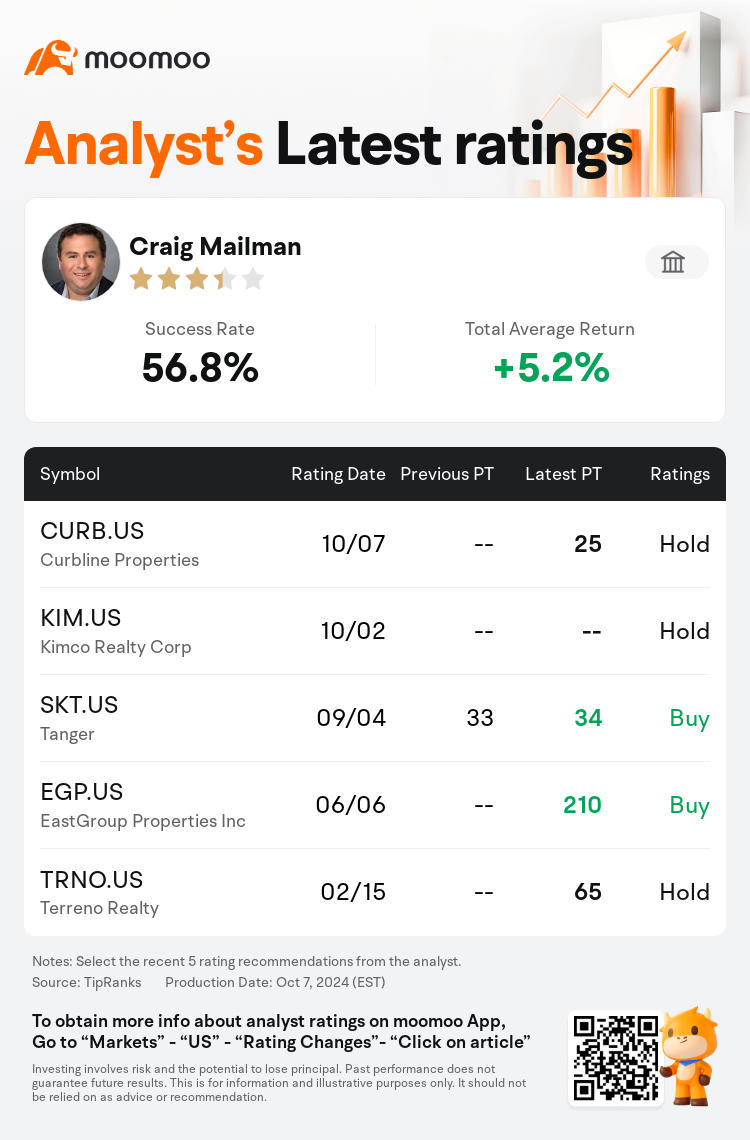

Citi analyst Craig Mailman initiates coverage on $Curbline Properties (CURB.US)$ with a hold rating, and sets the target price at $25.

According to TipRanks data, the analyst has a success rate of 56.8% and a total average return of 5.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Curbline Properties (CURB.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Curbline Properties (CURB.US)$'s main analysts recently are as follows:

Curbline Properties, having been spun off from SITE Centers, may be considered a new entity, yet its management team and assets are already familiar to public investors. The company boasts a 'clean' financial slate, bolstered by an initial capitalization of $800M in cash along with an untapped $100M term loan, which offers significant potential for accretive acquisitions. This is set against a backdrop of a smaller asset base with robust tenant credit quality and potentially lower long-term capital expenditures compared to industry counterparts. Despite these favorable factors, the company's stock carries a 'premium' relative valuation.

The approach of Curbline Properties in the strip center real estate investment trust sector is considered unique due to its concentration on smaller-format, unanchored, convenience centers. These centers are typically located along the curbline of major streets and intersections, offering easy access. The business model and the future potential for the stock are viewed favorably.

Curbline Properties is considered well positioned to achieve above-average growth in net asset value and funds from operations over time. However, this premium growth compared to peers is believed to be accounted for in the stock's current valuation. A more constructive perspective might be adopted following a market pullback.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

花旗分析師Craig Mailman首次給予$Curbline Properties (CURB.US)$持有評級,目標價25美元。

根據TipRanks數據顯示,該分析師近一年總勝率為56.8%,總平均回報率為5.2%。

此外,綜合報道,$Curbline Properties (CURB.US)$近期主要分析師觀點如下:

此外,綜合報道,$Curbline Properties (CURB.US)$近期主要分析師觀點如下:

從SITE Centers分拆出來的Curbline Properties可能被視爲一個新實體,但其管理團隊和資產已經爲公衆投資者所熟悉。該公司擁有 「乾淨」 的財務狀況,其初始資本爲8億美元的現金,以及尚未開發的1億美元定期貸款,這爲增值收購提供了巨大的潛力。這是在資產基礎較小、租戶信貸質量強勁、長期資本支出可能較低的背景下發生的。儘管有這些有利因素,但該公司的股票相對估值仍爲 「溢價」。

Curbline Properties在拉斯維加斯大道中心房地產投資信託領域的方法被認爲是獨一無二的,因爲它專注於規模較小、沒有錨定的便利中心。這些中心通常位於主要街道和十字路口的路邊,交通便利。該股的商業模式和未來潛力受到好評。

隨着時間的推移,Curbline Properties被認爲完全有能力實現淨資產價值和運營資金高於平均水平的增長。但是,與同行相比,這種溢價增長被認爲是該股當前估值的原因。在市場回調之後,可能會採取更具建設性的觀點。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Curbline Properties (CURB.US)$近期主要分析師觀點如下:

此外,綜合報道,$Curbline Properties (CURB.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of