Morgan Stanley's Options: A Look at What the Big Money Is Thinking

Morgan Stanley's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Morgan Stanley.

資金充足的大戶已經明顯看淡摩根士丹利。

Looking at options history for Morgan Stanley (NYSE:MS) we detected 20 trades.

查看摩根士丹利(紐交所:MS)的期權歷史,我們檢測到20筆交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 65% with bearish.

如果我們考慮每筆交易的具體情況,準確地說,25%的投資者持有看好期望,而65%持有看淡期望。

From the overall spotted trades, 4 are puts, for a total amount of $272,134 and 16, calls, for a total amount of $1,768,416.

從所有發現的交易中,4筆爲看跌,總額爲272,134美元;16筆爲看漲,總額爲1,768,416美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $115.0 for Morgan Stanley over the recent three months.

根據交易活動,看起來重要的投資者正在瞄準摩根士丹利在最近三個月內的價格區間,從95.0美元到115.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

In terms of liquidity and interest, the mean open interest for Morgan Stanley options trades today is 1971.21 with a total volume of 3,792.00.

就流動性和興趣而言,今天摩根士丹利期權交易的平均持倉量爲1971.21,總成交量爲3,792.00。

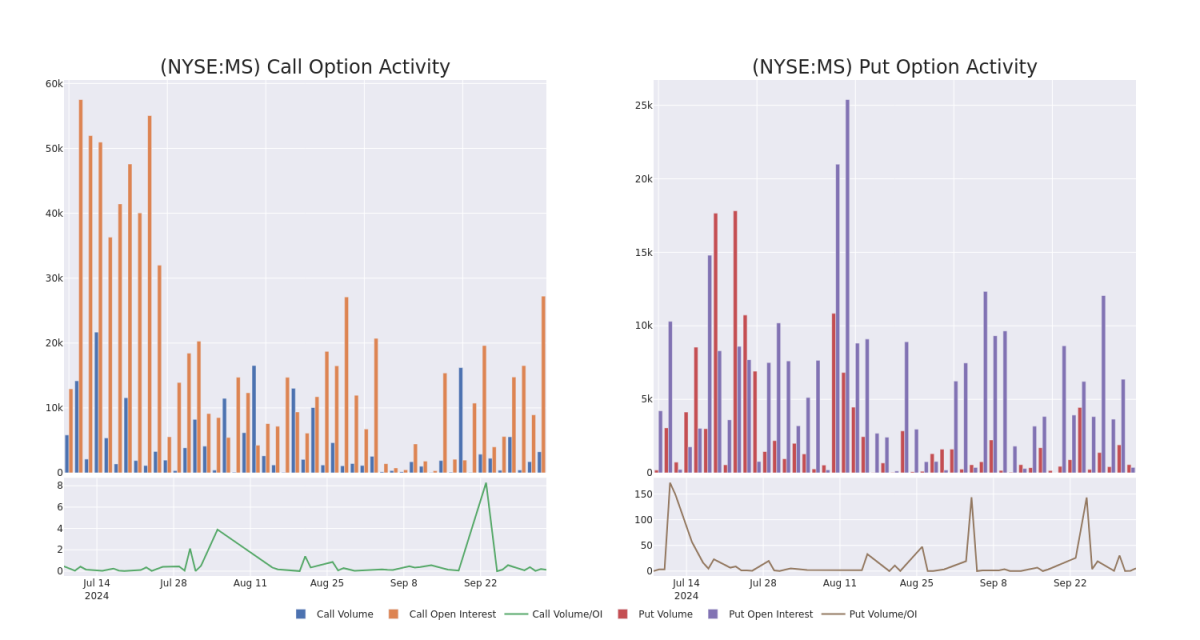

In the following chart, we are able to follow the development of volume and open interest of call and put options for Morgan Stanley's big money trades within a strike price range of $95.0 to $115.0 over the last 30 days.

在以下圖表中,我們可以跟蹤摩根士丹利在過去30天內在95.0美元至115.0美元區間內進行的看漲和看跌期權的成交量和未平倉量情況。

Morgan Stanley Call and Put Volume: 30-Day Overview

摩根士丹利看漲期權和看跌期權成交量:30天概覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | TRADE | BULLISH | 11/15/24 | $9.05 | $8.9 | $9.0 | $100.00 | $630.0K | 1.7K | 739 |

| MS | CALL | SWEEP | BEARISH | 10/04/24 | $6.0 | $5.75 | $5.7 | $102.00 | $199.5K | 1.0K | 358 |

| MS | CALL | TRADE | NEUTRAL | 11/15/24 | $5.25 | $5.15 | $5.2 | $105.00 | $140.9K | 7.1K | 367 |

| MS | CALL | SWEEP | BEARISH | 10/04/24 | $13.3 | $12.45 | $12.59 | $95.00 | $126.1K | 306 | 61 |

| MS | PUT | SWEEP | BEARISH | 02/21/25 | $5.45 | $5.4 | $5.4 | $105.00 | $104.2K | 102 | 45 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | 看漲 | 交易 | 看好 | 11/15/24 | $9.05 | $8.9 | 9.0美元 | $100.00。 | $630.0千美元 | 1.7K | 739 |

| MS | 看漲 | SWEEP | 看淡 | 10/04/24 | $6.0 | $5.75 | $5.7 | $102.00 | $199.5K | 1.0K | 358 |

| MS | 看漲 | 交易 | 中立 | 11/15/24 | $5.25 | $5.15 | $5.2 | $105.00 | 140.9千美元 | 7.1K | 367 |

| MS | 看漲 | SWEEP | 看淡 | 10/04/24 | $13.3 | $12.45 | 12.59美元 | $ 95.00 | $126.1K | 306 | 61 |

| MS | 看跌 | SWEEP | 看淡 | 02/21/25 | $5.45 | $5.4 | $5.4 | $105.00 | $104.2K | 102 | 45 |

About Morgan Stanley

關於摩根士丹利

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

摩根士丹利是一家全球性投資銀行,其歷史可以追溯到1924年的前身公司。該公司擁有機構證券、财富管理和投資管理業務,約45%的淨收入來自其機構證券業務,45%來自财富管理,10%來自投資管理。其總收入約30%來自美洲以外地區。截至2023年底,該公司客戶資產總額超過5萬億美元,員工人數約爲80,000人。

Following our analysis of the options activities associated with Morgan Stanley, we pivot to a closer look at the company's own performance.

在分析與摩根士丹利有關的期權交易活動之後,我們轉向更加詳細地研究該公司的業績。

Morgan Stanley's Current Market Status

摩根士丹利的當前市場狀況

- Currently trading with a volume of 2,391,337, the MS's price is up by 2.55%, now at $107.24.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 12 days.

- 目前交易量爲2,391,337,摩根士丹利的價格上漲了2.55%,目前爲107.24美元。

- RSI讀數表明股票目前可能超買。

- 預期收益將於 12 天內發佈。

Professional Analyst Ratings for Morgan Stanley

摩根士丹利的專業分析師評級

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $109.66666666666667.

在過去的一個月裏,有3位行業分析師分享了對這支股票的見解,提出了平均目標價爲109.66666666666667美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from HSBC has elevated its stance to Buy, setting a new price target at $118. * An analyst from Goldman Sachs has decided to maintain their Neutral rating on Morgan Stanley, which currently sits at a price target of $106. * In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $105.

Benzinga Edge的期權交易異動板塊可以在市場發生之前發現潛在的市場推動者。看看大額資金在您喜愛的股票上的持倉情況。點擊此處獲取訪問權限。* 來自匯豐銀行的分析師將其立場提升至買入,並將新的目標價設定爲118美元。* 來自高盛的分析師決定維持其對摩根士丹利的中立評級,目前的目標價爲106美元。* 作爲一種謹慎之舉,來自高盛的分析師將其評級下調至中立,設定了105美元的目標價。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易員通過不斷學習、調整策略、監控多個因子以及密切關注市場變化來管理這些風險。通過Benzinga Pro實時警報,及時了解最新的摩根士丹利期權交易。

From the overall spotted trades, 4 are puts, for a total amount of $272,134 and 16, calls, for a total amount of $1,768,416.

From the overall spotted trades, 4 are puts, for a total amount of $272,134 and 16, calls, for a total amount of $1,768,416.