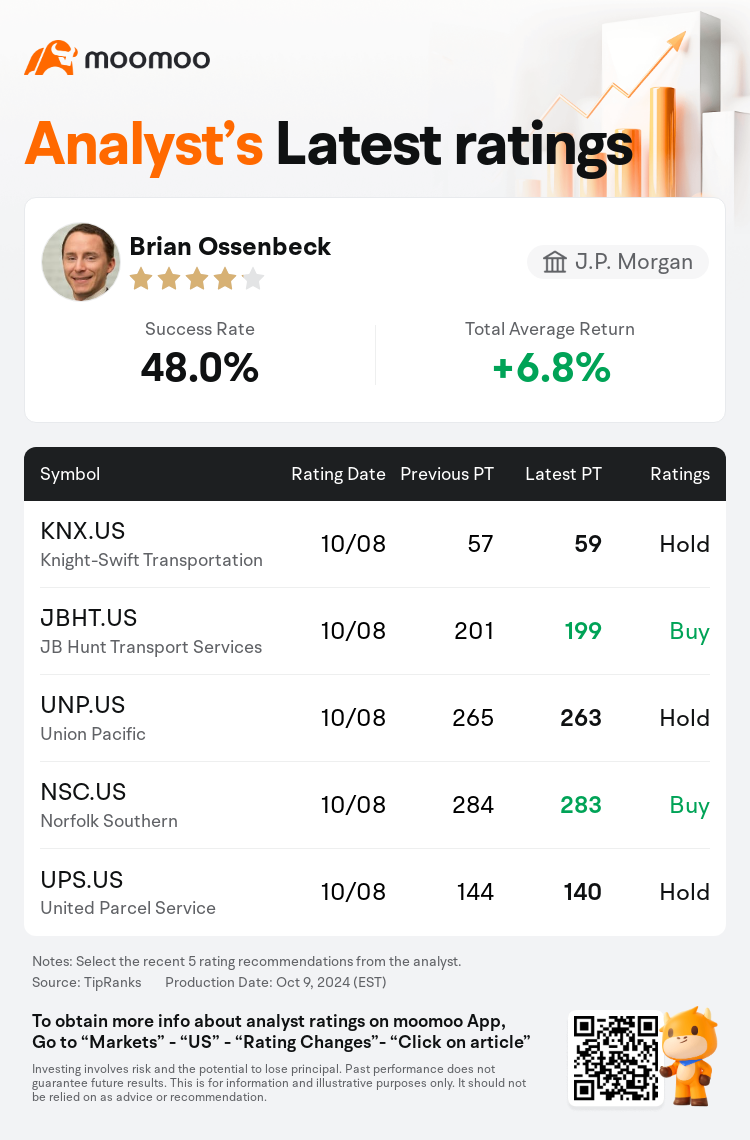

J.P. Morgan analyst Brian Ossenbeck maintains $Knight-Swift Transportation (KNX.US)$ with a hold rating, and adjusts the target price from $57 to $59.

According to TipRanks data, the analyst has a success rate of 48.0% and a total average return of 6.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Knight-Swift Transportation (KNX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Knight-Swift Transportation (KNX.US)$'s main analysts recently are as follows:

The firm's truckload earnings per share estimates for Q3 have been revised downwards due to a more cautious forecast for margin improvement in the quarter. This adjustment is based on stable revenue per mile projections paired with a broader anticipation of higher operating ratios, which suggest an extension of below-typical quarter-over-quarter margin results.

The analysis suggests that the transportation and logistics sector may be approaching the later stages of a cyclical downturn, with current rates and margins nearing their lowest points. This sets the stage for potential robust earnings growth in 2025 and 2026 as the rates are expected to rebound. The optimistic outlook is further bolstered by the belief that many companies in this sector are helmed by strong management teams who have demonstrated a commitment to disciplined capital allocation. Additionally, the essential nature of transportation services to the North American economy is seen as reducing the risk of disruption or replacement. Investors are advised to position themselves for the anticipated cyclical recovery, focusing on companies poised to benefit significantly from tightening freight conditions.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

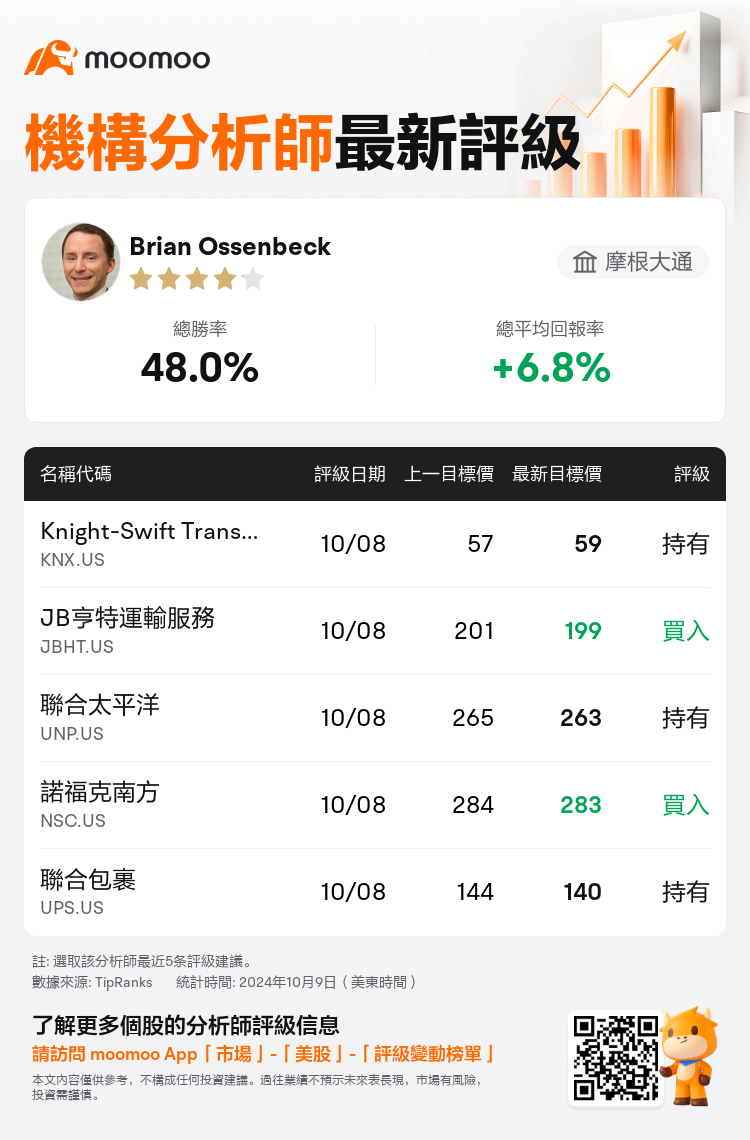

摩根大通分析師Brian Ossenbeck維持$Knight-Swift Transportation (KNX.US)$持有評級,並將目標價從57美元上調至59美元。

根據TipRanks數據顯示,該分析師近一年總勝率為48.0%,總平均回報率為6.8%。

此外,綜合報道,$Knight-Swift Transportation (KNX.US)$近期主要分析師觀點如下:

此外,綜合報道,$Knight-Swift Transportation (KNX.US)$近期主要分析師觀點如下:

由於對本季度利潤率提高的預測更爲謹慎,該公司第三季度的每股卡車收益預期已下調。此次調整基於穩定的每英里收入預測,加上對更高的運營比率的更廣泛預期,這表明季度同比利潤率將延長,低於典型水平。

分析表明,運輸和物流業可能已接近週期性衰退的後期階段,目前的利率和利潤率接近最低點。這爲2025年和2026年潛在的強勁收益增長奠定了基礎,因爲預計利率將反彈。人們認爲,該行業的許多公司都由強大的管理團隊領導,這些團隊表現出對嚴格資本配置的承諾,這進一步支撐了樂觀的前景。此外,北美經濟運輸服務的基本性質被視爲降低了中斷或替代的風險。建議投資者爲預期的週期性復甦做好準備,重點關注有望從緊縮的運費條件中受益的公司。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Knight-Swift Transportation (KNX.US)$近期主要分析師觀點如下:

此外,綜合報道,$Knight-Swift Transportation (KNX.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of