Cloudflare Options Trading: A Deep Dive Into Market Sentiment

Cloudflare Options Trading: A Deep Dive Into Market Sentiment

Investors with a lot of money to spend have taken a bullish stance on Cloudflare (NYSE:NET).

有大量資金的投資者對Cloudflare (紐交所:NET) 採取了看好的立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NET, it often means somebody knows something is about to happen.

無論是機構還是有錢人,我們不知道。但當有關NET發生如此重大的事情時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 8 options trades for Cloudflare.

今天,Benzinga的期權掃描器發現了8筆Cloudflare的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 75% bullish and 25%, bearish.

這些大手交易的整體情緒分爲75%的看漲和25%的看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $46,400, and 7, calls, for a total amount of $218,848.

在我們發現的所有期權中,有1筆看跌,總額爲46,400美元,還有7筆看漲,總額爲218,848美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $82.5 to $100.0 for Cloudflare during the past quarter.

通過分析這些合同的成交量和未平倉合約,似乎大玩家一直在關注Cloudflare過去一個季度的價格區間在$82.5到$100.0之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

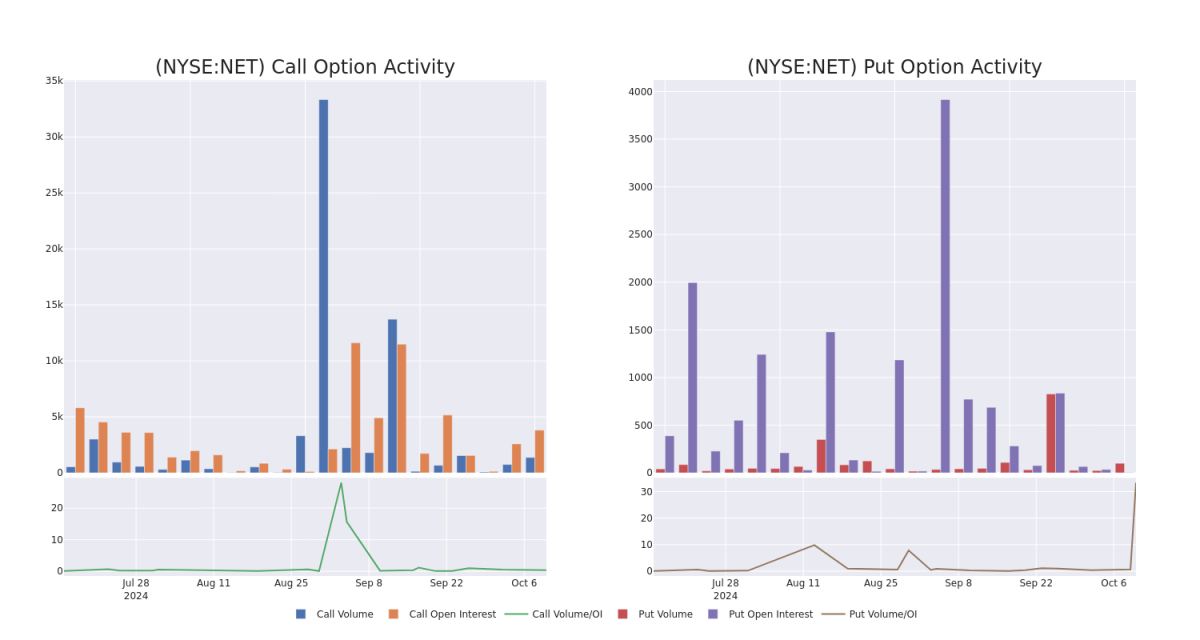

In today's trading context, the average open interest for options of Cloudflare stands at 635.5, with a total volume reaching 1,472.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cloudflare, situated within the strike price corridor from $82.5 to $100.0, throughout the last 30 days.

在今天的交易背景下,Cloudflare的期權平均未平倉合約數爲635.5,總成交量達到1,472.00。附表顯示了Cloudflare高價位交易的看漲和看跌期權成交量和未平倉合約的發展情況,這些交易位於$82.5到$100.0的行權價格走廊內,在過去30天的時間裏。

Cloudflare Option Volume And Open Interest Over Last 30 Days

Cloudflare期權成交量和未平倉合約在過去30天內的情況

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET | PUT | SWEEP | BEARISH | 11/01/24 | $2.49 | $2.06 | $2.32 | $86.00 | $46.3K | 3 | 100 |

| NET | CALL | TRADE | BULLISH | 10/11/24 | $4.45 | $3.75 | $4.35 | $85.00 | $43.4K | 1.2K | 355 |

| NET | CALL | SWEEP | BULLISH | 10/11/24 | $3.4 | $2.76 | $3.4 | $85.00 | $34.6K | 1.2K | 150 |

| NET | CALL | TRADE | BULLISH | 01/17/25 | $10.7 | $10.05 | $10.7 | $82.50 | $32.1K | 833 | 30 |

| NET | CALL | TRADE | BULLISH | 12/20/24 | $3.6 | $3.45 | $3.6 | $100.00 | $29.8K | 1.5K | 106 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET | 看跌 | SWEEP | 看淡 | 11/01/24 | $2.49 | $2.06 | $2.32 | $86.00 | $46.3K | 3 | 100 |

| NET | 看漲 | 交易 | 看好 | 10/11/24 | $4.45 | $3.75 | $4.35 | $85.00 | $43.4K | 1.2K | 355 |

| NET | 看漲 | SWEEP | 看好 | 10/11/24 | $3.4 | $2.76 | $3.4 | $85.00 | $34.6K | 1.2K | 150 |

| NET | 看漲 | 交易 | 看好 | 01/17/25 | $10.7 | $10.05 | $10.7 | $82.50 | 32,100美元 | 833 | 30 |

| NET | 看漲 | 交易 | 看好 | 12/20/24 | $3.6 | $3.45 | $3.6 | $100.00。 | $29.8K | 1.5K | 106 |

About Cloudflare

關於Cloudflare

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

Cloudflare是一家總部位於加利福尼亞州舊金山的軟件公司,通過利用分佈式、無服務器內容交付網絡或CDN提供安全性和網絡性能服務。該公司的邊緣計算平台Workers利用該網絡,爲客戶提供在不維護服務器的情況下部署和執行代碼的能力。

Following our analysis of the options activities associated with Cloudflare, we pivot to a closer look at the company's own performance.

在分析與Cloudflare有關的期權交易活動之後,我們轉而更近距離地關注該公司自身的表現。

Present Market Standing of Cloudflare

Cloudflare的現市場地位

- With a volume of 50,090, the price of NET is down -0.19% at $84.79.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 28 days.

- 成交量爲50,090,NEt的價格下跌了-0.19%,爲84.79美元。

- RSI指標暗示該股票可能要超買了。

- 下一個季度收益預計在28天內公佈。

Professional Analyst Ratings for Cloudflare

Cloudflare的專業分析師評級

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $65.0.

在過去30天裏,共有1位專業分析師對這隻股票發表了看法,設定了65.0美元的平均目標價格。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Exane BNP Paribas downgraded its action to Underperform with a price target of $65.

20年期權交易老手透露了他的一行圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取訪問。* 來自Exane BNP Paribas的分析師將其評級調降至表現不佳,並設定了65美元的價格目標。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cloudflare options trades with real-time alerts from Benzinga Pro.

期權交易存在更高風險和潛在回報。精明的交易者通過持續教育自己、調整策略、監控多個因子並密切關注市場走勢來管理這些風險。通過Benzinga Pro提供的實時警報,及時了解最新的Cloudflare期權交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NET, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NET, it often means somebody knows something is about to happen.