Spotlight on PDD Holdings: Analyzing the Surge in Options Activity

Spotlight on PDD Holdings: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on PDD Holdings.

有大量資金的鯨魚對pdd holdings採取了明顯看好的立場。

Looking at options history for PDD Holdings (NASDAQ:PDD) we detected 39 trades.

查看pdd holdings(納斯達克:PDD)的期權歷史,我們發現了39筆交易。

If we consider the specifics of each trade, it is accurate to state that 51% of the investors opened trades with bullish expectations and 38% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說有51%的投資者持有看好期望,38%持有看淡期望。

From the overall spotted trades, 5 are puts, for a total amount of $243,675 and 34, calls, for a total amount of $24,374,273.

從所有被發現的交易中,有5筆是看跌期權,金額總計$243,675,34筆是看漲期權,金額總計$24,374,273。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $230.0 for PDD Holdings during the past quarter.

分析這些合約的成交量和持倉量,似乎大戶們在過去一個季度一直留意pdd holdings的股價區間爲$55.0至$230.0。

Insights into Volume & Open Interest

成交量和持倉量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for PDD Holdings's options for a given strike price.

這些數據可以幫助您跟蹤PDD Holdings在給定行權價的期權的流動性和利益。

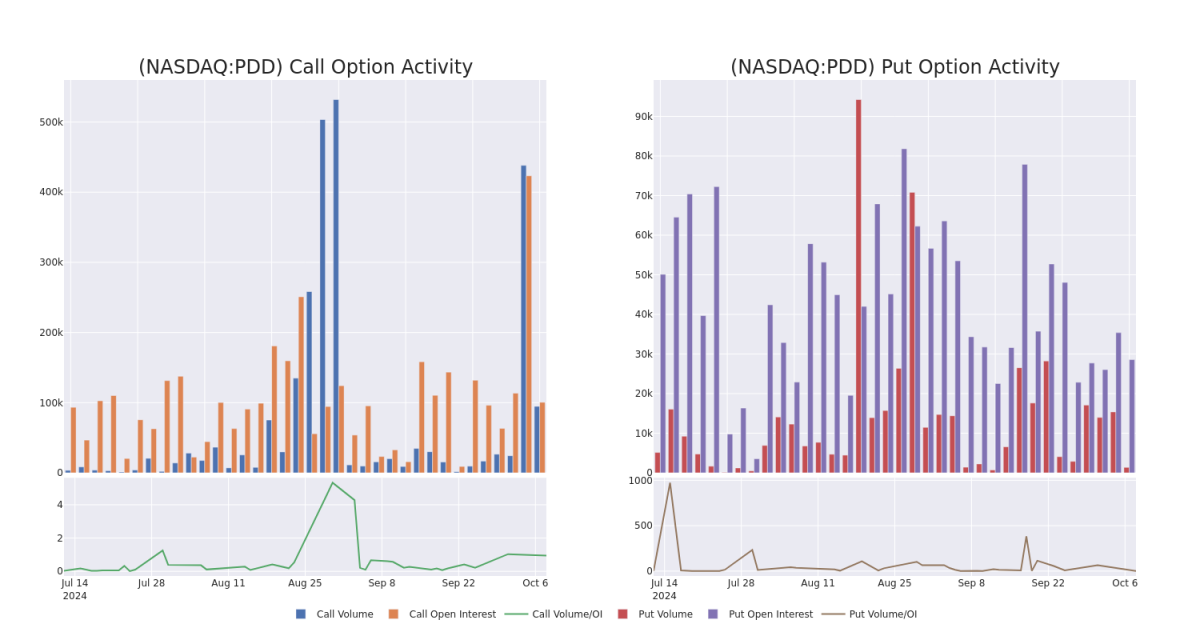

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PDD Holdings's whale activity within a strike price range from $55.0 to $230.0 in the last 30 days.

下面,我們可以觀察過去30天內,pdd holdings所有的大宗交易活動中,涉及到從55.0美元到230.0美元的行權價區間內看漲和看跌期權的成交量和未平倉量的演變。

PDD Holdings Option Volume And Open Interest Over Last 30 Days

PDD Holdings在過去30天內的期權成交量和未平倉金額

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 01/16/26 | $57.4 | $55.7 | $57.05 | $100.00 | $2.8M | 17.5K | 11.3K |

| PDD | CALL | TRADE | BULLISH | 01/16/26 | $57.05 | $55.65 | $57.05 | $100.00 | $2.8M | 17.5K | 10.3K |

| PDD | CALL | SWEEP | BEARISH | 01/16/26 | $59.0 | $58.0 | $58.0 | $100.00 | $2.3M | 17.5K | 800 |

| PDD | CALL | SWEEP | BEARISH | 01/16/26 | $59.0 | $58.0 | $58.0 | $100.00 | $2.3M | 17.5K | 400 |

| PDD | CALL | SWEEP | BULLISH | 01/16/26 | $59.0 | $56.05 | $58.0 | $100.00 | $2.3M | 17.5K | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 看漲 | 交易 | 看好 | 01/16/26 | $57.4 | $55.7 | $57.05 | $100.00。 | 2.8百萬美元 | 17.5K | 11.3K |

| PDD | 看漲 | 交易 | 看好 | 01/16/26 | $57.05 | 55.65美元 | $57.05 | $100.00。 | 2.8百萬美元 | 17.5K | 10.3K |

| PDD | 看漲 | SWEEP | 看淡 | 01/16/26 | $59.0 | $58.0 | $58.0 | $100.00。 | $2.3M | 17.5K | 800 |

| PDD | 看漲 | SWEEP | 看淡 | 01/16/26 | $59.0 | $58.0 | $58.0 | $100.00。 | $2.3M | 17.5K | 400 |

| PDD | 看漲 | SWEEP | 看好 | 01/16/26 | $59.0 | $56.05 | $58.0 | $100.00。 | $2.3M | 17.5K | 0 |

About PDD Holdings

關於pdd holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨國商業集團,擁有和經營一系列業務。PDD的目標是將更多的企業和人們引入數字經濟,從而使當地社區和小企業能從增加的生產率和新的機會中受益。PDD建立了一個支持其基礎業務的採購、物流和履行能力網絡。

Following our analysis of the options activities associated with PDD Holdings, we pivot to a closer look at the company's own performance.

在分析與PDD Holdings相關的期權活動之後,我們轉向更仔細地關注該公司自身的表現。

Current Position of PDD Holdings

納斯達克現狀持倉

- Trading volume stands at 10,710,457, with PDD's price down by -7.22%, positioned at $142.03.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 49 days.

- 交易量爲10,710,457,PDD的價格下跌了-7.22%,位於$142.03。

- RSI指示股票可能已超買。

- 預計在49天內公佈收益。

What Analysts Are Saying About PDD Holdings

關於pdd holdings的分析師觀點

In the last month, 1 experts released ratings on this stock with an average target price of $224.0.

上個月,有1位專家對這隻股票發佈了評級,平均目標價爲$224.0。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Macquarie has elevated its stance to Outperform, setting a new price target at $224.

20年期期權交易員揭示了他的一線圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏進行訪問。* 來自麥格理的分析師已將其立場提升至表現優異,設定了新的目標價爲$224。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大風險,但也有更高利潤的潛力。精明的交易員通過持續教育、戰略交易調整、利用各種因子,並保持對市場動態的敏感,來降低這些風險。使用Benzinga Pro實時提醒,了解pdd holdings的最新期權交易。

From the overall spotted trades, 5 are puts, for a total amount of $243,675 and 34, calls, for a total amount of $24,374,273.

From the overall spotted trades, 5 are puts, for a total amount of $243,675 and 34, calls, for a total amount of $24,374,273.