Microsoft Stock Nears Death Cross As OpenAI Partnership Weakens: Time To Lock In Gains?

Microsoft Stock Nears Death Cross As OpenAI Partnership Weakens: Time To Lock In Gains?

Microsoft Corp. (NASDAQ:MSFT) has been riding high in 2024, with the stock up 11.38% year-to-date and 25.21% over the past year.

微軟公司(納斯達克:MSFT)在2024年表現不俗,股價年初至今上漲11.38%,過去一年上漲25.21%。

However, dark clouds may be forming on two fronts: technical indicators are flashing bearish signals and Microsoft's high-profile partnership with OpenAI is showing signs of strain.

然而,兩面山下似乎正在聚集黑雲:技術因子發出消極信號,微軟與OpenAI的備受關注的合作關係顯示出緊張跡象。

Death Cross Looming: Bearish Signals Pile Up

死亡交叉逼近:消極信號堆積

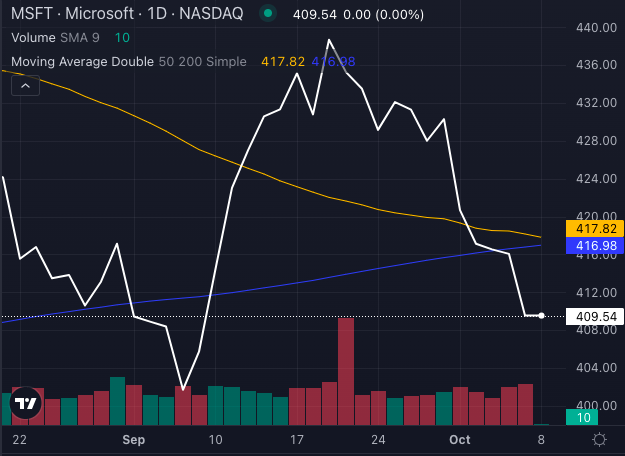

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Microsoft stock is inching closer to forming a Death Cross, a technical pattern where the 50-day moving average dips below the 200-day moving average, signaling a potential shift from bullish to bearish momentum.

微軟股票正逐漸接近形成死亡交叉,這是一種技術模式,即50天均線下跌至200天均線以下,預示着可能由看好的動能轉變爲看淡。

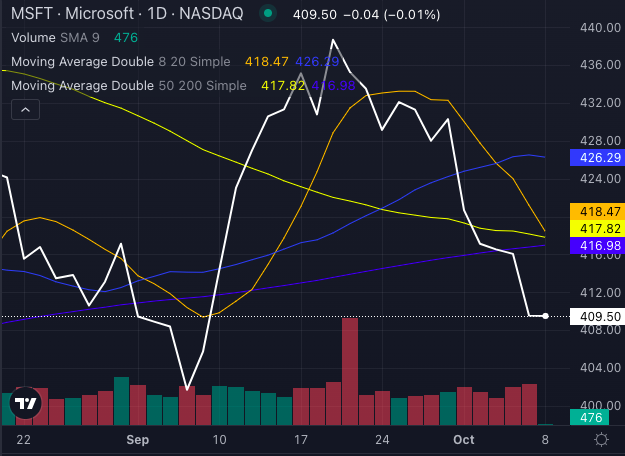

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Right now, Microsoft stock is already trading below key moving averages, indicating that selling pressure is building.

目前,微軟股票已經跌破關鍵移動平均線,表明賣壓正在積累。

- Eight-day SMA: $418.47 (Bearish)

- 20-day SMA: $426.29 (Bearish)

- 50-day SMA: $417.82 (Bearish)

- 200-day SMA: $416.98 (Bearish)

- 8日簡單移動平均線:$418.47(看淡)

- 20日簡單移動平均線:$426.29(看淡)

- 50日簡單移動平均線:$417.82(看淡)

- 200日簡單移動平均線:$416.98(看淡)

At a share price of $409.50, Microsoft's stock is clearly under pressure, with bearish signals stacking up. A Death Cross would only solidify this, potentially signaling a deeper downtrend.

在409.50美元的股價下,微軟股票明顯承受壓力,看淡信號不斷疊加。死亡交叉只會加強這一點,可能預示着更深的下跌趨勢。

OpenAI Moves To Oracle: Cracks In The Microsoft Partnership?

OpenAI轉向Oracle:微軟合作關係出現裂痕?

Adding to Microsoft's troubles is the evolving relationship with OpenAI. According to The Information, OpenAI is seeking more independence from Microsoft's cloud services, opting to lease data centers from Oracle Corp (NYSE:ORCL) in Texas. This shift comes as OpenAI raised $6.6 billion in new funding and looks to expand its capabilities without being solely dependent on Microsoft.

爲微軟增添困擾的是與OpenAI不斷演變的關係。根據The Information的報道,OpenAI正在尋求更多脫離微軟雲服務的獨立性,選擇租用Oracle Corp(NYSE:ORCL)在德克薩斯州的數據中心。這一轉變是因爲OpenAI籌集了60多億美元的新資金,並希望在不完全依賴微軟的情況下擴展其能力。

Read Also: Intel Vs. Oracle: Can Apollo's Rescue Plan Beat Oracle's AI Cloud Domination?

閱讀更多:英特爾對抗甲骨文:阿波羅的挽救計劃能否擊敗甲骨文的人工智能雲主導地位?

Concerns have emerged over Microsoft's ability to meet OpenAI's growing need for computing power, prompting OpenAI's search for alternative solutions. Though OpenAI maintains that its strategic relationship with Microsoft remains strong, the move toward Oracle signals some level of dissatisfaction.

對於微軟滿足OpenAI日益增長的計算需求的能力出現了擔憂,促使OpenAI尋找替代解決方案。儘管OpenAI堅稱與微軟的戰略關係依然牢固,但轉向甲骨文表明瞭某種程度的不滿。

Time To Lock In Gains?

是時候鎖定收益了?

With Microsoft stock on the brink of a Death Cross and its once rock-solid partnership with OpenAI showing cracks, now might be the perfect time for investors to consider locking in gains.

隨着微軟股票瀕臨死亡十字並且其曾經堅固的與OpenAI之間的合作關係出現裂痕,現在或許是投資者考慮鎖定收益的絕佳時機。

The combination of bearish technicals and potential shifts in cloud business partnerships adds to the risk of a downturn.

消極技術因子的結合以及雲業務合作伙伴關係的潛在變化進一步增加了轉向看淡的風險。

Investors riding Microsoft's strong 2024 performance might want to reevaluate whether to stay in or take profits before the Death Cross becomes a reality.

投資者跟隨微軟2024年強勁表現,可能會想重新評估是繼續持有還是在死亡十字成爲現實之前獲利。

- Here's How Much $100 Invested In Microsoft 20 Years Ago Would Be Worth Today

- 20年前投資微軟100美元,今天會是多少錢?

Photo: Shutterstock

Photo: shutterstock

Microsoft stock is inching closer to forming a

Microsoft stock is inching closer to forming a