Looking At American Express's Recent Unusual Options Activity

Looking At American Express's Recent Unusual Options Activity

High-rolling investors have positioned themselves bearish on American Express (NYSE:AXP), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in AXP often signals that someone has privileged information.

高危投資者偏向看淡美國運通(紐交所: AXP),這對零售交易者來說很重要。\ 通過Benzinga對公開可獲取的期權數據的跟蹤,我們今天注意到了這一活動。 這些投資者的身份不確定,但AXP股票的如此重大變動通常表明某人掌握了內幕信息。

Today, Benzinga's options scanner spotted 8 options trades for American Express. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了美國運通的8筆期權交易。 這並不是一個典型的模式。

The sentiment among these major traders is split, with 25% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $29,062, and 7 calls, totaling $424,370.

這些主要交易者中的情緒分化,25%看好,50%看淡。 在我們識別出的所有期權中,有一個看跌,金額爲29062美元,7個看漲,總計424370美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $290.0 for American Express, spanning the last three months.

經過評估交易量和未平倉合約後,明顯看出主要市場操縱者着重於美國運通的股價區間在140.0美元至290.0美元之間,跨越過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

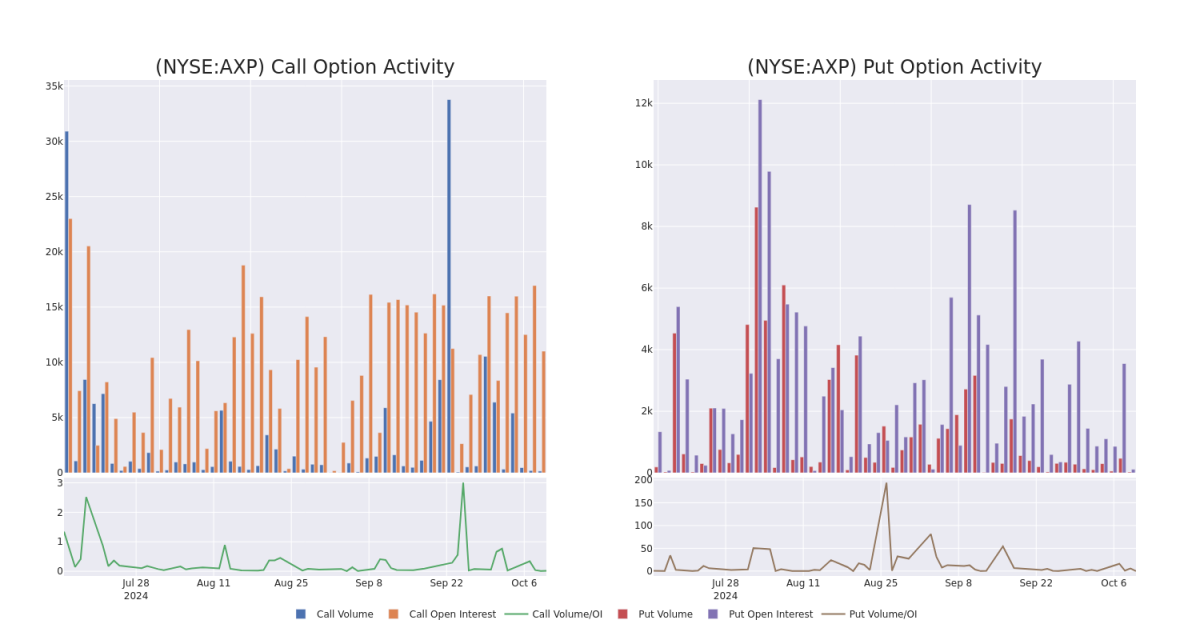

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for American Express's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across American Express's significant trades, within a strike price range of $140.0 to $290.0, over the past month.

審視成交量和未平倉合約能夠提供股票研究的關鍵見解。 這些信息對於衡量特定行權價上的美國運通期權的流動性和興趣水平至關重要。 在下面,我們展示了過去一個月內在140.0美元至290.0美元的行權價範圍內,關於美國運通重要交易的成交量和未平倉合約趨勢快照。

American Express Option Activity Analysis: Last 30 Days

美國運通期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | CALL | SWEEP | BEARISH | 01/16/26 | $141.15 | $139.2 | $139.2 | $140.00 | $125.2K | 147 | 10 |

| AXP | CALL | TRADE | NEUTRAL | 03/21/25 | $77.35 | $76.4 | $76.88 | $200.00 | $76.8K | 176 | 10 |

| AXP | CALL | SWEEP | BULLISH | 01/17/25 | $8.95 | $8.85 | $8.95 | $290.00 | $53.7K | 1.3K | 88 |

| AXP | CALL | SWEEP | BEARISH | 01/16/26 | $56.95 | $56.9 | $56.9 | $240.00 | $51.2K | 7.7K | 53 |

| AXP | CALL | SWEEP | BULLISH | 10/18/24 | $23.25 | $23.2 | $23.25 | $250.00 | $41.8K | 1.4K | 10 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | 看漲 | SWEEP | 看淡 | 01/16/26 | $141.15 | $139.2 | $139.2 | $140.00 | $125.2K | 147 | 10 |

| AXP | 看漲 | 交易 | 中立 | 03/21/25 | $77.35 | $76.4 | $76.88 | 。 | $76.8K | 176 | 10 |

| AXP | 看漲 | SWEEP | 看好 | 01/17/25 | $8.95 | $8.85 | $8.95 | $290.00 | $53.7K | 1.3K | 88 |

| AXP | 看漲 | SWEEP | 看淡 | 01/16/26 | $56.95 | $56.9 | $56.9 | $240.00 | $51.2K | 7.7K | 53 |

| AXP | 看漲 | SWEEP | 看好 | 10/18/24 | 23.25美元 | $23.2 | 23.25美元 | $250.00 | $41.8K | 1.4千 | 10 |

About American Express

關於美國運通

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

美國運通是一家全球性的金融機構,業務遍及約130個國家,提供針對消費者和企業的信用和借記卡支付產品,並運營高度盈利的商戶支付網絡。自2018年以來,它一直在三個業務領域運營:全球消費者服務、全球商業服務和全球商戶和網絡服務。除支付產品外,該公司的商業業務還提供費用管理工具、諮詢服務和商業貸款。

Having examined the options trading patterns of American Express, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過分析,我們現在將我們的注意力直接轉向該公司。這種轉變允許我們深入探討其當前的市場地位和表現。

Present Market Standing of American Express

美國運通的當前市場狀況

- Currently trading with a volume of 1,202,163, the AXP's price is down by -0.3%, now at $270.61.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 8 days.

- 以成交量爲1,202,163進行交易,AXP的價格下跌了-0.3%,目前爲$270.61。

- RSI讀數表明該股目前可能接近超買水平。

- 預計將在8天內發佈收益報告。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $290.0 for American Express, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $290.0 for American Express, spanning the last three months.