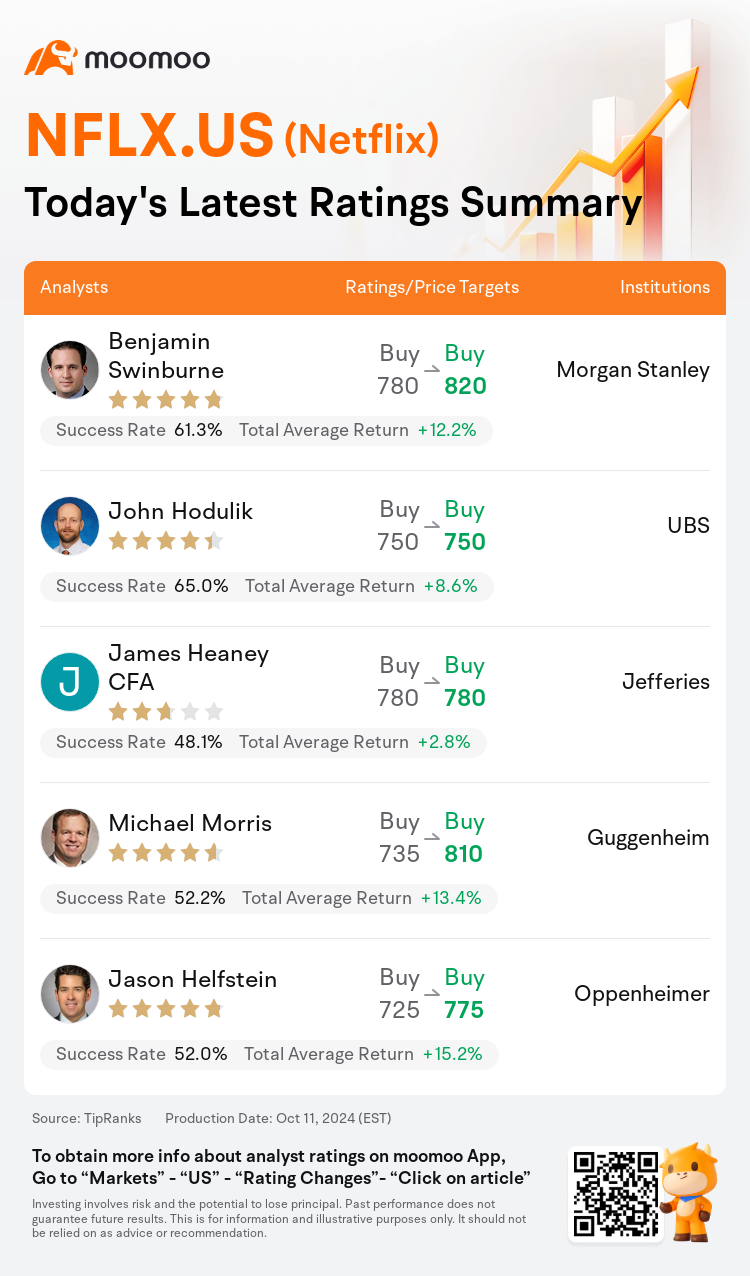

On Oct 11, major Wall Street analysts update their ratings for $Netflix (NFLX.US)$, with price targets ranging from $750 to $820.

Morgan Stanley analyst Benjamin Swinburne maintains with a buy rating, and adjusts the target price from $780 to $820.

UBS analyst John Hodulik maintains with a buy rating, and maintains the target price at $750.

Jefferies analyst James Heaney CFA maintains with a buy rating, and maintains the target price at $780.

Jefferies analyst James Heaney CFA maintains with a buy rating, and maintains the target price at $780.

Guggenheim analyst Michael Morris maintains with a buy rating, and adjusts the target price from $735 to $810.

Oppenheimer analyst Jason Helfstein maintains with a buy rating, and adjusts the target price from $725 to $775.

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

The perspective that Hollywood's 'new normal' is advantageous for Netflix is highlighted, with a reduction in the intensity of content competition and a renewed willingness among media company studios to consider licensing. The introduction of an ad-supported tier is seen as a potential avenue for Netflix to further maximize revenue, potentially expanding the total addressable market rather than just enhancing average revenue per member. Projections for subscriber growth remain robust, with an anticipation of conservative net additions in the third quarter, and even stronger growth expected in the fourth quarter.

Netflix is still seen as an attractive growth narrative with considerable potential for revenue, earnings, and free cash flow expansion in the coming years. Despite this, the current valuation of the stock suggests limited prospects for further multiple expansion, with a possibility of contraction as the company's growth is expected to slow by 2025 due to the diminishing temporary benefits from paid sharing. It's anticipated that Netflix experienced another surge in subscriber growth due to paid sharing in Q3, but the advantage of this temporary boost is likely tapering off.

Netflix shares have experienced a significant rise, marking a 56% increase since the beginning of the year. Analysts observe that the company still harbors considerable potential for further global membership growth, an acceleration in advertising revenue, and improvements in operating leverage and margins, all of which are anticipated to contribute to attractive returns for shareholders in the upcoming year. The sentiment surrounding the upcoming Q3 earnings report is largely dependent on membership trends. Forecasts for Q3 membership growth have been revised upwards, with expectations now surpassing the consensus estimates prevalent among sell-side analysts.

With the stock up significantly post-Q2 outcomes due to optimistic third-party subscriber data, it's anticipated that Netflix will have to deliver robust results and future projections, along with a potential announcement of a price hike. Previously, Netflix has adjusted the price for its Premium service tier in various markets. It is now expected that there might be an increase in the price for the Premium tier in additional regions, and perhaps more notably, a significant rise in the Standard plan's cost. Since the last price change for the Standard plan in early 2022, there has been a reduction in the price difference compared to competitors. Additionally, compelling viewership figures for Q3 and an attractive lineup of content for Q4, including sports offerings, are likely to contribute to a decreased risk of subscriber turnover.

Here are the latest investment ratings and price targets for $Netflix (NFLX.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

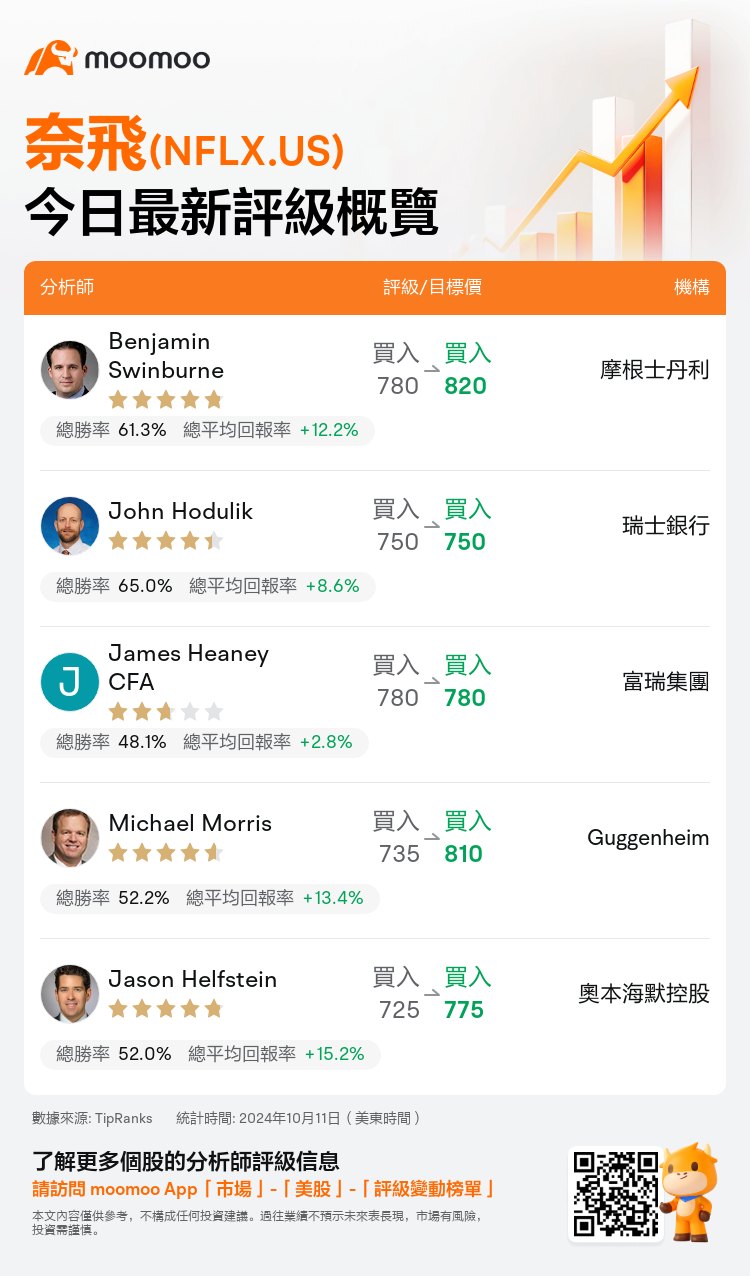

美東時間10月11日,多家華爾街大行更新了$奈飛 (NFLX.US)$的評級,目標價介於750美元至820美元。

摩根士丹利分析師Benjamin Swinburne維持買入評級,並將目標價從780美元上調至820美元。

瑞士銀行分析師John Hodulik維持買入評級,維持目標價750美元。

富瑞集團分析師James Heaney CFA維持買入評級,維持目標價780美元。

富瑞集團分析師James Heaney CFA維持買入評級,維持目標價780美元。

Guggenheim分析師Michael Morris維持買入評級,並將目標價從735美元上調至810美元。

奧本海默控股分析師Jason Helfstein維持買入評級,並將目標價從725美元上調至775美元。

此外,綜合報道,$奈飛 (NFLX.US)$近期主要分析師觀點如下:

突出了好萊塢「新常態」對奈飛的有利因素,內容競爭強度降低,傳媒公司製片廠重新考慮授權的意願。引入廣告支持層被視爲奈飛進一步最大化營業收入的潛在途徑,可能擴大總可尋址市場,而不僅僅是增強每位會員的平均營收。對訂閱者增長的預測仍然強勁,預計第三季度淨增長保守,第四季度的增長預計更爲強勁。

在未來幾年,奈飛仍被視爲具有可觀營收、收益和自由現金流擴張潛力的有吸引力增長敘事。儘管如此,目前股票的估值顯示進一步多重擴張的前景有限,由於預計公司的增長到2025年將緩慢,因爲由於付費共享帶來的暫時收益正在減少而可能出現萎縮。預計奈飛由於第三季度的付費共享再次經歷了訂閱者增長激增,但這種暫時提升的優勢可能正在逐漸減弱。

奈飛股價已經顯著上漲,自年初以來增長了56%。分析師觀察到,公司仍具有進一步全球會員增長、廣告收入加速增長以及運營槓桿和利潤率改善的潛力,所有這些預計都將有助於在未來一年對股東產生有吸引力的回報。圍繞第三季度盈利報告的情緒在很大程度上取決於會員趨勢。第三季度會員增長預測已被上調,預期現在超過了賣方分析師普遍預期的共識。

由於樂觀的第三方訂閱者數據,股價在第二季度業績後顯著上升,預計奈飛將不得不提供強勁的業績和未來預測,以及可能宣佈價格上漲。此前,奈飛在各個市場調整了其高級服務層的價格。現在預計高級層服務的價格可能會在其他地區上漲,或者更重要的是,標準計劃的成本將顯著上漲。自2022年初標準計劃價格調整以來,與競爭對手相比,價格差異已經減少。此外,第三季度的吸引力播放量和第四季度的內容吸引力,包括體育節目,可能有助於減少訂閱者流失的風險。

以下爲今日5位分析師對$奈飛 (NFLX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師James Heaney CFA維持買入評級,維持目標價780美元。

富瑞集團分析師James Heaney CFA維持買入評級,維持目標價780美元。

Jefferies analyst James Heaney CFA maintains with a buy rating, and maintains the target price at $780.

Jefferies analyst James Heaney CFA maintains with a buy rating, and maintains the target price at $780.