Here's Why We Think Anhui Yingjia Distillery (SHSE:603198) Is Well Worth Watching

Here's Why We Think Anhui Yingjia Distillery (SHSE:603198) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

許多投資者,尤其是那些經驗不足的人在購買公司股票時,都會選擇那些好故事的公司,即使這些公司正在虧損。但現實情況是,當公司連年虧損時,投資者通常會承擔這些損失。虧損的公司可能像吸取資本的海綿一樣,因此投資者應謹慎,不要將好錢投向壞處。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Anhui Yingjia Distillery (SHSE:603198). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

所以,如果這種高風險高回報的理念不適合您,您可能更感興趣的是盈利能力強、增長迅速的公司,比如迎駕貢酒(SHSE:603198)。雖然這並不一定意味着它被低估,但業務的盈利能力足以獲得一些欣賞 - 尤其是如果它在增長。

How Fast Is Anhui Yingjia Distillery Growing?

迎駕貢酒增長有多快?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Anhui Yingjia Distillery's EPS has grown 29% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

市場在短期內是一臺投票機,但在長期內是一臺稱重機,因此您可以預期股價最終會跟隨每股收益(EPS)結果。這意味着大多數成功的長期投資者認爲EPS增長是一個真正的利好。股東們會高興地知道,迎駕貢酒的EPS每年複合增長率爲29%,持續三年。如果這樣的增長繼續下去,那麼股東們將會有很多值得微笑的地方。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Anhui Yingjia Distillery's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Anhui Yingjia Distillery shareholders can take confidence from the fact that EBIT margins are up from 41% to 45%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

收入增長是增長可持續性的重要指標,再加上高息稅前利潤(EBIT)利潤率,這是公司在市場上保持競爭優勢的好方法。並非所有迎駕貢酒今年的收入都來自營運收入,因此請記住,本文中使用的收入和利潤率數字可能並不是對基礎業務的最佳代表。迎駕貢酒股東可以從息前稅後利潤率從41%上升到45%以及營收增長中獲得信心。在我們看來,勾選這兩個方面是增長的好跡象。

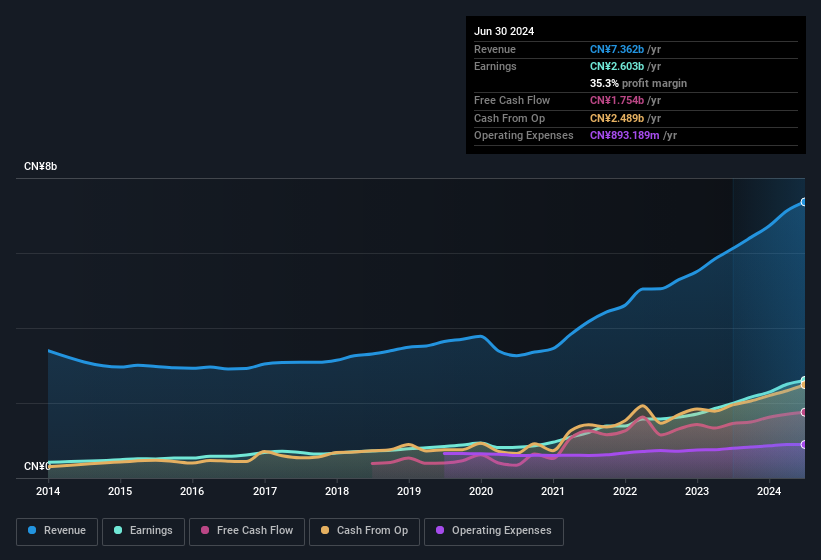

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

下面的表格顯示了公司的營收和淨利潤如何隨着時間的推移的變化。點擊圖表可以查看準確的數字。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Anhui Yingjia Distillery?

儘管我們生活在當前時刻,毫無疑問未來在投資決策過程中最爲重要。爲何不查看這個交互式圖表,展示安徽迎駕貢酒未來的每股收益預估呢?

Are Anhui Yingjia Distillery Insiders Aligned With All Shareholders?

安徽迎駕貢酒內部人士與所有股東的利益是否一致?

We would not expect to see insiders owning a large percentage of a CN¥58b company like Anhui Yingjia Distillery. But we are reassured by the fact they have invested in the company. As a matter of fact, their holding is valued at CN¥116m. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.2%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

我們不會指望看到內部人士擁有像安徽迎駕貢酒這樣580億元人民幣公司的大部分股權。但他們對公司的投資使我們感到放心。事實上,他們持有的價值達到了11600萬元人民幣。這是一大筆資金,也是一個不小的工作動力。儘管他們的所有權僅佔0.2%,但這仍然是一筆相當可觀的利益,促使企業保持一種能夠爲股東創造價值的策略。

Is Anhui Yingjia Distillery Worth Keeping An Eye On?

是否值得密切關注安徽迎駕貢酒?

You can't deny that Anhui Yingjia Distillery has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. It is worth noting though that we have found 1 warning sign for Anhui Yingjia Distillery that you need to take into consideration.

您不能否認,迎駕貢酒的每股收益增長速度非常令人印象深刻。這是令人感到吸引的。有這樣的每股收益增長率,看到公司高層繼續持有重要投資並對公司抱有信心並不奇怪。增長和內部信心受到良好評價,因此值得進一步調查,以找出股票的真實價值。但值得注意的是,我們發現了1個關於迎駕貢酒的警告信號,您需要考慮。

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

雖然不選取增長收益和缺少內部人買入的股票可能會產生效果,但是對於重視這些關鍵指標的投資者,這裏是一份精心挑選的具有巨大增長潛力和內部人信心的CN公司列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)