Jefferies analyst Philip Ng maintains $Builders FirstSource (BLDR.US)$ with a buy rating, and adjusts the target price from $185 to $223.

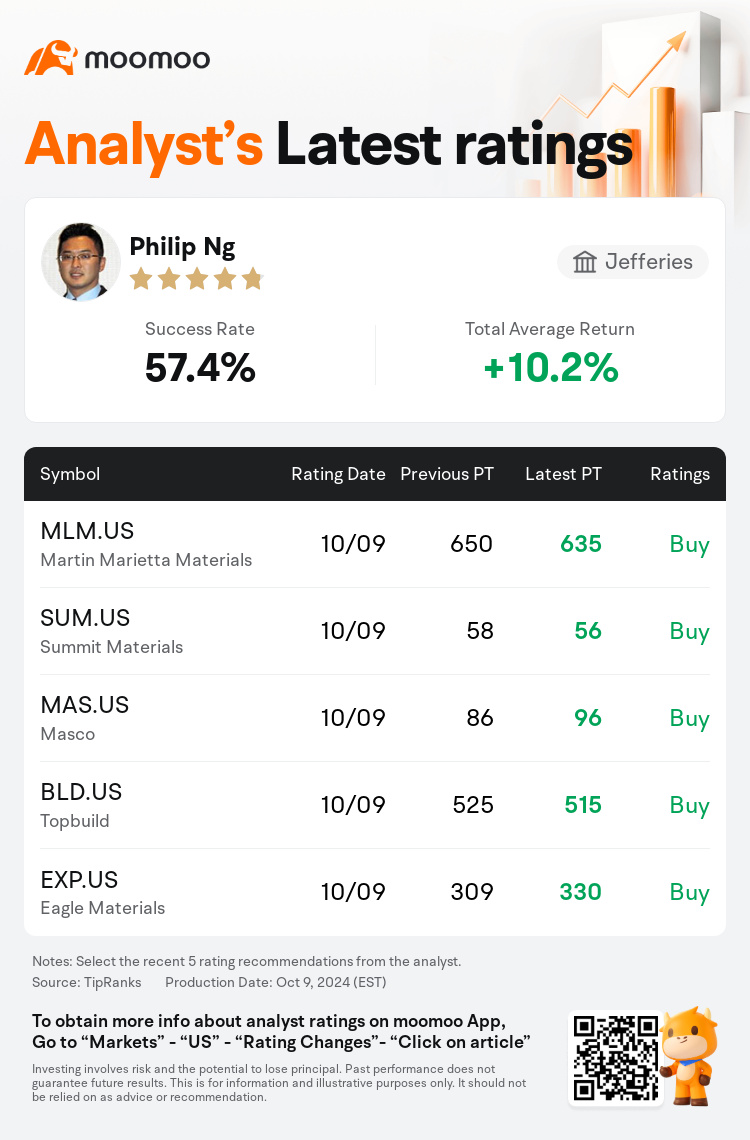

According to TipRanks data, the analyst has a success rate of 57.4% and a total average return of 10.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Builders FirstSource (BLDR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Builders FirstSource (BLDR.US)$'s main analysts recently are as follows:

Builders FirstSource, as a principal ally to professional homebuilders and construction experts, stands poised to benefit from a resurgence in new residential construction and from an increase in higher-margin value-added products. This positions the company for potential above-average growth in revenue and EBITDA in the forthcoming years. Moreover, there is an anticipated incremental rise in revenue and earnings projections through 2026.

The preference for building products over homebuilders is noted amidst a less certain earnings forecast for the upcoming quarter within the homebuilding and building products sector.

Analysts are adjusting their expectations for the building products sector due to short-term challenges, including adverse weather conditions and a decline in housing starts, which may result in volatile stock performance around earnings announcements. Nonetheless, analysts maintain a positive outlook towards 2025, anticipating that declining interest rates will facilitate a recovery. Stocks that have underperformed, including those in the materials and building sectors, are expected to experience a rebound in response to their earnings reports.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富瑞集團分析師Philip Ng維持$Builders FirstSource (BLDR.US)$買入評級,並將目標價從185美元上調至223美元。

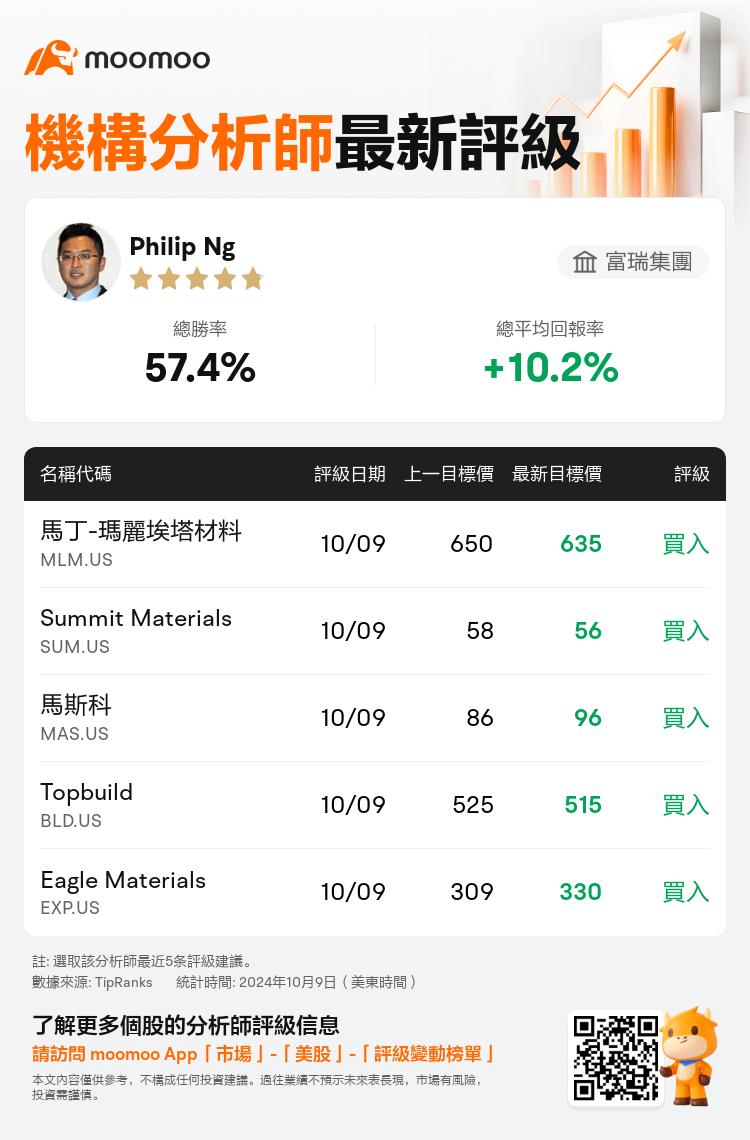

根據TipRanks數據顯示,該分析師近一年總勝率為57.4%,總平均回報率為10.2%。

此外,綜合報道,$Builders FirstSource (BLDR.US)$近期主要分析師觀點如下:

此外,綜合報道,$Builders FirstSource (BLDR.US)$近期主要分析師觀點如下:

作爲專業房屋建築商和建築專家的主要盟友,Builders FirstSource有望從新住宅建築的復甦和利潤率更高的增值產品的增加中受益。這使公司的收入和息稅折舊攤銷前利潤有可能在未來幾年實現高於平均水平的增長。此外,預計到2026年,收入和收益預測將逐步增長。

房屋建築和建築產品行業對下個季度的收益預測不太確定,因此人們更傾向於建築產品而不是房屋建築商。

由於包括惡劣天氣條件和房屋開工量下降在內的短期挑戰,分析師正在調整對建築產品行業的預期,這可能會導致業績公告前後的股票表現波動。儘管如此,分析師對2025年保持樂觀的前景,預計利率下降將促進復甦。表現不佳的股票,包括材料和建築板塊的股票,預計將因其收益報告而出現反彈。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Builders FirstSource (BLDR.US)$近期主要分析師觀點如下:

此外,綜合報道,$Builders FirstSource (BLDR.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of