Solid Earnings May Not Tell The Whole Story For China Nuclear Energy Technology (HKG:611)

Solid Earnings May Not Tell The Whole Story For China Nuclear Energy Technology (HKG:611)

The market for China Nuclear Energy Technology Corporation Limited's (HKG:611) stock was strong after it released a healthy earnings report last week. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

中國核能科技股份有限公司(HKG:611)股票上週發佈了健康的收入報告後,中國核能科技股份有限公司的股票市場表現強勁。然而,我們認爲股東應該謹慎,因爲我們發現了一些潛在利潤方面令人擔憂的因素。

A Closer Look At China Nuclear Energy Technology's Earnings

China Nuclear Energy Technology收入的更近一步審視

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

正如財務迷們已經知道的那樣,現金流的應計比率是評估公司自由現金流(FCF)與利潤匹配程度的重要指標。爲了獲得應計比率,我們首先減去一段時間的FCF和利潤,然後將該數字除以該期間的平均營運資產。該比率顯示了公司的利潤超過其FCF的多少。

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

這意味着負應計比率是一件好事,因爲它表明公司帶來的自由現金流比其利潤所建議的要多。這並不意味着我們應該擔心正應計比率,但值得注意的是應計比率相當高的地方。這是因爲一些學術研究表明,高應計比率往往會導致利潤降低或利潤增長較少。

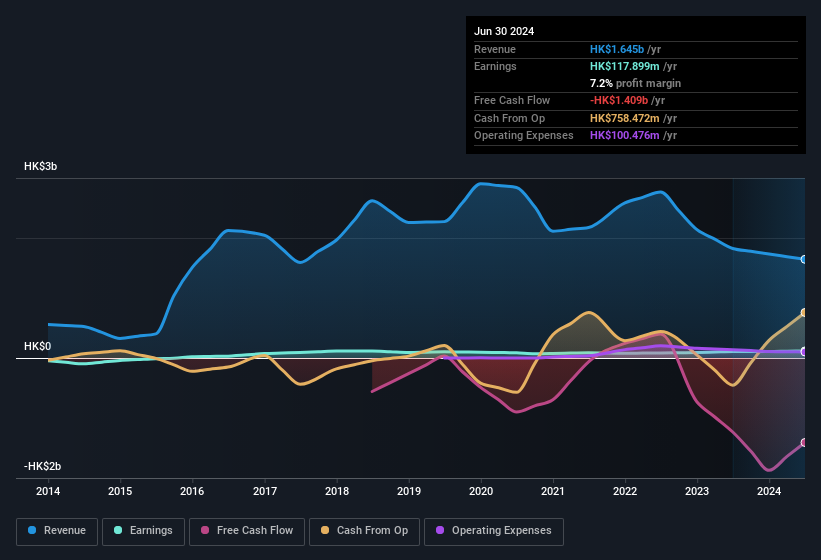

Over the twelve months to June 2024, China Nuclear Energy Technology recorded an accrual ratio of 0.23. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of HK$1.4b, in contrast to the aforementioned profit of HK$117.9m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of HK$1.4b, this year, indicates high risk.

2024年6月期間,中國核能科技累計比率爲0.23。不幸的是,這意味着其自由現金流大幅低於其報告的利潤。過去一年,其實際上擁有14億港元的負自由現金流,與上述11790萬港元的利潤相對比。考慮到去年的負自由現金流,我們設想一些股東可能會懷疑,今年的14億港元現金消耗是否意味着高風險。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of China Nuclear Energy Technology.

注意:我們始終建議投資者檢查資產負債表的實力。請點擊此處查看我們對中國核能科技資產負債表分析。

Our Take On China Nuclear Energy Technology's Profit Performance

我們對中國核能技術的收益表現持有看法

China Nuclear Energy Technology's accrual ratio for the last twelve months signifies cash conversion is less than ideal, which is a negative when it comes to our view of its earnings. Therefore, it seems possible to us that China Nuclear Energy Technology's true underlying earnings power is actually less than its statutory profit. The good news is that, its earnings per share increased by 9.2% in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, China Nuclear Energy Technology has 3 warning signs (and 2 which are potentially serious) we think you should know about.

中國核能技術過去十二個月的應計比率表明現金轉換並不理想,這在我們看待其收益時是一個負面因素。因此,對我們來說,中國核能技術真正的基本盈利能力實際上可能低於其法定利潤。好消息是,其每股收益在過去一年增長了9.2%。當然,在分析其收益時,我們只是觸及了表面;人們還可以考慮毛利率、預期增長和投資回報等其他因素。因此,如果您想深入研究這支股票,考慮到它所面臨的任何風險是至關重要的。例如,中國核能技術有3個警示信號(其中2個可能很嚴重),我們認爲您應該了解。

Today we've zoomed in on a single data point to better understand the nature of China Nuclear Energy Technology's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

今天,我們聚焦於一個單一數據點,以更好地了解中國核能技術的利潤性質。但如果您能夠集中注意力在細枝末節上,就會發現更多內容。有些人認爲高股本回報率是優質業務的良好跡象。雖然這可能需要您進行一些研究,但您可能會發現這個免費的公司收藏中擁有高股本回報率的公司,或者這個持有大量內部股份的股票清單是有用的。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Over the twelve months to June 2024, China Nuclear Energy Technology recorded an accrual ratio of 0.23. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had

Over the twelve months to June 2024, China Nuclear Energy Technology recorded an accrual ratio of 0.23. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had