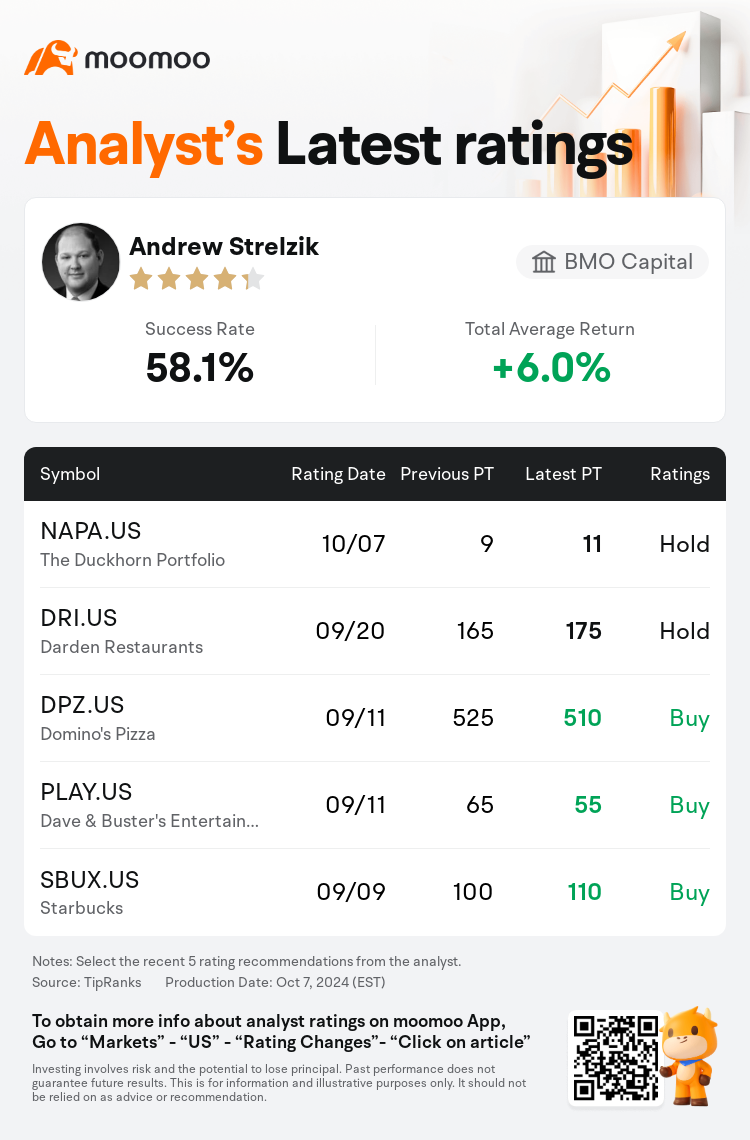

BMO Capital analyst Andrew Strelzik maintains $The Duckhorn Portfolio (NAPA.US)$ with a hold rating, and adjusts the target price from $9 to $11.

According to TipRanks data, the analyst has a success rate of 58.1% and a total average return of 6.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $The Duckhorn Portfolio (NAPA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $The Duckhorn Portfolio (NAPA.US)$'s main analysts recently are as follows:

The proposed transaction with Butterfly Equity is viewed as likely to conclude, particularly since Duckhorn Portfolio's two principal shareholders have consented to endorse the deal. The 'go-shop' period is perceived more as a gesture of good faith towards minority shareholders rather than a substantive shopping period. The valuation is considered consistent with the proposed transaction price per share.

Anticipation of Duckhorn Portfolio's fiscal Q4 report has led to a slight adjustment in fiscal 2025 estimates, taking into account the possible impacts on pricing and product mix due to increased promotions and a deceleration in trends for Sonoma-Cutrer within monitored channels.

The acquisition of Duckhorn Portfolio by a private equity company for approximately $1.95 billion, or $11.10 per share, is highlighted, which includes a 45-day 'go-shop' period, though the probability of a competing offer emerging is considered low. The timing of the deal is noted as unexpected, especially after the closure of the Sonoma-Cutrer acquisition and the anticipation of enhanced consumer spending in the medium term.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

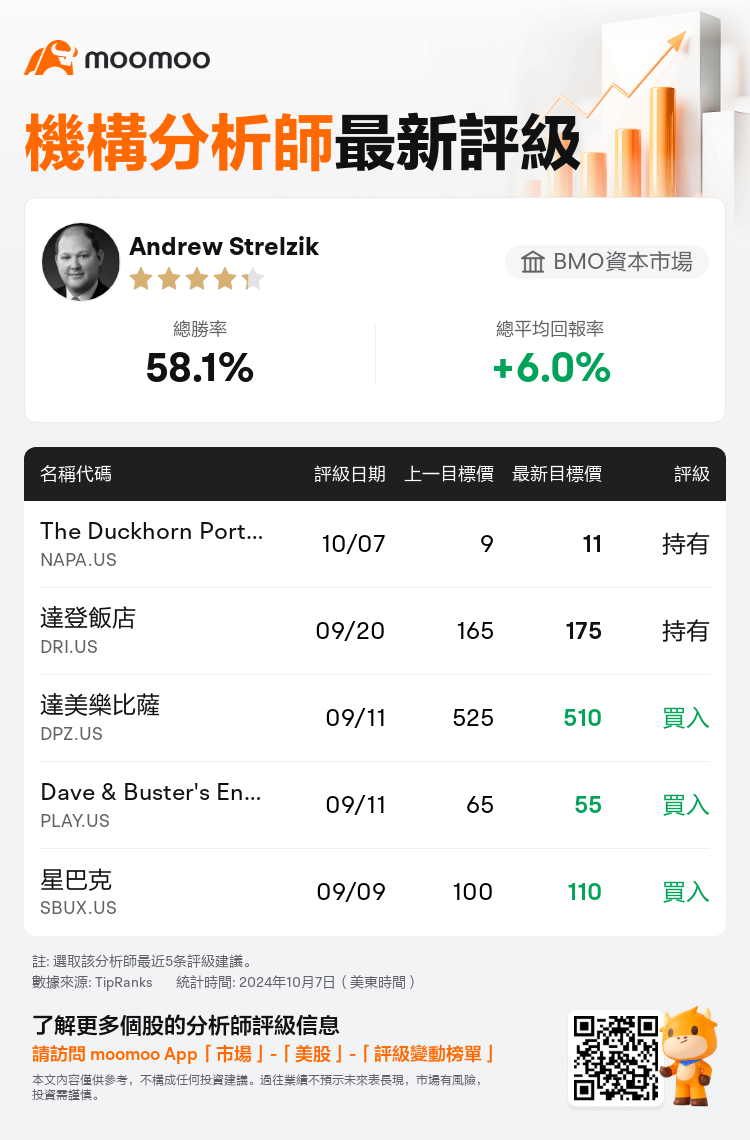

BMO資本市場分析師Andrew Strelzik維持$The Duckhorn Portfolio (NAPA.US)$持有評級,並將目標價從9美元上調至11美元。

根據TipRanks數據顯示,該分析師近一年總勝率為58.1%,總平均回報率為6.0%。

此外,綜合報道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析師觀點如下:

此外,綜合報道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析師觀點如下:

與Butterfly Equity的擬議交易被認爲有可能結束,特別是因爲Duckhorn Portfolio的兩位主要股東已同意支持該交易。「上市」 期更多地被視爲對少數股東的誠意表現,而不是實質性的購物期。估值被認爲與擬議的每股交易價格一致。

對Duckhorn Portfolio第四財季報告的預期導致2025財年的估計略有調整,其中考慮到促銷活動增加以及Sonoma-Cutrer在監控渠道內的趨勢減速可能對定價和產品組合產生的影響。

重點介紹了一傢俬募股權公司以約19.5億美元,合每股11.10美元的價格收購Duckhorn Portfolio,其中包括45天的 「上市」 期,儘管出現競爭性報價的可能性被認爲很低。該交易的時機被認爲是出乎意料的,尤其是在完成對Sonoma-Cutrer的收購以及預計中期消費者支出將增加之後。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析師觀點如下:

此外,綜合報道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of