Guangdong Huiyun Titanium Industry (SZSE:300891) Takes On Some Risk With Its Use Of Debt

Guangdong Huiyun Titanium Industry (SZSE:300891) Takes On Some Risk With Its Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Guangdong Huiyun Titanium Industry Co., Ltd. (SZSE:300891) does use debt in its business. But should shareholders be worried about its use of debt?

霍華德·馬克斯說得很好,他說,與其擔心股價波動,'我擔心的是永久損失的可能性... 我認識的每位實際投資者都在擔心這個。' 所以看起來明智的資金知道,債務 - 通常涉及破產 - 是評估公司風險水平時非常重要的因素。我們可以看到,廣東惠雲鈦業股份有限公司(深證:300891)在業務中確實使用債務。但股東們應該擔心公司使用債務嗎?

When Is Debt A Problem?

什麼時候負債才是一個問題?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

在企業用新的資本或自由現金流償還之前,債務對企業有幫助。最終,如果企業不能履行償還債務的法律義務,股東可能一無所有。然而,更常見(但仍然昂貴)的情況是企業必須以廉價的股價稀釋股東權益,以控制債務。話雖如此,最常見的情況是企業合理地管理其債務並使其對自己有利。在考慮公司的債務水平時,第一步是將現金和債務一起考慮。

What Is Guangdong Huiyun Titanium Industry's Net Debt?

廣東惠雲鈦業的淨債務是多少?

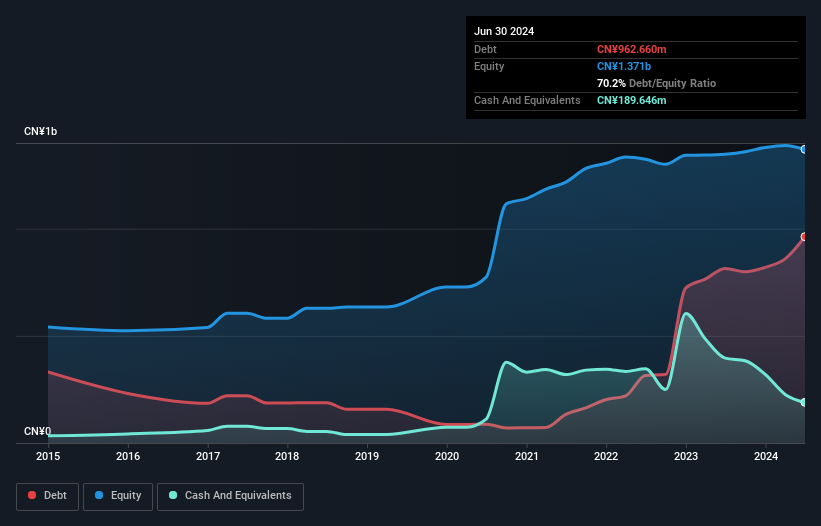

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Guangdong Huiyun Titanium Industry had CN¥962.7m of debt, an increase on CN¥814.5m, over one year. However, it also had CN¥189.6m in cash, and so its net debt is CN¥773.0m.

您可以點擊下方的圖表查看歷史數據,但截至2024年6月,廣東惠雲鈦業的債務爲96270萬人民幣,比去年的81450萬人民幣增加。然而,它也有18960萬人民幣的現金,淨債務爲77300萬人民幣。

How Strong Is Guangdong Huiyun Titanium Industry's Balance Sheet?

廣東惠雲鈦業的資產負債表有多強?

We can see from the most recent balance sheet that Guangdong Huiyun Titanium Industry had liabilities of CN¥913.7m falling due within a year, and liabilities of CN¥526.9m due beyond that. Offsetting these obligations, it had cash of CN¥189.6m as well as receivables valued at CN¥370.7m due within 12 months. So its liabilities total CN¥880.4m more than the combination of its cash and short-term receivables.

我們可以從最近的資產負債表中看到,廣東惠雲鈦業到期的負債爲人民幣91370萬,到期超過一年的負債爲人民幣52690萬。 抵消這些義務的是,它持有涉及12個月內到期的人民幣18960萬現金以及37070萬應收賬款。 因此,它的負債總額比其現金和短期應收賬款的組合多了人民幣88040萬。

While this might seem like a lot, it is not so bad since Guangdong Huiyun Titanium Industry has a market capitalization of CN¥3.54b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

雖然這看起來很多,但並不那麼糟糕,因爲廣東惠雲鈦業的市值爲人民幣35.4億,因此,如果需要,它可能通過增加資本來加強其資產負債表。 但很明顯,我們絕對應該密切審查它是否能夠在不稀釋股權的情況下管理其債務。

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

我們通過查看淨債務與利息、稅、折舊和攤銷前收益(EBITDA)之比以及計算其利息支出由收益前利息和稅(EBIT)覆蓋的程度來度量一家公司的債務負載相對於其收益能力的程度。此方法的優點在於我們同時考慮了債務的絕對量(以淨債務爲EBITDA)以及與該債務相關的實際利息支出(以其利息覆蓋倍數計算)。

With a net debt to EBITDA ratio of 6.2, it's fair to say Guangdong Huiyun Titanium Industry does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 6.9 times, suggesting it can responsibly service its obligations. We also note that Guangdong Huiyun Titanium Industry improved its EBIT from a last year's loss to a positive CN¥43m. When analysing debt levels, the balance sheet is the obvious place to start. But it is Guangdong Huiyun Titanium Industry's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

淨債務與EBITDA比率爲6.2,可以說廣東惠雲鈦業確實有相當大額的債務。 但好消息是,它擁有相當令人寬慰的6.9倍利息保障倍數,表明它可以負責地履行其義務。 我們還注意到,廣東惠雲鈦業將其EBIt從去年虧損轉爲盈利,盈利額爲人民幣4300萬。 在分析債務水平時,資產負債表是顯而易見的起點。 但廣東惠雲鈦業的收入將影響資產負債表未來的表現。 因此,如果您渴望了解更多關於其收入的信息,值得查看其長期收入趨勢的圖表。

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Guangdong Huiyun Titanium Industry saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

最後,一家公司只能用冷硬現金償還債務,而不是會計利潤。因此,檢查其利息和稅前利潤(EBIT)轉化爲實際自由現金流的比例是很重要的。在過去一年中,惠雲鈦業的自由現金流顯示出明顯的負增長。儘管投資者無疑希望這種情況會在不久的將來扭轉,但這顯然意味着它的債務使用更加冒險。

Our View

我們的觀點

To be frank both Guangdong Huiyun Titanium Industry's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Guangdong Huiyun Titanium Industry's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Guangdong Huiyun Titanium Industry is showing 4 warning signs in our investment analysis , and 3 of those can't be ignored...

坦率地說,無論是惠雲鈦業的淨債務至息稅折舊及攤銷前利潤(EBITDA)比,還是其將EBIT轉化爲自由現金流的歷史記錄,都讓我們對其債務水平感到不安。但值得一提的是,其利息覆蓋率是一個好跡象,這讓我們更加樂觀。當我們綜合考慮以上所有因素時,我們認爲惠雲鈦業的債務使其變得有點冒險。有些人喜歡這種風險,但我們會謹慎考慮潛在的風險,所以我們可能更傾向於減少債務。毫無疑問,我們從資產負債表中可以了解到關於債務的大部分信息。但最終,每家公司都可能承擔資產負債表之外存在的風險。請注意,根據我們的投資分析,惠雲鈦業展示出4個警示信號,其中3個是不容忽視的...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

如果在所有這些之後,您更感興趣的是具有堅實資產負債表的快速增長公司,那麼不要拖延,查看我們的淨現金增長股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

We can see from the most recent balance sheet that Guangdong Huiyun Titanium Industry had liabilities of CN¥913.7m falling due within a year, and liabilities of CN¥526.9m due beyond that. Offsetting these obligations, it had cash of CN¥189.6m as well as receivables valued at CN¥370.7m due within 12 months. So its liabilities total CN¥880.4m more than the combination of its cash and short-term receivables.

We can see from the most recent balance sheet that Guangdong Huiyun Titanium Industry had liabilities of CN¥913.7m falling due within a year, and liabilities of CN¥526.9m due beyond that. Offsetting these obligations, it had cash of CN¥189.6m as well as receivables valued at CN¥370.7m due within 12 months. So its liabilities total CN¥880.4m more than the combination of its cash and short-term receivables.