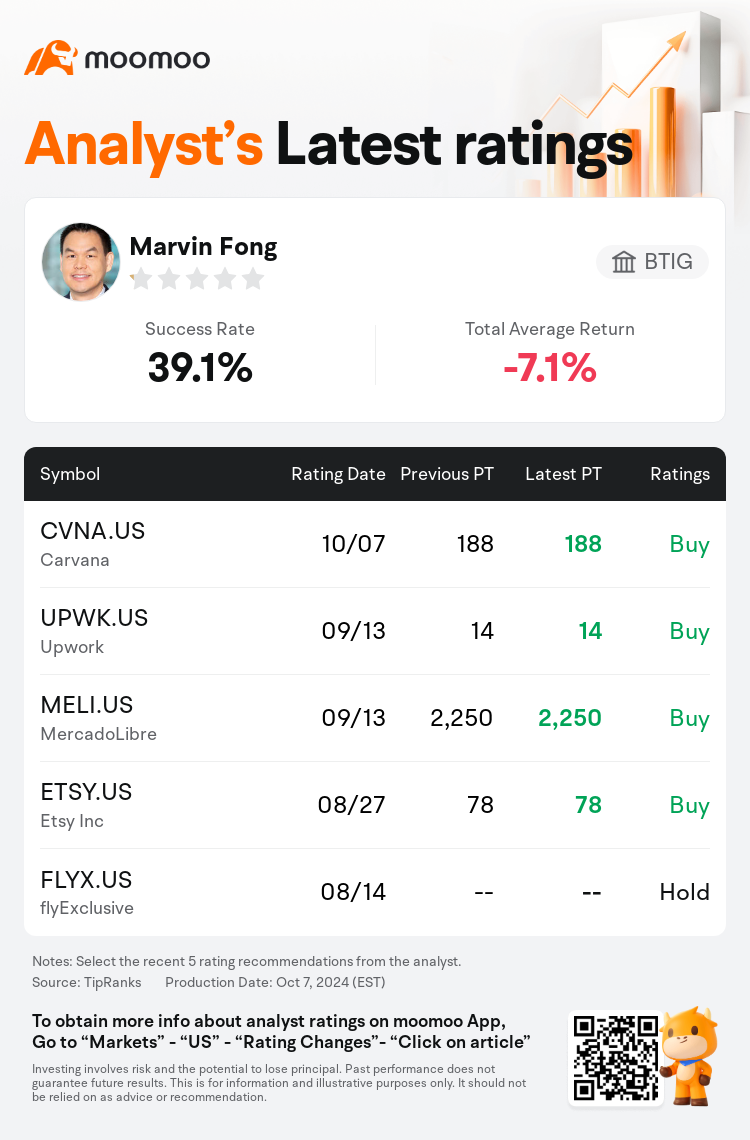

BTIG analyst Marvin Fong maintains $Carvana (CVNA.US)$ with a buy rating, and maintains the target price at $188.

According to TipRanks data, the analyst has a success rate of 39.1% and a total average return of -7.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Carvana (CVNA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Carvana (CVNA.US)$'s main analysts recently are as follows:

Observations indicate that Carvana's third-quarter unit sales may exceed consensus estimates, with sales potentially reaching 107,800 units. Analyses suggest an increase in unit and EBITDA projections for the third quarter and future periods, in light of the company's growing demand, expanding inventory, and ongoing efficiency improvements. There is a noted appreciation for Carvana's ability to enhance gross profit per unit through substantial operational advancements, and the anticipation of further progress. Despite a constructive outlook on the stock as demand increases and margins widen, a cautious stance is maintained due to the significant rise in share value since early September. A strategic approach would be considered around any significant market retractions.

The company's risk exposure to Q3 Other GPU is seen as limited, with a slightly higher risk anticipated for Q4. Updated forecasts for Q3 unit sales are now higher than previous estimates, with the adjustment based on the uptick in website traffic and improved conversion rates due to a growth in inventory, reduced average selling prices, and marginally decreased loan APRs enhancing affordability. The recent three-day port strike is considered to have a negligible impact, whereas Hurricane Helene is believed to have modestly affected sales in the Southeast towards the quarter's end, likely deferring those sales to October.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

BTIG分析師Marvin Fong維持$Carvana (CVNA.US)$買入評級,維持目標價188美元。

根據TipRanks數據顯示,該分析師近一年總勝率為39.1%,總平均回報率為-7.1%。

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

觀察表明,Carvana第三季度的銷量可能超過市場普遍預期,銷量可能達到107,800輛。分析表明,鑑於公司需求的增長、庫存的擴大和效率的持續提高,第三季度及未來時期的單位和息稅折舊攤銷前利潤預測將增加。人們對Carvana通過實質性運營進展提高單位毛利的能力以及對進一步進展的預期表示讚賞。儘管隨着需求的增加和利潤率的擴大,該股前景樂觀,但由於自9月初以來股價大幅上漲,該股保持謹慎立場。將圍繞任何重大的市場回撤考慮採取戰略方針。

該公司對第三季度其他 GPU 的風險敞口被認爲是有限的,預計第四季度的風險略高。現在,對第三季度單位銷售額的最新預測高於先前的預期,調整的依據是網站流量上升,以及庫存增長、平均銷售價格下降以及貸款年利率小幅下降導致的轉化率提高,從而提高了可負擔性。最近爲期三天的港口罷工被認爲產生的影響可以忽略不計,而據信颶風海倫在本季度末對東南部的銷售產生了適度影響,可能將銷售推遲到10月。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of