Unpacking the Latest Options Trading Trends in Cameco

Unpacking the Latest Options Trading Trends in Cameco

Investors with a lot of money to spend have taken a bearish stance on Cameco (NYSE:CCJ).

擁有大量資金的投資者對cameco(紐交所:CCJ)持看淡態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

無論這些是機構還是富裕個人,我們都不清楚。但當CCJ發生這麼大的事情時,這通常意味着某人知道即將發生的事情。

Today, Benzinga's options scanner spotted 20 options trades for Cameco.

今天,Benzinga的期權掃描器發現了20筆對cameco的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 40% bullish and 45%, bearish.

這些大宗交易商的整體情緒在40%看漲和45%看淡之間分歧。

Out of all of the options we uncovered, there was 1 put, for a total amount of $62,433, and 19, calls, for a total amount of $1,367,447.

在我們發現的所有期權中,有1筆看跌期權,金額總計62433美元,以及19筆看漲期權,金額總計1367447美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $13.0 and $60.0 for Cameco, spanning the last three months.

經評估交易量和未平倉合約後,很明顯主要市場推動因素着眼於Cameco股價處於13.0到60.0美元之間的區間,橫跨過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

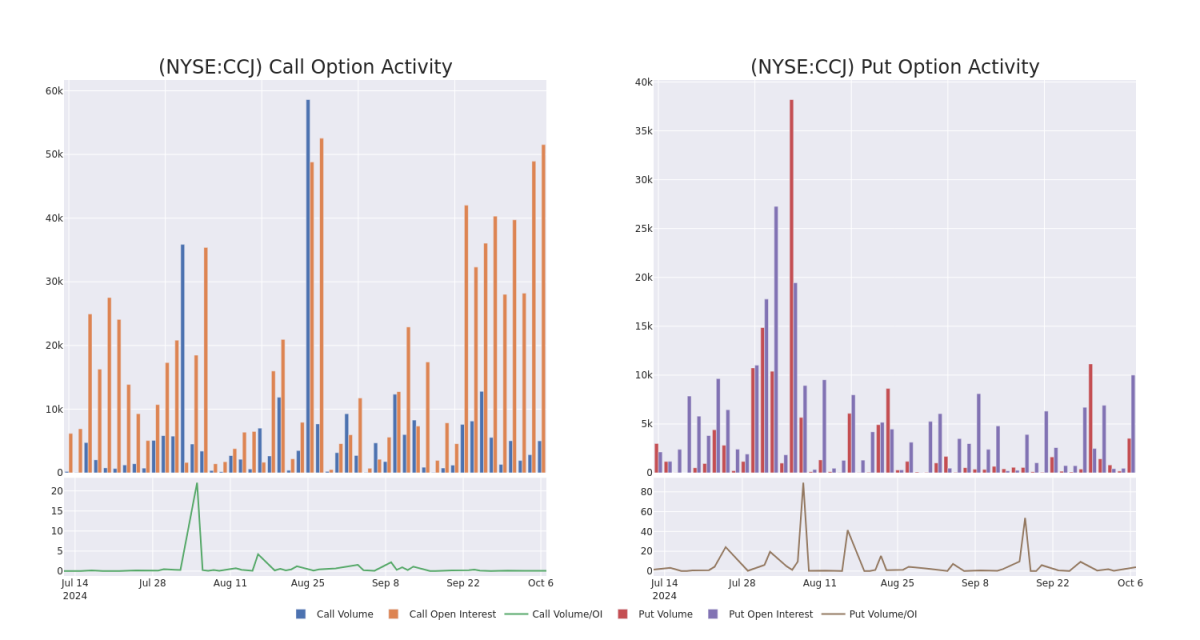

In terms of liquidity and interest, the mean open interest for Cameco options trades today is 3344.08 with a total volume of 6,096.00.

就流動性和關注度而言,Cameco期權交易的平均未平倉合約量爲3344.08,總成交量爲6096.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cameco's big money trades within a strike price range of $13.0 to $60.0 over the last 30 days.

在下圖中,我們可以追蹤Cameco大手交易的看漲和看跌期權的成交量和未平倉合約發展情況,涵蓋了過去30天內的13.0到60.0美元的執行價格範圍。

Cameco Call and Put Volume: 30-Day Overview

Cameco看漲和看跌期權成交量:30天總覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | CALL | TRADE | BEARISH | 01/17/25 | $3.6 | $3.5 | $3.5 | $55.00 | $350.0K | 17.5K | 1.2K |

| CCJ | CALL | TRADE | BEARISH | 01/17/25 | $38.6 | $38.0 | $38.0 | $13.00 | $220.4K | 288 | 121 |

| CCJ | CALL | SWEEP | BULLISH | 09/19/25 | $11.75 | $11.6 | $11.75 | $47.00 | $110.4K | 61 | 94 |

| CCJ | CALL | SWEEP | BEARISH | 10/18/24 | $4.4 | $4.3 | $4.3 | $47.00 | $86.0K | 14.4K | 33 |

| CCJ | PUT | SWEEP | BULLISH | 10/11/24 | $8.4 | $7.9 | $7.9 | $59.00 | $62.4K | 0 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 鈾 | 看漲 | 交易 | 看淡 | 01/17/25 | $3.6 | $3.5 | $3.5 | $55.00 | $350.0K | 17.5K | 1.2K |

| 鈾 | 看漲 | 交易 | 看淡 | 01/17/25 | $38.6 | $38.0 | $38.0 | $13.00 | $220.4K | 288 | 121 |

| 鈾 | 看漲 | SWEEP | 看好 | 09/19/25 | 11.75美元 | $11.6 | 11.75美元 | $47.00 | $110.4K | 61 | 94 |

| 鈾 | 看漲 | SWEEP | 看淡 | 10/18/24 | $4.4 | $4.3 | $4.3 | $47.00 | $86.0K | 14.4K | 33 |

| 鈾 | 看跌 | SWEEP | 看好 | 10/11/24 | $8.4 | $7.9 | $7.9 | $59.00 | $62.4千美元 | 0 | 0 |

About Cameco

關於Cameco Cameco是全球最大的鈾燃料供應商之一,爲發展無污染世界所需的鈾燃料貢獻力量。我們的競爭地位基於我們對世界最大的高品質儲量和低成本經營的控制所有權,以及對核燃料循環的整個投資,包括對西屋電氣公司和全球激光濃縮的所有權。全球實用程序公司依靠Cameco爲世界各地提供全球性的核燃料解決方案,以生成安全、可靠、無碳的核能。我們的股票在多倫多和紐約證券交易所上市。我們的總部位於加拿大薩斯喀徹溫省的薩斯卡通市。

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

Cameco公司是一家提供鈾的供應商,以在全球範圍內產生清潔可靠的基礎電力爲使命,是鈾生產商之一。 Cameco擁有三個可報告部門,分別是鈾、燃料服務和Westinghouse。它從鈾部門獲得最大營業收入。其一些項目包括;Millennium、Yeelirrie、Kintyre和勘探。該公司在加拿大、哈薩克斯坦、德國、澳大利亞和美國開展業務。

Following our analysis of the options activities associated with Cameco, we pivot to a closer look at the company's own performance.

在對與Cameco相關的期權活動進行分析之後,我們轉而更近距離地觀察該公司的表現。

Present Market Standing of Cameco

Cameco目前的市場地位

- Trading volume stands at 2,127,504, with CCJ's price down by -0.88%, positioned at $50.97.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 30 days.

- 交易量爲2,127,504,CCJ的價格下跌了-0.88%,定位於$50.97。

- RSI指示股票可能已超買。

- 預計30天內公佈收益公告。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.