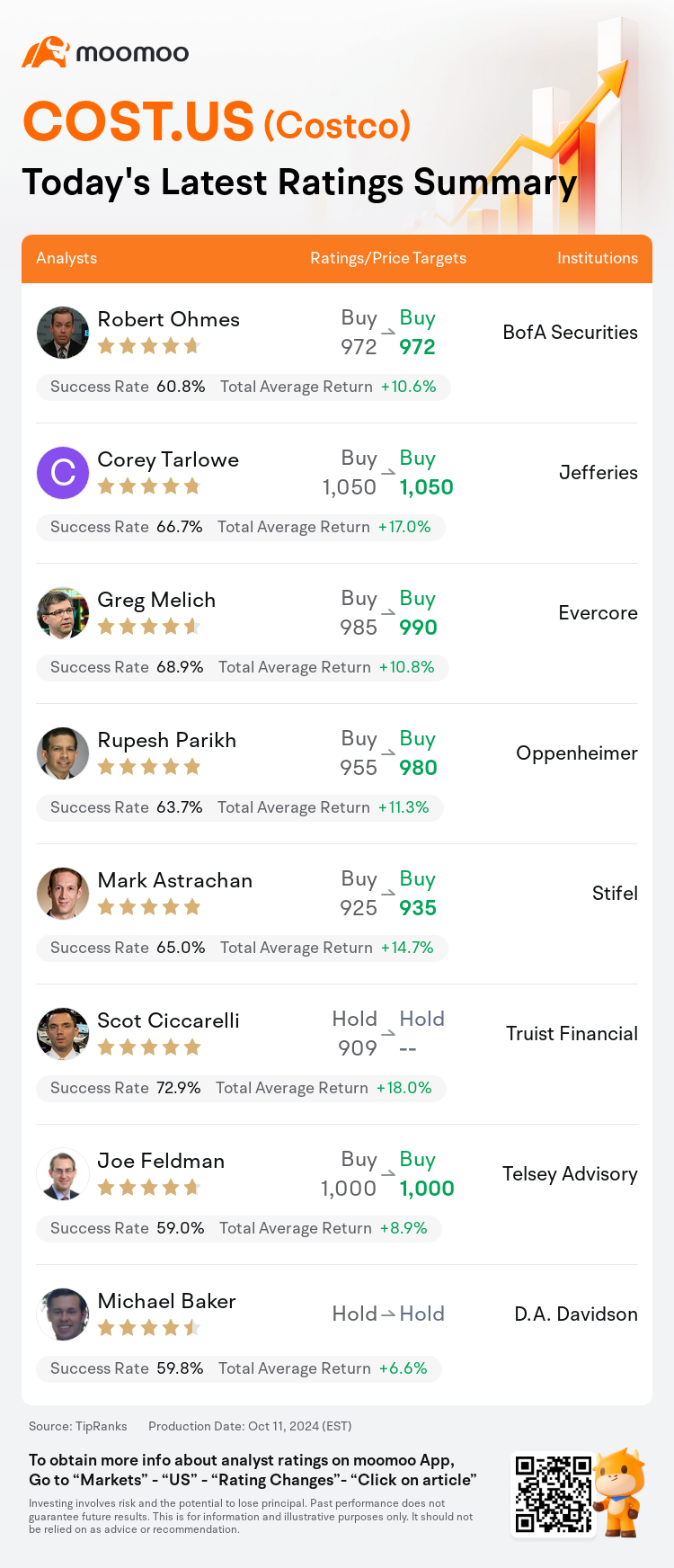

On Oct 11, major Wall Street analysts update their ratings for $Costco (COST.US)$, with price targets ranging from $935 to $1,050.

BofA Securities analyst Robert Ohmes maintains with a buy rating, and maintains the target price at $972.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $1,050.

Evercore analyst Greg Melich maintains with a buy rating, and adjusts the target price from $985 to $990.

Evercore analyst Greg Melich maintains with a buy rating, and adjusts the target price from $985 to $990.

Oppenheimer analyst Rupesh Parikh maintains with a buy rating, and adjusts the target price from $955 to $980.

Stifel analyst Mark Astrachan maintains with a buy rating, and adjusts the target price from $925 to $935.

Furthermore, according to the comprehensive report, the opinions of $Costco (COST.US)$'s main analysts recently are as follows:

Costco's 9% U.S. and Global Core comp growth in September demonstrates the strong attraction of its members to the company's exceptional value, merchandise variety, and multichannel convenience. Even when considering adjustments for external factors such as Hurricane Helene and port strikes, which contributed approximately 200 basis points to U.S. growth, the core growth figure of over 7% significantly outpaces the broader U.S. retail sales expansion rate.

Following Costco's announcement of a September adjusted U.S. comp increase of 9.3%, which was influenced by approximately 2 percentage points from unusual consumer behavior due to port strikes and Hurricane Helene, the company's performance aligns with positive observations from store assessments. The continued strength in non-food categories, especially jewelry and gift cards, which saw low teen increases, reaffirms the expectation that robust top-line growth will continue through the remainder of the year. This outlook is supported by Costco's outstanding merchandising capabilities and its compelling value offering. Additionally, there is an anticipation of a potential rise in memberships in the near term as a result of more rigorous checks of membership cards.

Costco reported robust total and U.S. core September comparable sales growth, surpassing consensus estimates. This performance includes a notable boost from circumstances such as Hurricane Helene and port strikes. Furthermore, traffic growth remained strong both globally and in the U.S., suggesting that Costco's value proposition is effectively attracting customers, leading to increased shopping frequency and market share expansion.

Here are the latest investment ratings and price targets for $Costco (COST.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

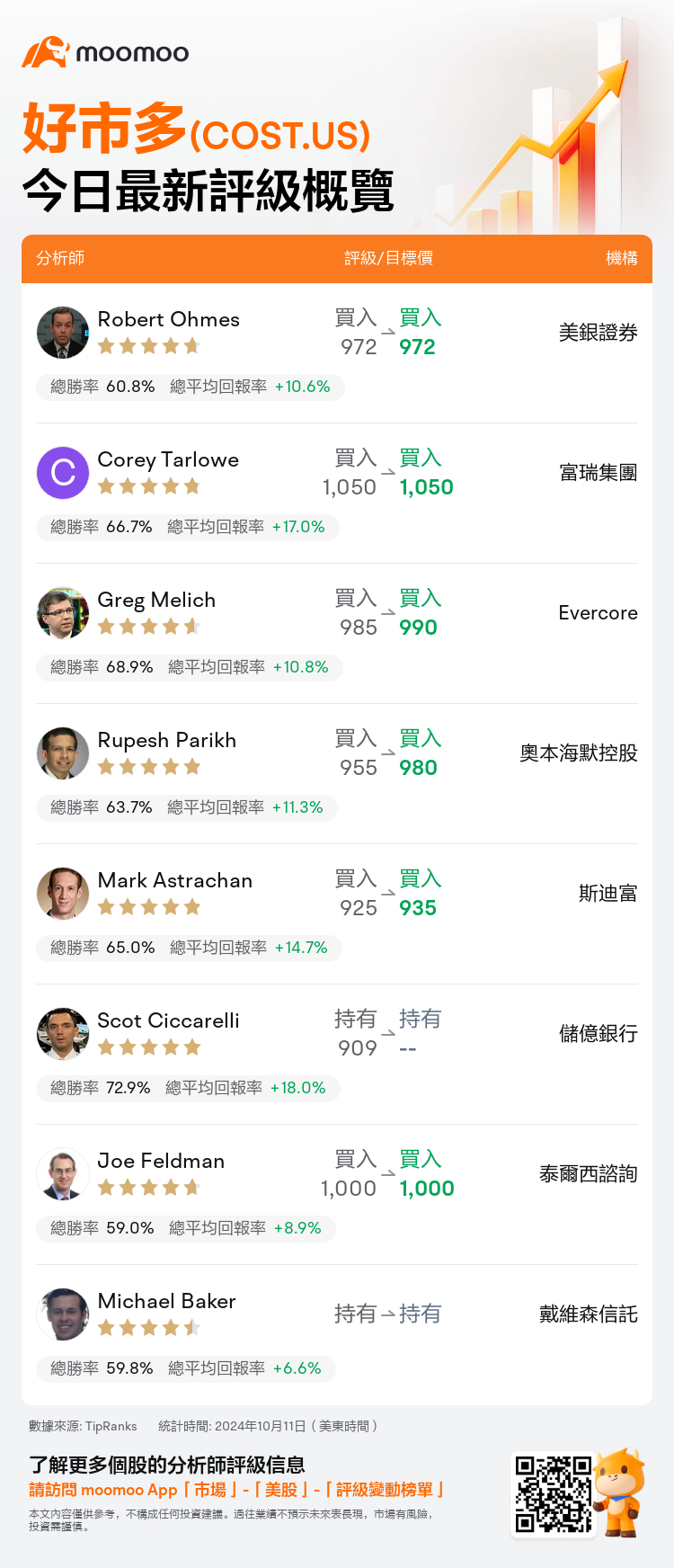

美東時間10月11日,多家華爾街大行更新了$好市多 (COST.US)$的評級,目標價介於935美元至1,050美元。

美銀證券分析師Robert Ohmes維持買入評級,維持目標價972美元。

富瑞集團分析師Corey Tarlowe維持買入評級,維持目標價1,050美元。

Evercore分析師Greg Melich維持買入評級,並將目標價從985美元上調至990美元。

Evercore分析師Greg Melich維持買入評級,並將目標價從985美元上調至990美元。

奧本海默控股分析師Rupesh Parikh維持買入評級,並將目標價從955美元上調至980美元。

斯迪富分析師Mark Astrachan維持買入評級,並將目標價從925美元上調至935美元。

此外,綜合報道,$好市多 (COST.US)$近期主要分析師觀點如下:

好市多在九月份取得的美國和全球核心環比增長達到9%,彰顯了其會員對公司卓越價值、商品種類和多渠道便利的強大吸引力。即使考慮到颶風海倫和港口罷工等外部因素所帶來的調整,這些因素對美國增長的貢獻約爲200個點子,核心增長率超過7%的數據明顯高於更廣泛的美國零售銷售擴張率。

繼好市多公佈九月美國調整後的環比增長率達到9.3%之後,由於港口罷工和颶風海倫等飛凡消費者行爲的影響約有2個百分點,公司表現與店鋪評估的積極觀察相一致。在非食品類別持續強勁增長的情況下,尤其是珠寶和禮品卡,增長率較低成倍增長,進一步證實了對強勁頂線增長將會持續至年底的預期。這一展望得到了好市多出色的商品銷售能力和極具吸引力的價值優惠的支持。此外,預計由於會員卡的更加嚴格檢查,短期內有望出現會員數的潛在增長。

好市多報告顯示,總體和美國核心九月可比銷售額增長強勁,超過了共識預期。這一表現包括來自颶風海倫和港口罷工等情況的明顯提振。此外,全球和美國的客流增長依然強勁,表明好市多的價值主張有效吸引了客戶,從而提高了購物頻率和市場份額擴張。

以下爲今日8位分析師對$好市多 (COST.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師Greg Melich維持買入評級,並將目標價從985美元上調至990美元。

Evercore分析師Greg Melich維持買入評級,並將目標價從985美元上調至990美元。

Evercore analyst Greg Melich maintains with a buy rating, and adjusts the target price from $985 to $990.

Evercore analyst Greg Melich maintains with a buy rating, and adjusts the target price from $985 to $990.