Shopify Unusual Options Activity For October 09

Shopify Unusual Options Activity For October 09

Whales with a lot of money to spend have taken a noticeably bullish stance on Shopify.

有大筆資金的鯨魚已經明顯看好shopify。

Looking at options history for Shopify (NYSE:SHOP) we detected 17 trades.

查看Shopify(紐交所:SHOP)的期權歷史,我們檢測到有17筆交易。

If we consider the specifics of each trade, it is accurate to state that 47% of the investors opened trades with bullish expectations and 47% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說有47%的投資者帶着看好的期待開倉,47%的投資者帶着看淡的期待開倉。

From the overall spotted trades, 5 are puts, for a total amount of $226,195 and 12, calls, for a total amount of $871,724.

在所有觀察到的交易中,有5筆看跌期權,總金額爲$226,195,另外有12筆看漲期權,總金額爲$871,724。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $130.0 for Shopify, spanning the last three months.

經過評估交易量和未平倉合約的數據,顯而易見的是主要市場參與者正在關注Shopify的價格區間在$40.0和$130.0之間,該區間跨越了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Shopify's options for a given strike price.

這些數據可以幫助您跟蹤shopify特定執行價格的期權流動性和利益。

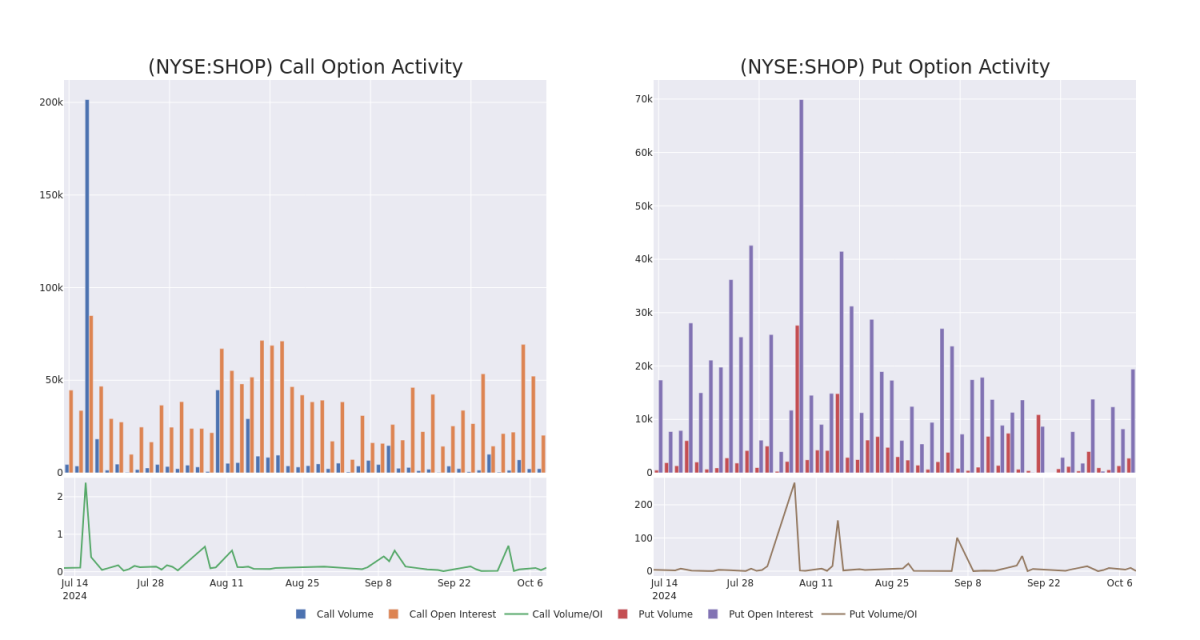

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Shopify's whale activity within a strike price range from $40.0 to $130.0 in the last 30 days.

在下面,我們可以觀察過去30天內,shopify所有鯨魚活動的成交量和未平倉量的發展,分別涵蓋了從40.0美元到130.0美元的執行價格區間。

Shopify Option Volume And Open Interest Over Last 30 Days

過去30天內Shopify期權成交量和未平倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | SWEEP | NEUTRAL | 06/20/25 | $6.85 | $6.55 | $6.85 | $105.00 | $275.3K | 3.5K | 564 |

| SHOP | CALL | SWEEP | BULLISH | 06/20/25 | $7.0 | $6.7 | $6.85 | $105.00 | $106.8K | 3.5K | 157 |

| SHOP | CALL | SWEEP | BULLISH | 01/16/26 | $6.4 | $6.25 | $6.4 | $130.00 | $106.2K | 286 | 175 |

| SHOP | CALL | TRADE | BEARISH | 10/18/24 | $4.8 | $4.65 | $4.65 | $80.00 | $93.0K | 11.0K | 323 |

| SHOP | PUT | SWEEP | BEARISH | 01/17/25 | $5.8 | $5.75 | $5.75 | $80.00 | $82.2K | 3.4K | 178 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | 看漲 | SWEEP | 中立 | 06/20/25 | $6.85 | $ 6.55 | $6.85 | $105.00 | $275.3K | 3.5K | 564 |

| SHOP | 看漲 | SWEEP | 看好 | 06/20/25 | $7.0 | $6.7 | $6.85 | $105.00 | $106.8K | 3.5K | 157 |

| SHOP | 看漲 | SWEEP | 看好 | 01/16/26 | 6.4美元 | 6.25美元 | 6.4美元 | $130.00 | $106.2千美元 | 286 | 175 |

| SHOP | 看漲 | 交易 | 看淡 | 10/18/24 | $4.8 | $4.65 | $4.65 | $80.00 | $93.0千 | 11.0K | 323 |

| SHOP | 看跌 | SWEEP | 看淡 | 01/17/25 | $5.8 | $5.75 | $5.75 | $80.00 | $82.2K | 3.4千 | 178 |

About Shopify

關於shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Shopify主要爲中小型企業提供電子商務平台。該公司共有兩個部分。訂閱解決方案部分允許Shopify商家在包括該公司網站、實體店、彈出式店鋪、亭子、社交網絡(Facebook)和亞馬遜等各種平台上進行電子商務。商家解決方案部分爲該平台提供了促進電子商務的附加產品,包括Shopify支付、Shopify運送和Shopify資本。

Current Position of Shopify

Shopify的現狀

- Trading volume stands at 2,237,558, with SHOP's price up by 1.51%, positioned at $83.83.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 22 days.

- 成交量爲2,237,558,SHOP的價格上漲了1.51%,定位在83.83美元。

- RSI指示股票可能已超買。

- 預計在22天內公佈收益報告。

Professional Analyst Ratings for Shopify

shopify的專業分析師評級爲:

5 market experts have recently issued ratings for this stock, with a consensus target price of $78.6.

有5位市場專家最近爲這隻股票發表了評級意見,達成共識目標價爲78.6美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $70. * In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $70. * Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $80.* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Shopify with a target price of $103. * An analyst from Barclays persists with their Equal-Weight rating on Shopify, maintaining a target price of $70.

Benzinga Edge的飛凡期權委員會在市場變動發生前發現潛在潛在市場走勢。查看大筆資金在您喜愛的股票上的倉位。單擊此處進行訪問。*在謹慎的舉措中,花旗集團的分析師將其評級下調至中立,設定目標價爲70美元。*反映擔憂的是,JMP證券的分析師將其評級下調至市場表現優越,並設定新目標價爲80美元。*在其評估中保持一致的是,花旗集團的分析師保持了shopify的買入評級,目標價爲103美元。*巴克萊銀行的分析師堅持對shopify的等權評級,維持目標價爲70美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

From the overall spotted trades, 5 are puts, for a total amount of $226,195 and 12, calls, for a total amount of $871,724.

From the overall spotted trades, 5 are puts, for a total amount of $226,195 and 12, calls, for a total amount of $871,724.