Market Mover | PBBANK's Share Price Fell by 4.38% to RM4.37 after Trading Resumed

Market Mover | PBBANK's Share Price Fell by 4.38% to RM4.37 after Trading Resumed

October 11, 2024 - $PBBANK (1295.MY)$ shares fell by 4.38% to RM4.37 on Friday, following the resumption of trading.

2024年10月11日 - $PBBANK (1295.MY)$ 股價週五下跌4.38%,至RM4.37,在交易恢復後。

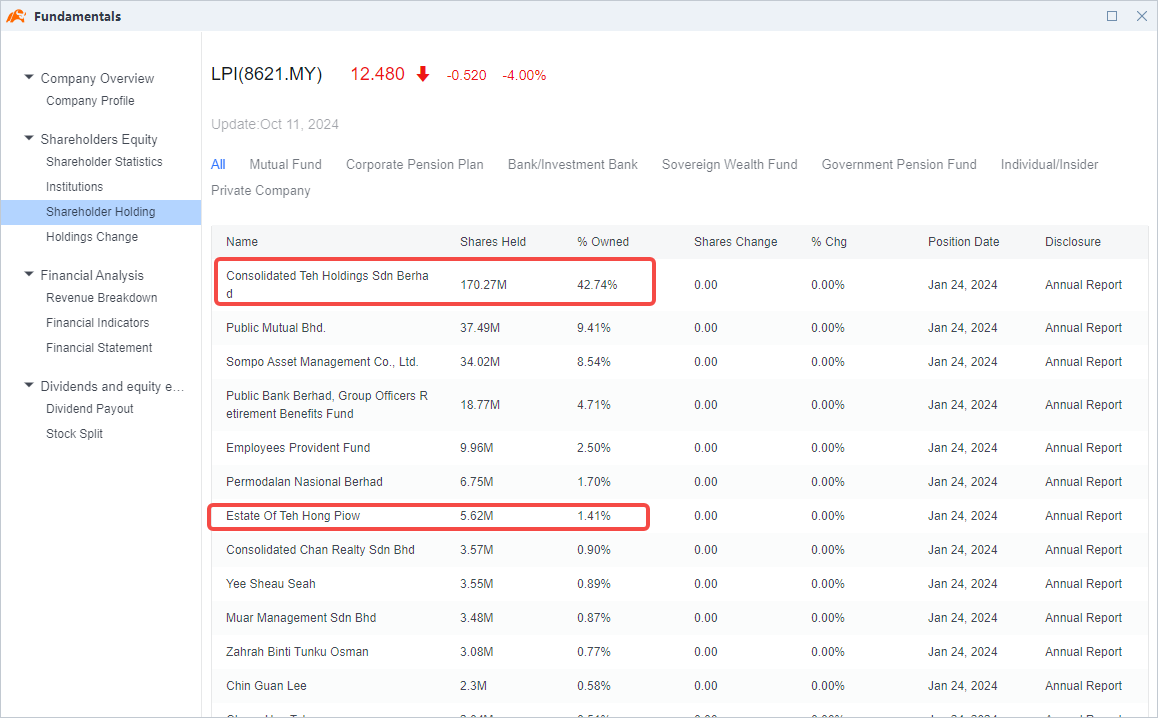

$PBBANK (1295.MY)$, Malaysia's third-largest bank by assets, is set to acquire a 44.15% stake in $LPI (8621.MY)$ for RM1.72 billion in cash. This purchase is from the family of the late Tan Sri Teh Hong Piow. Teh's estate includes a 1.41% direct stake and another 42.74% through Consolidated Teh Holdings Sdn Bhd. Following the acquisition, Public Bank will extend a mandatory general offer for the remaining shares at RM9.80 per share,which is 25% cheaper than the market price, aiming to maintain LPI's listing on Bursa Malaysia's Main Market. $LPI (8621.MY)$ shares also fell by 4% to RM12.48 today.

$PBBANK (1295.MY)$馬來西亞第三大銀行的資產,打算收購44.15%的股份$LPI (8621.MY)$ 以17.2億令吉現金收購。這個交易是從已故丹斯里鄭東標家族手中進行的。鄭氏的資產包括直接持有的1.41%股份和通過Consolidated Teh Holdings Sdn Bhd持有的42.74%股份。收購後,Public Bank將以每股9.80令吉的價格發出強制性的要約,比市場價格便宜25%,旨在維持$LPI(8621.MY)$在馬來西亞主要市場的上市地位。 $LPI (8621.MY)$ 今天股價也下跌了4%,跌至RM12.48。

Meanwhile, it was announced that the Teh family will gradually reduce its stake in Public Bank to 10% within five years to comply with national regulations. According to the annual report of Public Bank, the Teh family currently holds more than 22% of the shares. The shares they plan to sell are worth more than RM10 billion.

與此同時,據公佈,鄭氏家族將在五年內逐漸減持對大衆銀行的股份至10%,以符合國家法規要求。根據大衆銀行的年度報告,鄭氏家族目前持有超過22%的股份。他們計劃出售的股份價值超過100億令吉。