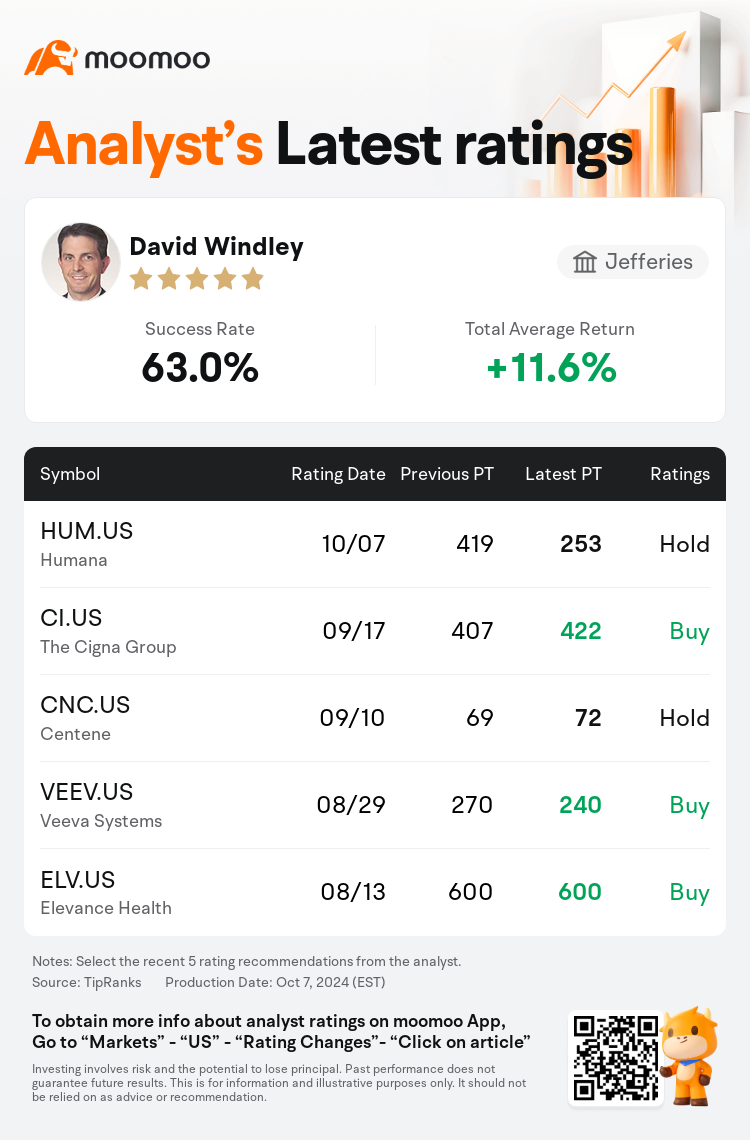

Jefferies analyst David Windley downgrades $Humana (HUM.US)$ to a hold rating, and adjusts the target price from $419 to $253.

According to TipRanks data, the analyst has a success rate of 63.0% and a total average return of 11.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

The anticipated performance of Humana is thought to be contingent upon the outcome of their appeal with CMS, following the reported decrease in the 2025 Star ratings for the payment year 2026. It is suggested that a resolution may not be reached by the commencement of open enrollment.

For 2025, a mere 25% of Humana's members are projected to be enrolled in bonus-qualified plans, a stark decrease from the 94% in the previous year. The preliminary star results have reportedly fallen short of investors' anticipations and are perceived as a notable risk factor for the company's financial outlook for 2026.

Humana is reportedly one metric away from reaching the pivotal 4-Star threshold in three of its four affected plans, which could be a significant advantage if their appeal prevails. Despite potential setbacks, there's a positive outlook for the company's capacity to recover in the following year. The company's leadership is exploring various mitigation strategies, although it's premature to offer detailed guidance at this point. The recent developments have cast some uncertainty over the organization's journey to achieving its 3% margin goal by 2027.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富瑞集團分析師David Windley下調$哈門那 (HUM.US)$至持有評級,並將目標價從419美元下調至253美元。

根據TipRanks數據顯示,該分析師近一年總勝率為63.0%,總平均回報率為11.6%。

此外,綜合報道,$哈門那 (HUM.US)$近期主要分析師觀點如下:

此外,綜合報道,$哈門那 (HUM.US)$近期主要分析師觀點如下:

據報道,2026付款年度的2025年星級評級有所下降,Humana的預期表現被認爲取決於他們向CMS提出上訴的結果。有人建議,在開始公開招生之前可能無法達成解決方案。

到2025年,預計只有25%的Humana會員將加入符合獎金條件的計劃,與去年的94%相比明顯下降。據報道,初步的明星業績未達到投資者的預期,被視爲公司2026年財務前景的重要風險因素。

據報道,Humana在其四項受影響計劃中有三項距離達到關鍵的四星門檻還有一個指標,如果他們的吸引力佔上風,這可能是一個顯著的優勢。儘管可能遇到挫折,但該公司第二年的產能恢復前景樂觀。該公司的領導層正在探索各種緩解策略,儘管目前提供詳細指導還爲時過早。最近的事態發展給該組織到2027年實現3%的利潤率目標的征程帶來了一些不確定性。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$哈門那 (HUM.US)$近期主要分析師觀點如下:

此外,綜合報道,$哈門那 (HUM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of