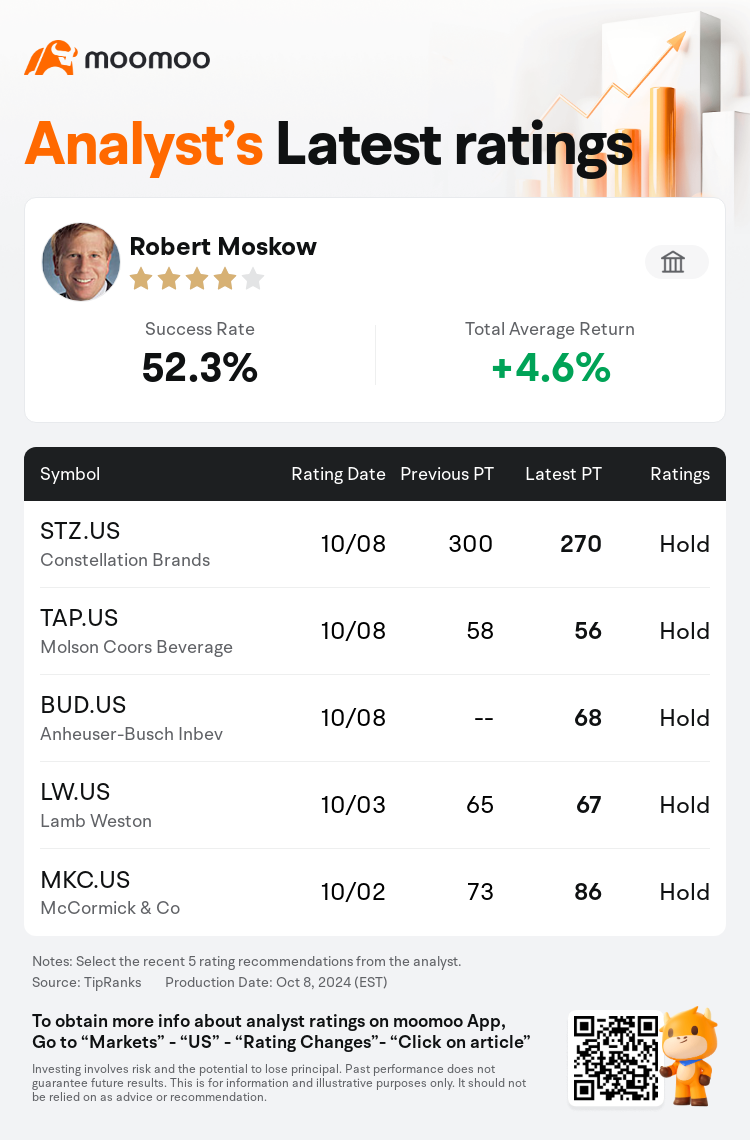

TD Cowen analyst Robert Moskow downgrades $Constellation Brands (STZ.US)$ to a hold rating, and adjusts the target price from $300 to $270.

According to TipRanks data, the analyst has a success rate of 52.3% and a total average return of 4.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Constellation Brands (STZ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Constellation Brands (STZ.US)$'s main analysts recently are as follows:

The key focus for Constellation Brands is the emerging equilibrium in the investment case, which encompasses growth in sales, profits, and cash flows.

Concerns have been raised regarding Constellation Brands' modest beer volume expansion, which analysts believe indicates challenges beyond the broader economic conditions. This slower growth trajectory may strain investor tolerance towards growth capital expenditures, the Wine and Spirits division, and corporate governance issues.

Constellation Brands' effective marketing and well-positioned Mexican imports for U.S. demographic trends remain admirable. Nevertheless, the deceleration in the company's growth trajectory into fiscal 2025 reflects its susceptibility to wider challenges within the beer industry, indicating potential risks for fiscal 2026 projections. The triggers for a favorable reassessment of value currently seem ambiguous.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

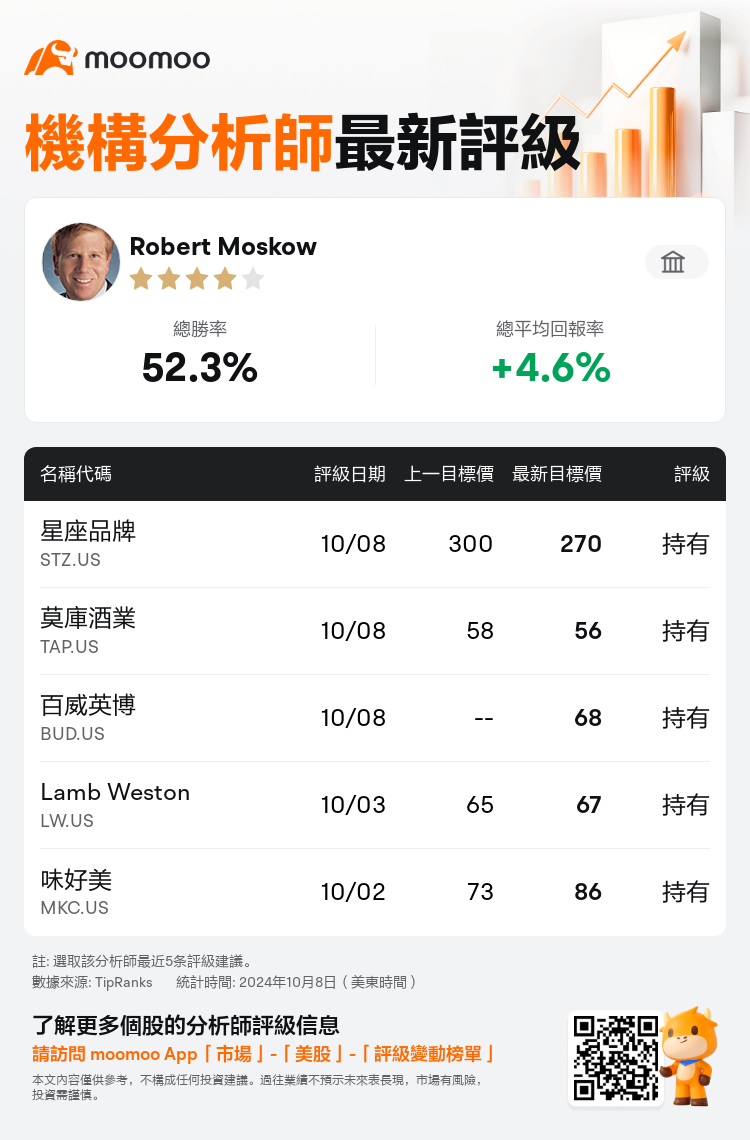

TD Cowen分析師Robert Moskow下調$星座品牌 (STZ.US)$至持有評級,並將目標價從300美元下調至270美元。

根據TipRanks數據顯示,該分析師近一年總勝率為52.3%,總平均回報率為4.6%。

此外,綜合報道,$星座品牌 (STZ.US)$近期主要分析師觀點如下:

此外,綜合報道,$星座品牌 (STZ.US)$近期主要分析師觀點如下:

Constellation Brands的主要重點是投資案例中新出現的均衡,其中包括銷售額、利潤和現金流的增長。

有人對Constellation Brands啤酒銷量適度增長表示擔憂,分析師認爲,這表明除了更廣泛的經濟條件外,還存在挑戰。這種放緩的增長軌跡可能會使投資者對增長資本支出、葡萄酒和烈酒部門以及公司治理問題的容忍度受到壓力。

Constellation Brands的有效營銷和針對美國人口趨勢的有利墨西哥進口仍然令人欽佩。儘管如此,該公司到2025財年的增長軌跡減速反映了其易受啤酒行業更廣泛挑戰的影響,這表明2026財年預測存在潛在風險。目前,有利於重新評估價值的觸發因素似乎不明確。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$星座品牌 (STZ.US)$近期主要分析師觀點如下:

此外,綜合報道,$星座品牌 (STZ.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of