Wall Street's Most Accurate Analysts Spotlight On 3 Health Care Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Spotlight On 3 Health Care Stocks Delivering High-Dividend Yields

華爾街最準確的分析師聚焦於3只醫療保健股票,提供高股息收益。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以訪問分析師股票評級頁面,查看對他們喜愛的股票的最新分析師看法。交易員可以通過Benzinga的龐大分析師評級數據庫進行篩選,包括按照分析師準確性篩選。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

以下是醫療保健板塊三隻高收益股票最準確的分析師評級。

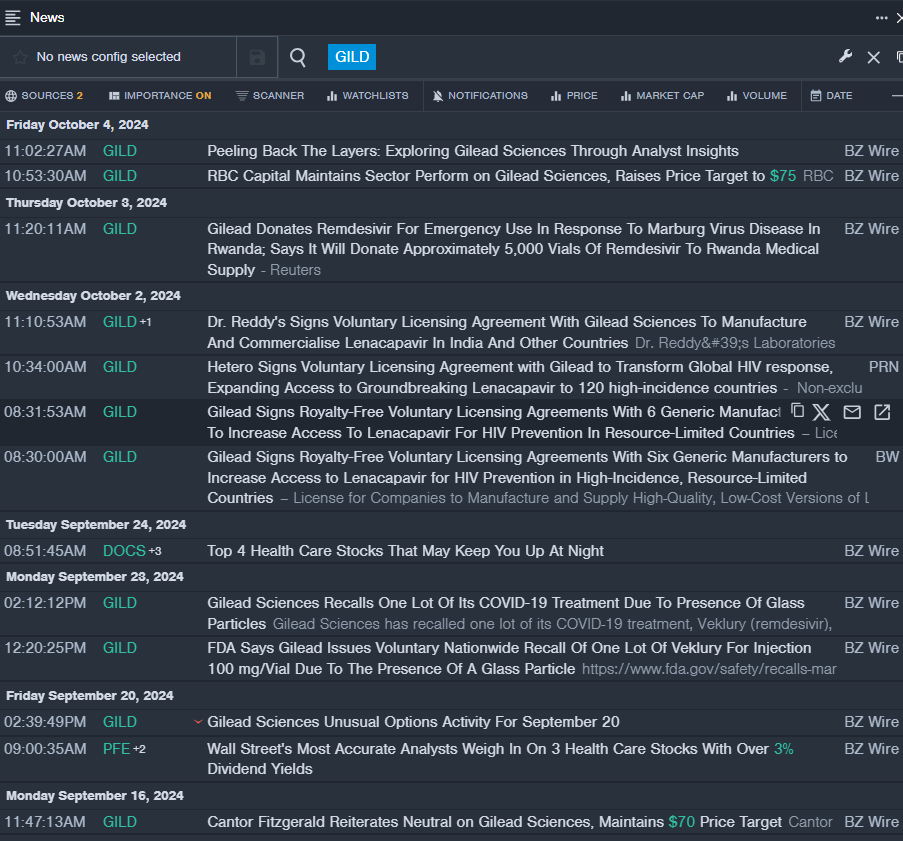

Gilead Sciences, Inc. (NASDAQ:GILD)

吉利德科學股份有限公司(納斯達克股票代碼:GILD)

- Dividend Yield: 3.64%

- RBC Capital analyst Brian Abrahams maintained a Sector Perform rating and raised the price target from $74 to $75 on Oct. 4. This analyst has an accuracy rate of 61%.

- Needham analyst Joseph Stringer reiterated a Hold rating on Aug. 15. This analyst has an accuracy rate of 76%.

- Recent News: On Oct. 2, Dr. Reddy's signed voluntary licensing agreement with Gilead Sciences to manufacture and commercialise Lenacapavir in India and other countries.

- Benzinga Pro's real-time newsfeed alerted to latest GILD news.

- 股息收益率:3.64%

- RBC Capital的分析師Brian Abrahams維持了板塊表現評級,並將價格目標從74萬億美元提高到75美元,準確率爲61%。

- Needham的分析師Joseph Stringer在8月15日重申了持有評級,準確率爲76%。

- 近期資訊:10月2日,Dr. Reddy's與吉利德科學簽署了自願許可協議,授權在印度和其他國家制造和商業化Lenacapavir。

- Benzinga Pro的實時新聞提醒了最新的吉利德科學資訊。

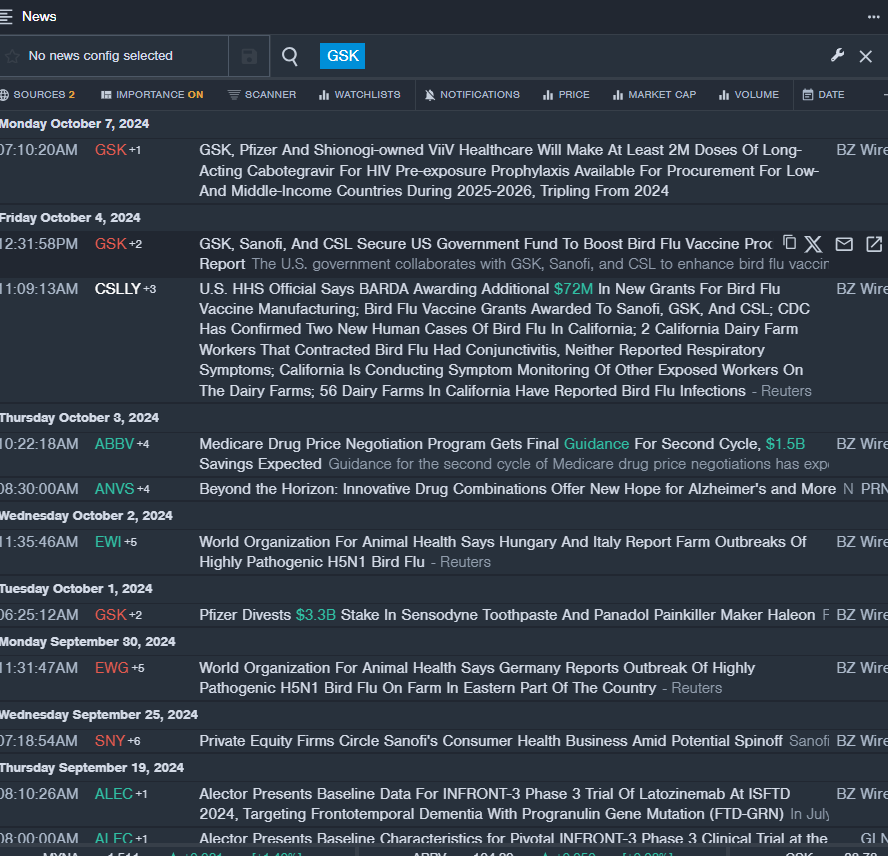

GSK plc (NYSE:GSK)

GSK股票(NYSE:GSK)

- Dividend Yield: 3.94%

- Jefferies analyst Peter Welford maintained a Buy rating and raised the price target from $52.5 to $53 on July 2. This analyst has an accuracy rate of 68%.

- Guggenheim analyst Seamus Fernandez upgraded the stock from Neutral to Buy on March 4. This analyst has an accuracy rate of 62%

- Recent News: The U.S. government has granted $72 million to European pharma giants GSK Plc, Sanofi SA (NASDAQ:SNY) and Australian firm CSL Limited (OTC:CSLLY) to more than double the U.S. supply of bird flu vaccines.

- Benzinga Pro's real-time newsfeed alerted to latest GSK news.

- 股息率:3.94%

- 傑富瑞分析師Peter Welford維持了買入評級,並在7月2日將目標價格由52.5美元上調至53美元。該分析師的準確率爲68%。

- 古根海姆分析師Seamus Fernandez於3月4日將該股票的評級從中立上調至買入。該分析師的準確率爲62%

- 最近的資訊:美國政府已向歐洲製藥巨頭輝瑞(GSk Plc)、賽諾菲安萬特(納斯達克股票代碼: SNY)和澳大利亞公司CSL有限公司(場外交易代碼: CSLLY)提供了7200萬美元,以將禽流感疫苗的美國供應量增加一倍以上。

- Benzinga Pro的實時新聞提醒了最新的輝瑞資訊。

AbbVie Inc. (NYSE:ABBV)

艾伯維公司(紐約證券交易所:ABBV)

- Dividend Yield: 3.19%

- Morgan Stanley analyst Terence Flynn maintained an Overweight rating and boosted the price target from $211 to $218 on Aug. 12. This analyst has an accuracy rate of 70%.

- Wells Fargo analyst Mohit Bansal maintained an Overweight rating and raised the price target from $200 to $205 on July 26. This analyst has an accuracy rate of 75%.

- Recent News: AbbVie will announce its third-quarter financial results on Wednesday, Oct. 30, before the opening bell.

- Benzinga Pro's charting tool helped identify the trend in ABBV stock.

- 股息率:3.19%

- 摩根士丹利的分析師Terence Flynn維持超配評級,並於8月12日將價格目標從211美元提高至218美元。該分析師的準確率爲70%。

- 富國銀行的分析師Mohit Bansal維持超配評級,並於7月26日將價格目標從200美元提高至205美元。該分析師的準確率爲75%。

- 最新資訊:艾伯維公司將於10月30日星期三在開盤前公佈其第三季度業績。

- Benzinga Pro的圖表工具幫助識別了ABBV股票的趨勢。

Read More:

閱讀更多:

- Top 3 Risk Off Stocks That May Explode This Month

- 本月可能會暴漲的前三支避險股票