和45%看淡之間。

Out of all of the special options we uncovered, 3 are puts, for a total amount of $181,450, and 30 are calls, for a total amount of $1,241,915.

在我們發現的所有特殊期權中,有3單看跌,總額爲$181,450,還有30單看漲,總額爲$1,241,915。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.

分析這些合同的成交量和持倉量,似乎大戶關注向上融科控股在過去季度的價格區間在$5.0到$17.0之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

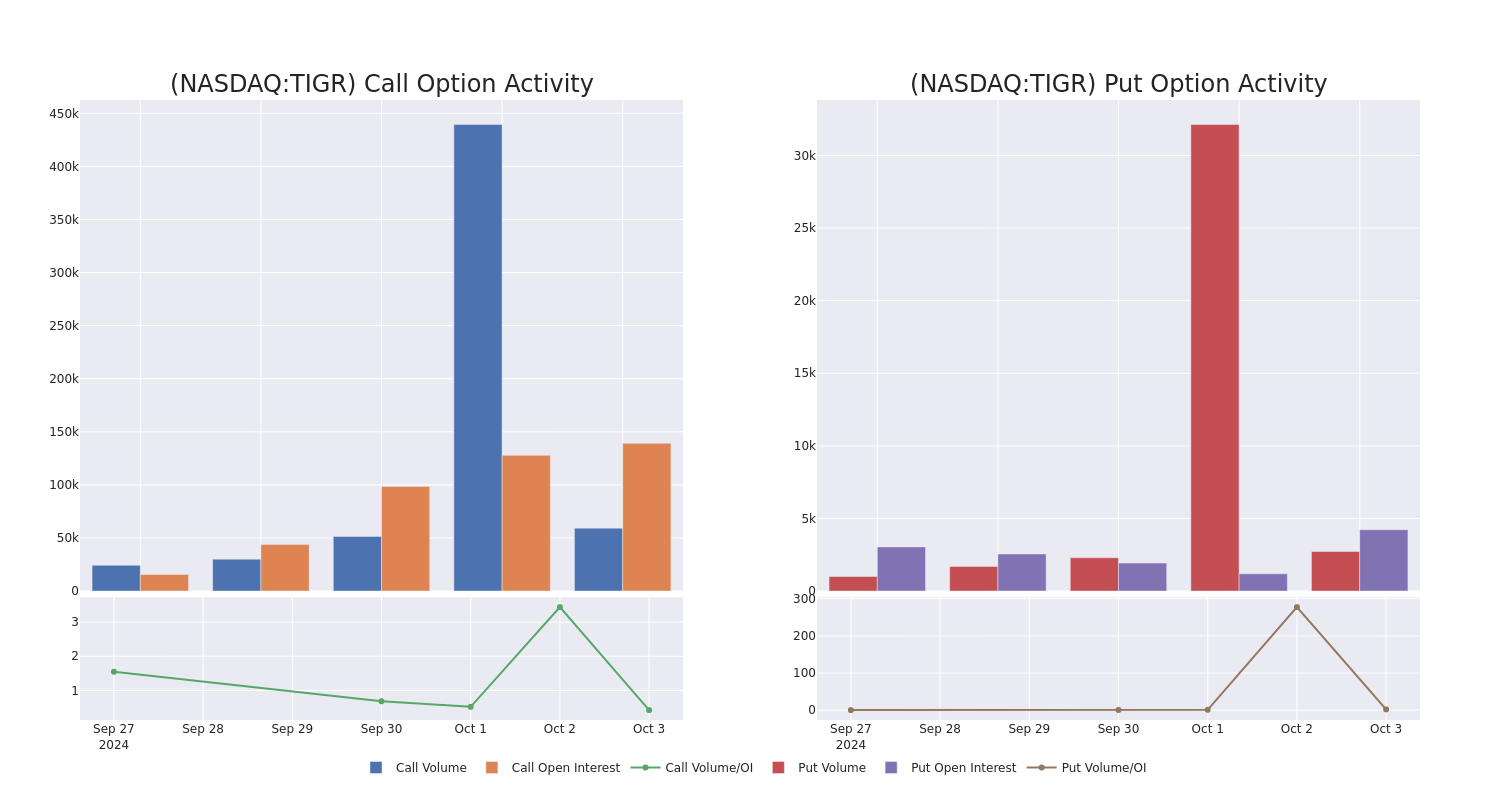

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for UP Fintech Holding's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UP Fintech Holding's whale trades within a strike price range from $5.0 to $17.0 in the last 30 days.

在交易期權時,觀察成交量和未平倉合約是一個強大的舉措。這些數據可以幫助您跟蹤向上融科控股公司特定行使價期權的流動性和興趣。在下面,我們可以觀察到過去30天內,對於所有向上融科控股公司特定行使價範圍從$5.0到$17.0的大宗交易的看漲期權和看跌期權成交量和未平倉合約的演變。

UP Fintech Holding Call and Put Volume: 30-Day Overview

向上融科控股公司看漲和看跌期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

TIGR |

CALL |

TRADE |

BEARISH |

10/18/24 |

$3.7 |

$3.5 |

$3.56 |

$5.50 |

$106.8K |

2.8K |

813 |

TIGR |

CALL |

SWEEP |

BULLISH |

11/15/24 |

$1.5 |

$1.4 |

$1.5 |

$10.00 |

$75.0K |

10.0K |

2.4K |

TIGR |

PUT |

SWEEP |

BEARISH |

11/15/24 |

$0.85 |

$0.75 |

$0.75 |

$7.00 |

$74.9K |

1.0K |

1.7K |

TIGR |

CALL |

SWEEP |

BEARISH |

11/15/24 |

$2.5 |

$2.35 |

$2.35 |

$8.00 |

$70.5K |

4.1K |

920 |

TIGR |

CALL |

SWEEP |

BEARISH |

10/18/24 |

$1.25 |

$1.2 |

$1.2 |

$10.00 |

$69.3K |

9.8K |

6.7K |

標的 |

看跌/看漲 |

交易類型 |

情緒 |

到期日 |

賣盤 |

買盤 |

價格 |

執行價格 |

總交易價格 |

未平倉合約數量 |

成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

TIGR |

看漲 |

交易 |

看淡 |

10/18/24 |

$3.7 |

$3.5 |

$3.56 |

5.50美元 |

$106.8K |

2.8K |

813 |

TIGR |

看漲 |

SWEEP |

看好 |

11/15/24 |

$1.5 |

$1.4 |

$1.5 |

$10.00 |

$75.0K |

10.0K |

2.4K |

TIGR |

看跌 |

SWEEP |

看淡 |

11/15/24 |

$0.85 |

0.75美元 |

0.75美元 |

$7.00 |

$74.9K |

1.0K |

1.7K |

TIGR |

看漲 |

SWEEP |

看淡 |

11/15/24 |

$2.5 |

$2.35 |

$2.35 |

8.00美元 |

$70.5K |

4.1K |

920 |

TIGR |

看漲 |

SWEEP |

看淡 |

10/18/24 |

$1.25 |

$1.2 |

$1.2 |

$10.00 |

$69.3K |

9.8千 |

6.7千 |

About UP Fintech Holding

關於向上融科控股

UP Fintech Holding Ltd is an online brokerage firm focusing on Chinese investors. Its trading platform enables investors to trade in equities and other financial instruments on multiple exchanges of stocks and other derivatives. The company offers its customers brokerage and value-added services, including trade order placement and execution, margin financing, account management, investor education, community discussion, and customer support.

向上融科控股有限公司是一家專注於中國投資者的在線券商公司。其交易平台使投資者能夠在多個股票交易所和其他衍生品上交易。該公司爲客戶提供券商和增值服務,包括交易下單和執行、按金融資、帳戶管理、投資教育、社區討論和客戶支持。

After a thorough review of the options trading surrounding UP Fintech Holding, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對向上融科控股周邊期權交易進行徹底審查之後,我們開始更詳細地檢查該公司。這包括評估其當前市場地位和表現。

Current Position of UP Fintech Holding

向上融科控股的當前位置

Currently trading with a volume of 17,126,367, the TIGR's price is up by 12.45%, now at $9.06.

RSI readings suggest the stock is currently may be overbought.

Anticipated earnings release is in 53 days.

目前成交量爲17,126,367,TIGR的價格上漲12.45%,目前爲9.06美元。

RSI讀數表明股票目前可能超買。

預期收益發布將在53天后。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.