Top 3 Risk Off Stocks That May Explode This Month

Top 3 Risk Off Stocks That May Explode This Month

本月可能會暴漲的前三支避險股票

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

必需消費品行業中超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

Farmer Bros Co (NASDAQ:FARM)

農民兄弟公司(納斯達克股票代碼:FARM)

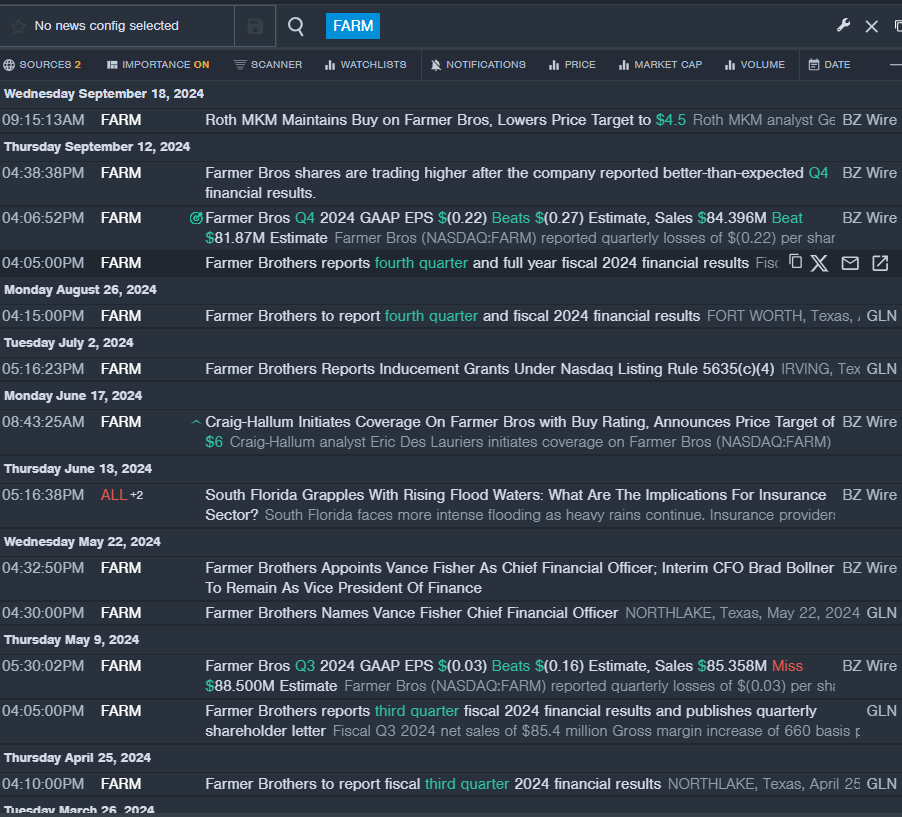

- On Sept. 12, Farmer Bros reported better-than-expected fourth-quarter financial results. "This past year was a transformative one for Farmer Brothers," said President and Chief Executive Officer John Moore. "The decision to sell our direct ship business and focus on our more profitable DSD business helped significantly improve our gross margins and drive adjusted EBITDA profitability and overall operational efficiency." The company's stock fell around 30% over the past month and has a 52-week low of $1.85.

- RSI Value: 27.27

- FARM Price Action: Shares of Farmer Bros fell 2.1% to close at $1.89 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest FARM news.

- 9月12日,農民兄弟公佈的第四季度財務業績好於預期。總裁兼首席執行官約翰·摩爾說:「過去的一年對農民兄弟來說是變革性的一年。」「出售我們的直運業務並專注於利潤更高的DSD業務的決定有助於顯著提高我們的毛利率,並提高調整後的息稅折舊攤銷前利潤盈利能力和整體運營效率。」該公司的股票在過去一個月中下跌了約30%,跌至52周低點1.85美元。

- RSI 值:27.27

- FarM價格走勢:農民兄弟股價週四下跌2.1%,收於1.89美元。

- Benzinga Pro 的實時新聞提醒注意最新的 FarM 新聞。

British American Tobacco PLC (NYSE:BTI)

英美菸草有限公司(紐約證券交易所代碼:BTI)

- On July 25, British American Tobacco posted H1 adjusted EPS of 169.3p down from 181.6p in the year-ago period. The company's stock fell around 6% over the past five days. It has a 52-week low of $28.25.

- RSI Value: 24.49

- BTI Price Action: Shares of British American Tobacco fell 2.4% to close at $35.11 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in BTI stock.

- 7月25日,英美菸草公司公佈的上半年調整後每股收益爲169.3便士,低於去年同期的181.6便士。該公司的股票在過去五天中下跌了約6%。它的52周低點爲28.25美元。

- RSI 值:24.49

- BTI價格走勢:英美菸草股價週四下跌2.4%,收於35.11美元。

- Benzinga Pro的圖表工具幫助確定了BTI股票的走勢。

Conagra Brands Inc (NYSE:CAG)

康納格拉品牌公司(紐約證券交易所代碼:CAG)

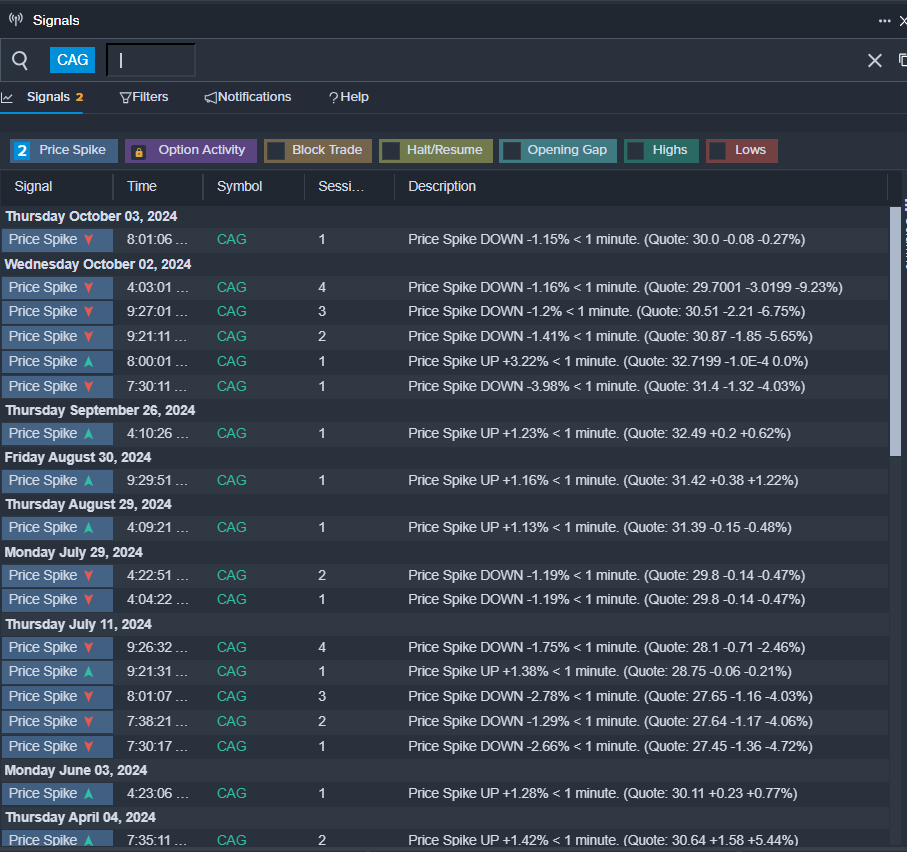

- On Oct. 2, ConAgra Brands reported worse-than-expected first-quarter financial results. Conagra Brands reaffirmed its fiscal 2025 guidance, projecting organic net sales to be between a decline of 1.5% and flat compared to fiscal year 2024, and expects adjusted earnings per share (EPS) to be between $2.60 and $2.65, compared to an estimated $2.61. The company's shares fell around 10% over the past five days and has a 52-week low of $25.16.

- RSI Value: 25.52

- CAG Price Action: Shares of Conagra Brands fell 2.4% to close at $29.35 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in CAG shares.

- 10月2日,康納格拉品牌公佈的第一季度財務業績低於預期。康納格拉品牌重申了其2025財年的指導方針,預計有機淨銷售額與2024財年相比將下降1.5%至持平,並預計調整後的每股收益(EPS)將在2.60美元至2.65美元之間,而估計爲2.61美元。該公司的股價在過去五天中下跌了約10%,跌至52周低點25.16美元。

- RSI 值:25.52

- CAG價格走勢:週四,康納格拉品牌的股價下跌2.4%,收於29.35美元。

- Benzinga Pro的信號功能被告知CAG股票可能出現突破。

- Top 2 Tech And Telecom Stocks That Are Ticking Portfolio Bombs

- 投資組合炸彈爆炸的兩大科技和電信股票