BofA Securities analyst Joshua Shanker maintains $Hartford Financial Services (HIG.US)$ with a hold rating, and adjusts the target price from $121 to $124.

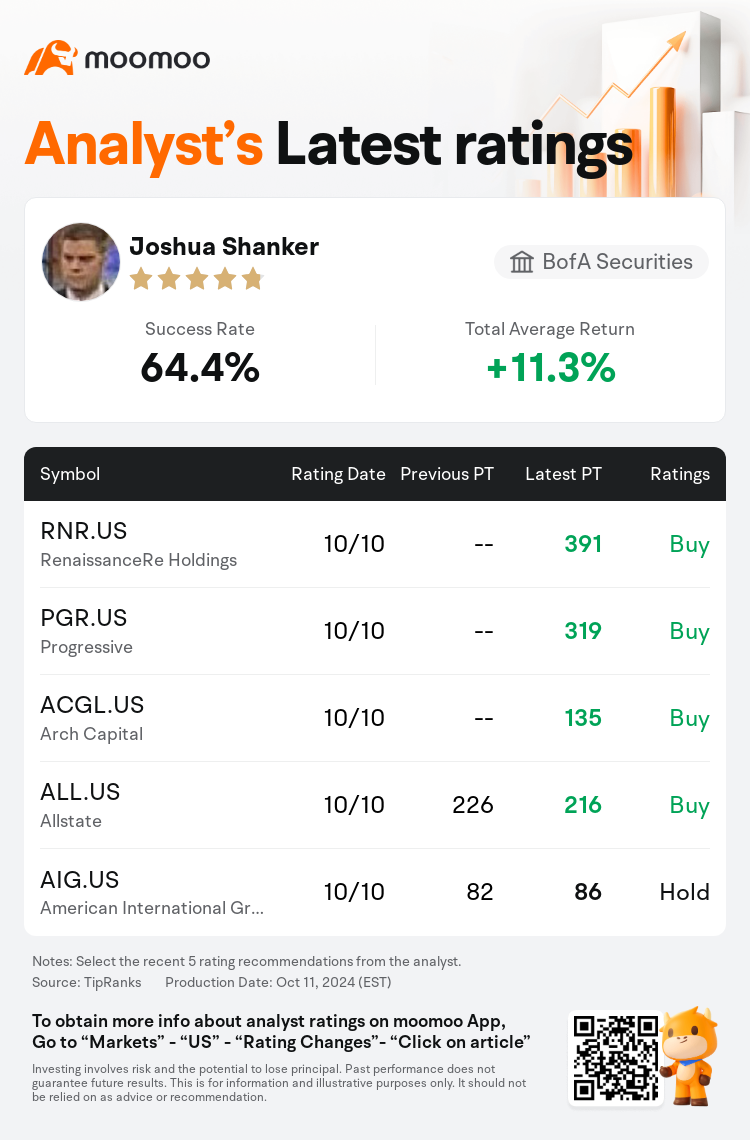

According to TipRanks data, the analyst has a success rate of 64.4% and a total average return of 11.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Hartford Financial Services (HIG.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Hartford Financial Services (HIG.US)$'s main analysts recently are as follows:

The third quarter was marked by numerous global catastrophe events, but it is anticipated that the impact of these incidents will be 'manageable' for property and casualty insurers. Analysts forecast that the third quarter catastrophe losses will be absorbed without significant distress. Additionally, provisional losses from Hurricane Milton have been incorporated into the fourth quarter models, though there is still some uncertainty given the recent landfall of the storm. Adjustments within the insurance group are reflective of the events of the quarter and the alterations in P/E multiples.

The firm's fundamental outlook for the property and casualty sector remains positive going into the third quarter reports. Despite this, there is a cautious stance on stocks due to already high expectations, optimistic investor sentiment, and current valuations. Key advantages include persistent firm pricing and the sector's defensive risk profile. However, there are optimistic expectations regarding margins for underwriters and sales growth for brokers.

The third-quarter outcomes, especially for reinsurers, might be outshone by the recent Hurricane Milton. There is an expectation of improvement in the Personal sector due to bettering margins and an increase in policies-in-force. Anticipations for the third quarter include catastrophe losses that are below the five-year seasonal norm but still considerably higher than those in the same quarter of the previous year, which could potentially bring about negative implications for primary insurers in the Property & Casualty Insurance/Insurtech sector.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美銀證券分析師Joshua Shanker維持$哈特福德金融 (HIG.US)$持有評級,並將目標價從121美元上調至124美元。

根據TipRanks數據顯示,該分析師近一年總勝率為64.4%,總平均回報率為11.3%。

此外,綜合報道,$哈特福德金融 (HIG.US)$近期主要分析師觀點如下:

此外,綜合報道,$哈特福德金融 (HIG.US)$近期主要分析師觀點如下:

第三季度發生了許多全球災難事件,但預計這些事件的影響對財產和意外傷害保險公司來說將是 「可控的」。分析師預測,第三季度的災難損失將在不造成重大損失的情況下被吸收。此外,颶風米爾頓造成的臨時損失已納入第四季度的模型,儘管鑑於該風暴最近登陸,仍存在一些不確定性。保險集團內部的調整反映了本季度的事件和市盈倍數的變化。

進入第三季度報告,該公司財產和意外傷害行業的基本前景仍然樂觀。儘管如此,由於本已很高的預期、樂觀的投資者情緒和當前的估值,人們對股票持謹慎立場。主要優勢包括持續的公司定價和該行業的防禦性風險狀況。但是,人們對承銷商的利潤率和經紀商的銷售增長抱有樂觀的預期。

最近的米爾頓颶風可能會超過第三季度的業績,尤其是再保險公司的業績。由於利潤率的提高和現行政策的增加,預計個人部門將有所改善。對第三季度的預期包括災難損失,這些損失低於五年的季節性標準,但仍大大高於去年同期的災難損失,這可能會對財產和意外傷害保險/保險科技領域的主要保險公司帶來負面影響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$哈特福德金融 (HIG.US)$近期主要分析師觀點如下:

此外,綜合報道,$哈特福德金融 (HIG.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of