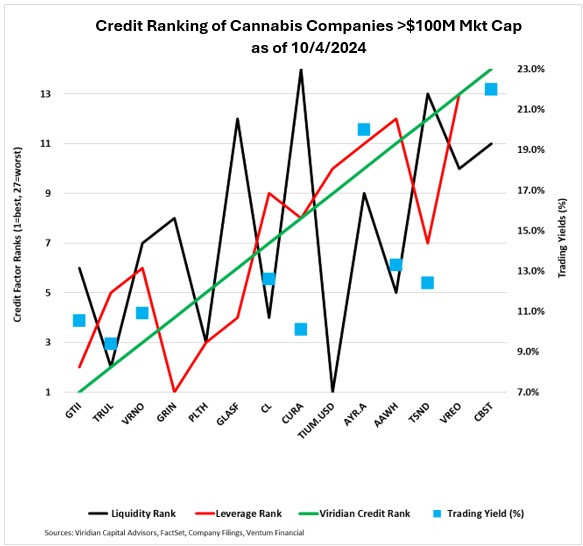

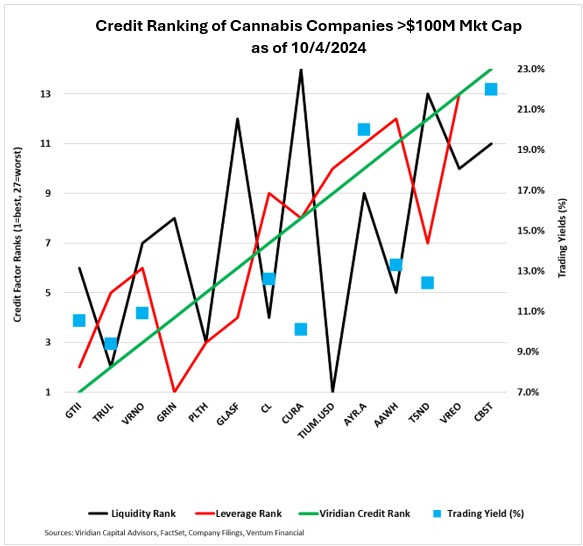

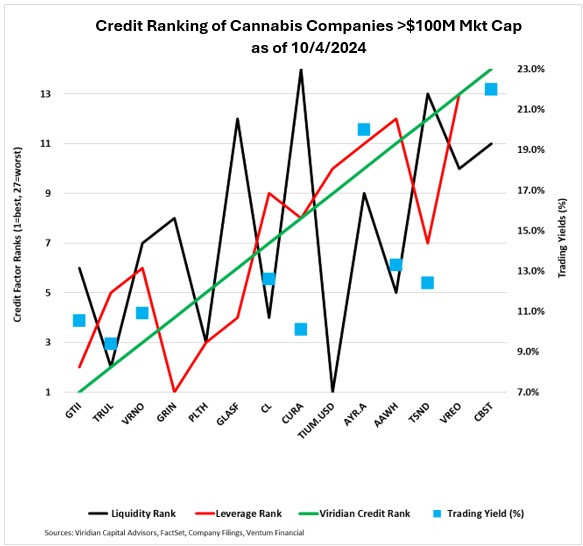

As Florida's pivotal vote on recreational cannabis looms, investors are eyeing key opportunities in the market. The Viridian Credit Tracker ranks AYR Wellness (OTC:AYRWF) as a strong buy, with a compelling 20% yield driven by its significant presence in Florida's cannabis market. With the potential for Florida voters to approve recreational use, AYR stands to gain considerably, making it a prime target for investors before the vote.

- Get Benzinga's exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can't afford to miss out if you're serious about the business.

AYR Wellness Offers 20% Yield: Capitalize on Florida's Potential Vote

According to the Viridian Credit Tracker from Viridian Capital Advisors, AYR's exposure to Florida's market gives it a unique advantage ahead of the state's potential legalization of recreational cannabis.

With a 20% trading yield, AYR outpaces many of its competitors. If Florida approves recreational cannabis, AYR's valuation could see a substantial boost, making this stock a strategic buy for investors ahead of the vote.

Cresco Labs vs. Curaleaf: A 250 Basis Point Difference

Another suggested pair trade from the report is to buy Cresco Labs (OTC:CRLBF) at a 12.6% yield and sell Curaleaf (OTC:CURLF) at 10.1%. This trade offers investors a 250 basis point yield upgrade, backed by Cresco's solid financials and credit improvement. Investors looking for higher returns and credit strength should consider this opportunity.

Another suggested pair trade from the report is to buy Cresco Labs (OTC:CRLBF) at a 12.6% yield and sell Curaleaf (OTC:CURLF) at 10.1%. This trade offers investors a 250 basis point yield upgrade, backed by Cresco's solid financials and credit improvement. Investors looking for higher returns and credit strength should consider this opportunity.

Read Also: EXCLUSIVE: 80% Growth Despite The Chaos: How Dutchie, C3 Defy 2024's Cannabis Slump

TerrAscend: Why 12% Yield Might Not Be Enough

In contrast, TerrAscend (OTC:TRSSF), which offers a 12% yield, is recommended as a sell. While TerrAscend remains a significant player in the cannabis industry, its lower yield and reduced exposure to Florida's growth potential make it less appealing compared to AYR.

Cannabist Faces Liquidity Challenges

Despite the attractive spreads among top stocks, Cannabist (OTC:CCHWF) ranks as the weakest credit in the group, largely due to liquidity concerns following recent asset sales. Investors should note that Cannabist's lower credit rating may limit its near-term upside despite potential improvements in the future.

Take Action Now: Florida's Vote Could Change the Game

With Florida's cannabis market potentially expanding, investors looking to maximize gains should consider this pair trade: buy AYR at 20%, sell TerrAscend at 12%, and look into Cresco Labs at 12.6% versus Curaleaf at 10.1%. The vote could transform the landscape for cannabis stocks, and taking action before this pivotal event could provide substantial returns.

Courtesy of Viridian Capital Advisors

Courtesy of Viridian Capital Advisors 隨着佛羅里達對休閒大麻的關鍵表決臨近,投資者正關注市場中的關鍵機會。 Viridian信貸追蹤器將AYR Wellness(場外交易:AYRWF)評爲強勁買入,強調其在佛羅里達大麻市場上的重要存在,帶來令人信服的20%收益。如果佛羅里達選民批准休閒使用,AYR將大幅獲益,使其成爲投資者在表決前的首要目標。

- 在Benzinga獲取獨家分析,並每天免費獲得關於大麻業務和市場的頭條新聞。立即訂閱我們的通訊,認真對待業務,您不容錯過。

AYR Wellness提供20%的收益:利用佛羅里達的潛在投票機會

根據Viridian Capital Advisors的Viridian信貸追蹤器顯示,AYR對佛羅里達市場的敞開態度使其在該州潛在合法化休閒大麻之前就已具備獨特優勢。

擁有20%的交易收益,AYR超越了許多競爭對手。如果佛羅里達批准休閒大麻,AYR的估值可能會大幅提升,這使得該股成爲投資者在投票前的戰略性買入。

Cresco Labs對比Curaleaf:250個點子的差異

報告另一個建議的配對交易是買入Cresco Labs(場外交易:CRLBF),收益率爲12.6%,賣出Curaleaf(場外交易:CURLF),收益率爲10.1%。此交易爲投資者提供250個點子的出廠升級,得到Cresco穩健的財務狀況和信用改善的支持。尋求更高回報和信用強度的投資者應考慮這一機會。

報告另一個建議的配對交易是買入Cresco Labs(場外交易:CRLBF),收益率爲12.6%,賣出Curaleaf(場外交易:CURLF),收益率爲10.1%。此交易爲投資者提供250個點子的出廠升級,得到Cresco穩健的財務狀況和信用改善的支持。尋求更高回報和信用強度的投資者應考慮這一機會。

閱讀更多:獨家報道:儘管混亂,Dutchie、C3仍然實現了80%的增長:如何抵禦2024年的大麻低迷

TerrAscend:爲什麼12%的收益可能不夠

相比之下,推薦賣出大麻股TerrAscend(場外交易代碼:TRSSF),提供12%的收益。儘管TerrAscend在大麻行業中仍然是一個重要的參與者,但其較低的收益率和對佛羅里達州增長潛力的減少暴露使其與AYR相比顯得不那麼吸引人。

大麻板塊面臨流動性挑戰

儘管各大股票之間利差吸引人,但大麻股Cannabist(場外交易代碼:CCHWF)被評爲該組中信用最弱的股票,這主要是由於近期資產銷售後對流動性的擔憂。投資者應注意,儘管未來有可能改善,Cannabist較低的信用評級可能限制其近期的上升空間。

立即行動:佛羅里達的選舉可能改變遊戲規則

隨着佛羅里達的大麻市場有望擴大,希望最大化收益的投資者應考慮這一交易組合:買入AYR股票20%,賣出TerrAscend股票12%,並關注Cresco Labs股票12.6%對比Curaleaf股票10.1%。該選舉可能改變大麻股的局勢,在這一關鍵事件發生前採取行動可能帶來可觀的回報。

由Viridian Capital Advisors 提供

由Viridian Capital Advisors 提供  報告另一個建議的配對交易是買入Cresco Labs(場外交易:CRLBF),收益率爲12.6%,賣出Curaleaf(場外交易:CURLF),收益率爲10.1%。此交易爲投資者提供250個點子的出廠升級,得到Cresco穩健的財務狀況和信用改善的支持。尋求更高回報和信用強度的投資者應考慮這一機會。

報告另一個建議的配對交易是買入Cresco Labs(場外交易:CRLBF),收益率爲12.6%,賣出Curaleaf(場外交易:CURLF),收益率爲10.1%。此交易爲投資者提供250個點子的出廠升級,得到Cresco穩健的財務狀況和信用改善的支持。尋求更高回報和信用強度的投資者應考慮這一機會。

Another suggested pair trade from the report is to buy

Another suggested pair trade from the report is to buy