PDD Holdings's Options Frenzy: What You Need to Know

PDD Holdings's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on PDD Holdings.

有大量資金可以花的鯨魚對PDD Holdings採取了明顯的看漲立場。

Looking at options history for PDD Holdings (NASDAQ:PDD) we detected 104 trades.

查看PDD Holdings(納斯達克股票代碼:PDD)的期權歷史記錄,我們發現了104筆交易。

If we consider the specifics of each trade, it is accurate to state that 49% of the investors opened trades with bullish expectations and 39% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,49%的投資者以看漲的預期開盤,39%的投資者持看跌預期。

From the overall spotted trades, 21 are puts, for a total amount of $2,224,901 and 83, calls, for a total amount of $9,801,050.

在所有已發現的交易中,有21筆是看跌期權,總額爲2,224,901美元;83筆看漲期權,總額爲9,801,050美元。

Expected Price Movements

預期的價格走勢

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $230.0 for PDD Holdings over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將PDD Holdings的價格區間定在100.0美元至230.0美元之間。

Volume & Open Interest Development

交易量和未平倉合約的發展

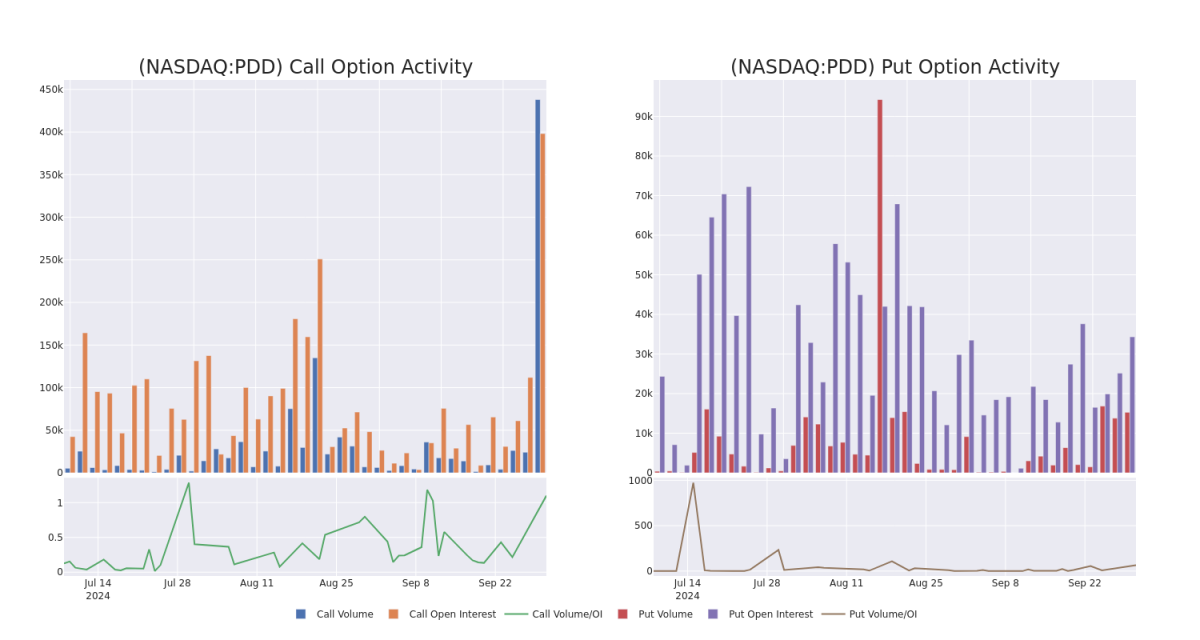

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PDD Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PDD Holdings's substantial trades, within a strike price spectrum from $100.0 to $230.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了PDD Holdings在指定行使價下期權的流動性和投資者對PDD Holdings期權的興趣。即將發佈的數據可視化了與PDD Holdings的大量交易相關的看漲期權和未平倉合約的交易量和未平倉合約的波動,在過去30天內,行使價範圍從100.0美元到230.0美元不等。

PDD Holdings Option Activity Analysis: Last 30 Days

PDD Holdings 期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | NEUTRAL | 11/01/24 | $9.35 | $8.8 | $9.1 | $155.00 | $910.0K | 696 | 2.0K |

| PDD | CALL | SWEEP | BULLISH | 11/15/24 | $7.5 | $7.4 | $7.5 | $165.00 | $675.0K | 6.8K | 14.8K |

| PDD | CALL | SWEEP | NEUTRAL | 01/16/26 | $22.0 | $21.9 | $21.92 | $200.00 | $320.2K | 2.1K | 1.5K |

| PDD | CALL | TRADE | NEUTRAL | 12/20/24 | $29.8 | $29.6 | $29.7 | $130.00 | $297.0K | 4.8K | 206 |

| PDD | CALL | TRADE | BULLISH | 12/20/24 | $54.7 | $54.35 | $54.7 | $100.00 | $273.5K | 3.0K | 174 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 打電話 | 貿易 | 中立 | 11/01/24 | 9.35 美元 | 8.8 美元 | 9.1 美元 | 155.00 美元 | 910.0 萬美元 | 696 | 2.0K |

| PDD | 打電話 | 掃 | 看漲 | 11/15/24 | 7.5 美元 | 7.4 美元 | 7.5 美元 | 165.00 美元 | 675.0 萬美元 | 6.8K | 14.8K |

| PDD | 打電話 | 掃 | 中立 | 01/16/26 | 22.0 美元 | 21.9 美元 | 21.92 美元 | 200.00 美元 | 320.2 萬美元 | 2.1K | 1.5K |

| PDD | 打電話 | 貿易 | 中立 | 12/20/24 | 29.8 美元 | 29.6 美元 | 29.7 美元 | 130.00 美元 | 297.0 萬美元 | 4.8K | 206 |

| PDD | 打電話 | 貿易 | 看漲 | 12/20/24 | 54.7 美元 | 54.35 美元 | 54.7 美元 | 100.00 美元 | 273.5 萬美元 | 3.0K | 174 |

About PDD Holdings

關於 PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨國商業集團,擁有並經營業務組合。PDD旨在將更多的企業和人員帶入數字經濟,使當地社區和小型企業能夠從生產力的提高和新的機遇中受益。PDD 已經建立了一個採購、物流和配送能力網絡,爲其基礎業務提供支持。

Where Is PDD Holdings Standing Right Now?

PDD Holdings現在處於什麼位置?

- With a volume of 16,894,034, the price of PDD is down -0.16% at $152.38.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 53 days.

- PDD的交易量爲16,894,034美元,下跌了0.16%,至152.38美元。

- RSI 指標暗示標的股票可能處於超買狀態。

- 下一份業績預計將在53天后公佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處訪問。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

From the overall spotted trades, 21 are puts, for a total amount of $2,224,901 and 83, calls, for a total amount of $9,801,050.

From the overall spotted trades, 21 are puts, for a total amount of $2,224,901 and 83, calls, for a total amount of $9,801,050.