Gold Recovers Amid Mixed US Economic Indicators

Gold Recovers Amid Mixed US Economic Indicators

By RoboForex Analytical Department

由RoboForex分析部門提供

Gold prices recovered, reaching 2,644.00 USD per troy ounce on Friday, as investors navigated mixed signals from recent US economic data. The resilience in September's employment market introduced some hesitations regarding the Federal Reserve's pace of monetary easing, as the robust job data might warrant a less aggressive approach to rate cuts.

黃金價格回升,週五達到每金衡盎司2,644.00美元,投資者在從最近的美國經濟數據中獲取混合信號時躊躇。9月就業市場的韌性介入對聯儲局貨幣寬鬆步伐產生了一些猶豫,因爲強勁的就業數據可能要求對減息採取更爲謹慎的態度。

Recent inflation reports further complicated the market. While the overall consumer price index slowed, it was less than anticipated, and core inflation, which excludes volatile food and energy prices, actually increased. These developments have hindered progress in easing price pressures, leading to adjustments in expectations for US monetary policy.

最近的通貨膨脹報告進一步加劇了市場的複雜性。儘管總體消費者價格指數放緩,但不及預期,並且除了食品和能源價格波動的核心通脹實際上有所增加。這些發展阻礙了緩解價格壓力的進展,導致對美國貨幣政策預期的調整。

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed's November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.

最初有關於大規模減息50個點子的推測;然而,鑑於當前的經濟形勢,更加保守的25個點子的減息在聯儲局11月會議上現在被認爲更有可能。根據市場預測,這種情形的概率爲86%。對於黃金來說,不產生票息的展望令美國聯邦公開市場委員會(FOMC)減息仍然是一個積極的催化劑,尤其是在債券和其他計息資產在利率環境更加不具競爭力時。

Despite the recent uptick, gold is on track to register its second consecutive weekly decline.

儘管最近有所上漲,但黃金正朝着登記第二個連續周度下跌的方向前進。

Technical Analysis Of Gold

黃金的技術面分析

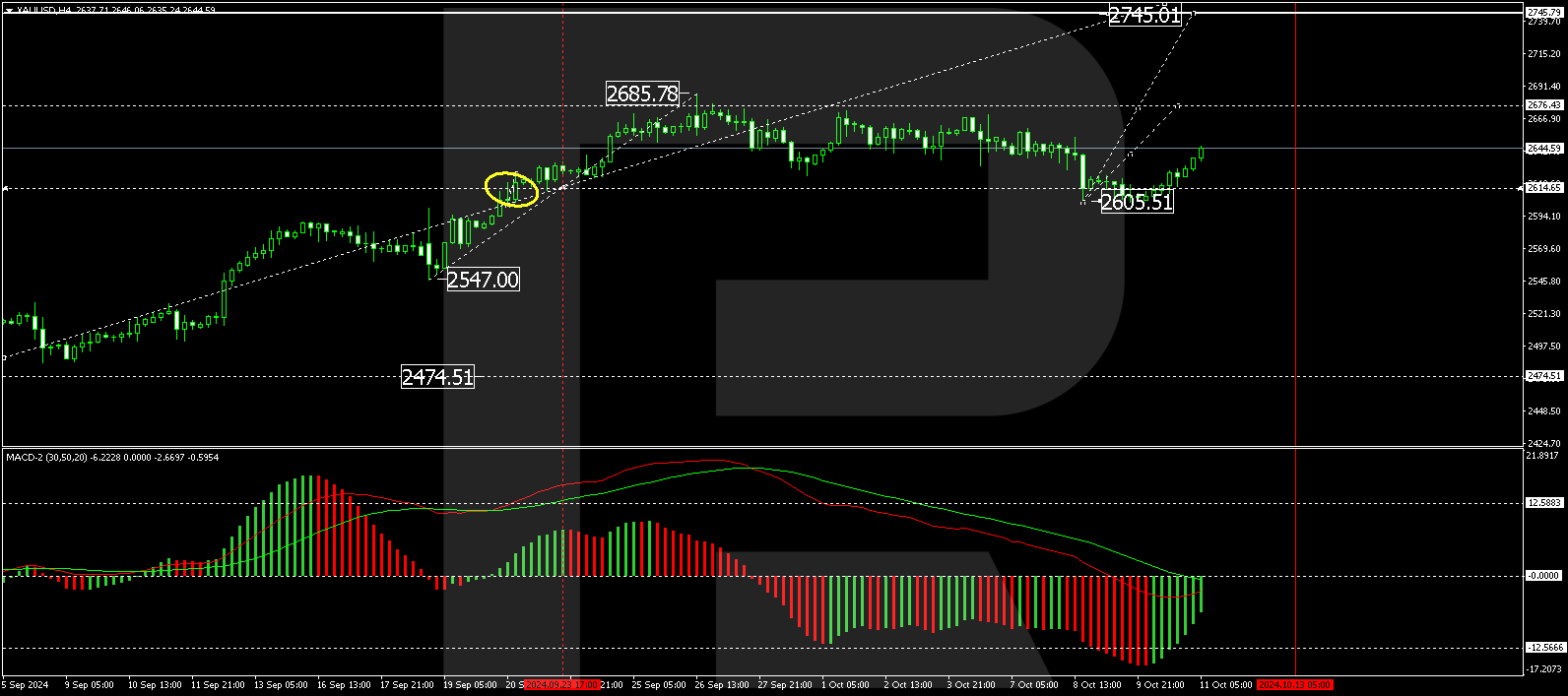

The gold market experienced a correction down to 2,605.00 but has since shown signs of resurgence. The current technical setup suggests a potential continuation towards 2,676.50, which would mark the next target in this upward trend. Following the achievement of this level, a correction back to 2,645.00 may occur. This bullish scenario is supported by the MACD indicator, which, although below zero, is gearing up for a potential rise, indicating strengthening momentum.

黃金市場經歷了一次回調至2,605.00,但此後顯示出回升跡象。當前的技術設置暗示可能會持續走向2,676.50,這將標誌着這一上升趨勢中的下一個目標。在達到此水平後,可能會出現回調至2,645.00。這種看好的情景得到了MACD指標的支撐,儘管位於零以下,正在爲潛在上漲作準備,表明增強的動量。

On the hourly chart, gold has formed a consolidation range above 2,605.00 and has broken upwards. It nearly reached the target of 2,644.00. Today, we might see the formation of a narrow consolidation range, and if a downward exit occurs, a corrective move to 2,625.00 could be expected. Following this correction, the market may gear up for another rise towards 2,662.00. This forecast is technically backed by the Stochastic oscillator, with its signal line currently above 80 but poised to start a decline, suggesting a short-term pullback before further gains.

在小時圖上,黃金形成了一個在2,605.00以上的盤整區間並向上突破。它幾乎達到了2,644.00的目標。今天,我們可能會看到一個狹窄的整理區間的形成,如果出現向下的突破,則可能預期一次向2,625.00的修正行情。在這次調整之後,市場可能會爲再次上漲至2,662.00做準備。這一預測在技術上得到了隨機振盪器的支持,其信號線目前位於80以上,但隨時準備開始下降,表明短期回撤之前的進一步漲勢。

Disclaimer

免責聲明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析僅代表作者個人觀點,不得視爲交易建議。RoboForex不承擔基於本文所含交易建議和評論所產生的任何交易結果的責任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文來自非報酬的外部投稿人。它不代表Benzinga的報道,並且沒有因爲內容或準確性而被編輯。

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed's November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed's November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.